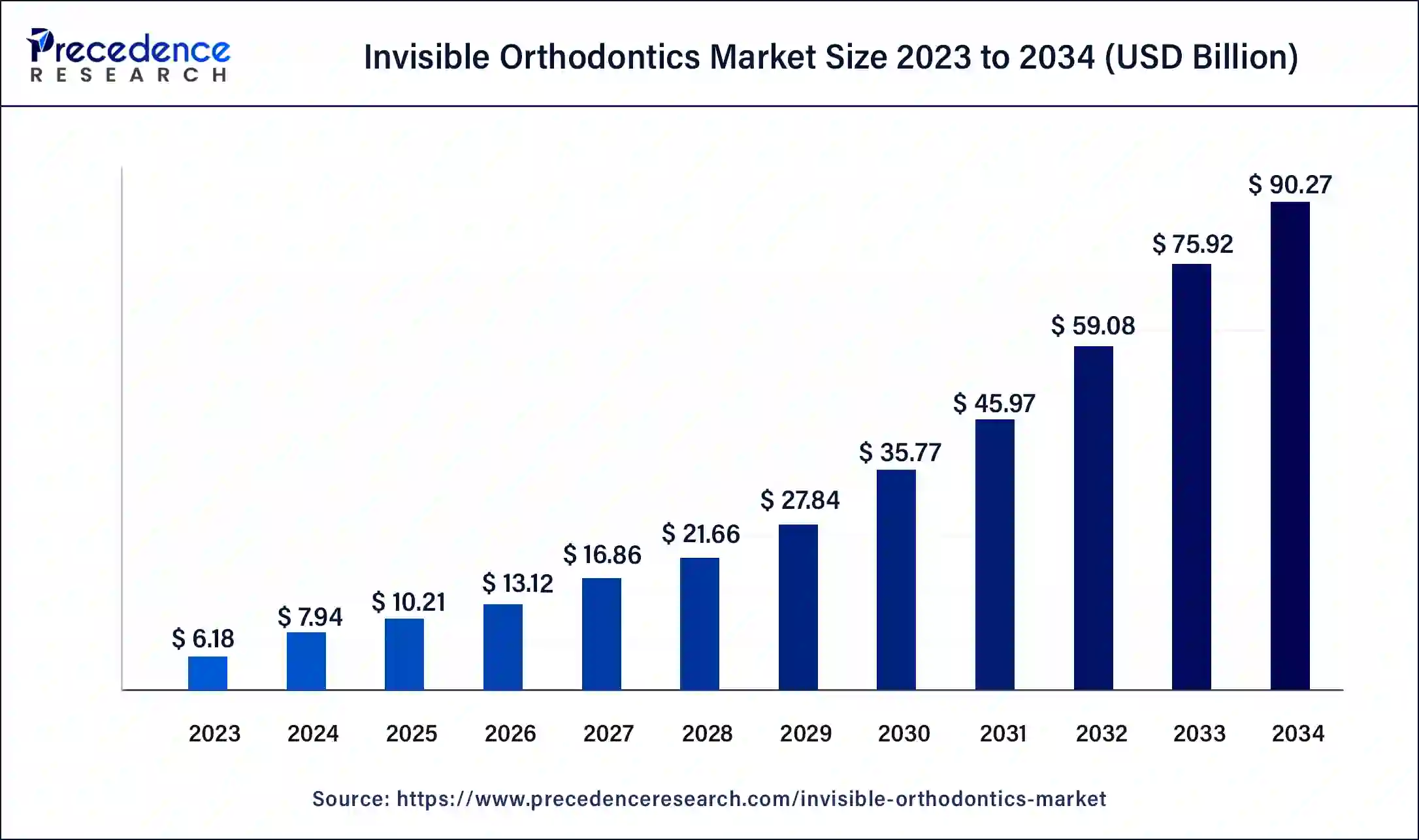

The global invisible orthodontics market size is estimated to rake around USD 75.92 billion by 2033, growing at a CAGR of 28.51% from 2024 to 2033.

Key Points

- The North America invisible orthodontics market size accounted for USD 3.40 billion in 2023 and is expected to attain around USD 41.76 billion by 2033.

- North America led the market with the largest market share of 55% in 2023.

- Asia Pacific is showcasing significant growth in the market.

- By product, the clear aligners segment has heled the largest market share of 85% in 2023.

- By product, the ceramic braces segment is expected to show significant growth in the upcoming years.

- By age group, the adult segment accounted for the highest market share of 60% in 2023.

- By age group, the teenager segment is anticipated to show the fastest growth over the forecasted period.

- By end use, the stand alone practice segment dominated the market in 2023.

- By end use, the hospital segment is predicted to register the fastest growth in the foreseeable future period.

- By dentist type, the orthodontists segment was estimated to hold the highest share of the market in 2023.

- By dentist type, the general dentists segment is expected to grow at a significant CAGR during the foreseen period.

The invisible orthodontics market has experienced rapid growth in recent years, driven by increasing demand for aesthetically pleasing orthodontic solutions and advancements in dental technology. Invisible orthodontics refer to a range of orthodontic treatments that use clear aligners or ceramic braces to straighten teeth discreetly, offering an alternative to traditional metal braces. This market segment has gained popularity among both adults and teenagers seeking orthodontic treatment without the visibility and discomfort associated with traditional braces.

Get a Sample: https://www.precedenceresearch.com/sample/4255

Growth Factors

Several factors contribute to the growth of the invisible orthodontics market. Firstly, the growing awareness of dental aesthetics and the desire for less conspicuous orthodontic options have fueled demand for invisible aligners and braces. Additionally, technological innovations in 3D imaging, computer-aided design (CAD), and manufacturing have enabled the customization and precision required for effective invisible orthodontic treatments. Moreover, favorable reimbursement policies and increasing disposable incomes in many regions have made these treatments more accessible to a broader population.

Region Insights

The adoption of invisible orthodontics varies across regions, influenced by factors such as cultural preferences, affordability, and regulatory environments. North America and Europe lead the market due to high disposable incomes, strong awareness of dental aesthetics, and advanced healthcare infrastructure. In Asia Pacific, countries like China and India are experiencing rapid growth in the market, driven by a rising middle class, increasing urbanization, and growing demand for cosmetic dental treatments.

Invisible Orthodontics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 28.51% |

| Global Market Size in 2023 | USD 6.18 Billion |

| Global Market Size in 2024 | USD 7.94 Billion |

| Global Market Size by 2033 | USD 75.92 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Age, By End-use, and By Dentist Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Invisible Orthodontics Market Dynamics

Drivers

Several drivers underpin the growth of the invisible orthodontics market. Patient preferences for more comfortable and discreet orthodontic solutions have led to increased adoption of clear aligners and ceramic braces. The convenience of removable aligners, which allow for easier oral hygiene and dietary flexibility compared to traditional braces, is another key driver. Furthermore, advancements in digital orthodontics and tele-dentistry have expanded access to invisible orthodontic treatments, enabling remote monitoring and treatment planning.

Opportunities

The invisible orthodontics market presents various opportunities for industry players and practitioners. Continued technological innovation, such as the integration of artificial intelligence (AI) and virtual treatment planning, can further enhance treatment outcomes and patient experience. Expansion into emerging markets with growing demand for cosmetic dental treatments presents another promising opportunity. Moreover, collaborations between dental professionals and technology companies can drive the development of more efficient and affordable invisible orthodontic solutions.

Challenges

Despite its growth trajectory, the invisible orthodontics market faces challenges that need to be addressed. One notable challenge is the higher cost of invisible orthodontic treatments compared to traditional braces, which may limit adoption among certain patient groups. Additionally, educating both patients and dental professionals about the benefits and limitations of invisible orthodontics is crucial for broader acceptance and adoption. Regulatory considerations and reimbursement policies also influence market dynamics and adoption rates across different regions.

Read Also: Healthcare Navigation Platform Market Size, Share, Report By 2033

Invisible Orthodontics Market Recent Developments

- In February 2023, SmileDirectClub launched a CarePlus, a new premium aligner treatment. It offers a flexible design that helps customers manage and start aligner care in-person or remotely.

- In April 2023, Henry Schein, Inc. held the acquisition of a majority ownership stake in Biotech Dental, a provider of clear aligners, dental implants, and digital dental software.

- In March 2022, Align Technology, Inc. Introduced the new Cone Beam Computed Tomography (CBCT) integration feature for ClinCheck digital treatment planning software. This feature helps doctors consciously expand diagnosis and treat a broader range of cases. It is possible to use Invisalign clear aligners to increase visibility and handle a patient’s underlying anatomical structures during the digital treatment planning process.

- In May 2022, Align Technology, Inc. Made an agreement with Asana, Inc., a leading work management platform for teams. The strategic partnership will offer Invisalign-trained doctors in the U.S. a new workflow solution, Asana SmilesTM for Align.

Invisible Orthodontics Market Companies

- Angel Aligner

- SmarTee

- Dentsply Sirona

- Institut Straumann AG

- SCHEU DENTAL GmbH

- Ormco Corporation (Envista)

- Henry Schein, Inc.

- SmileDirectClub

- Align Technology, Inc.

- TP Orthodontics, Inc.

- K Line Europe GmBH

- 3M

- ClearPath Healthcare Services Pvt Ltd

- DB Orthodontics, Inc.

- G&H Orthodontics

- Orthodontics SDC

Segments Covered in the Report

By Product

- Clear Aligners

- Ceramic Braces

- Lingual Braces

By Age

- Teens

- Adults

By End-use

- Hospitals

- Stand-alone Practices

- Group Practices

- Others

By Dentist Type

- General Dentists

- Orthodontists

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/