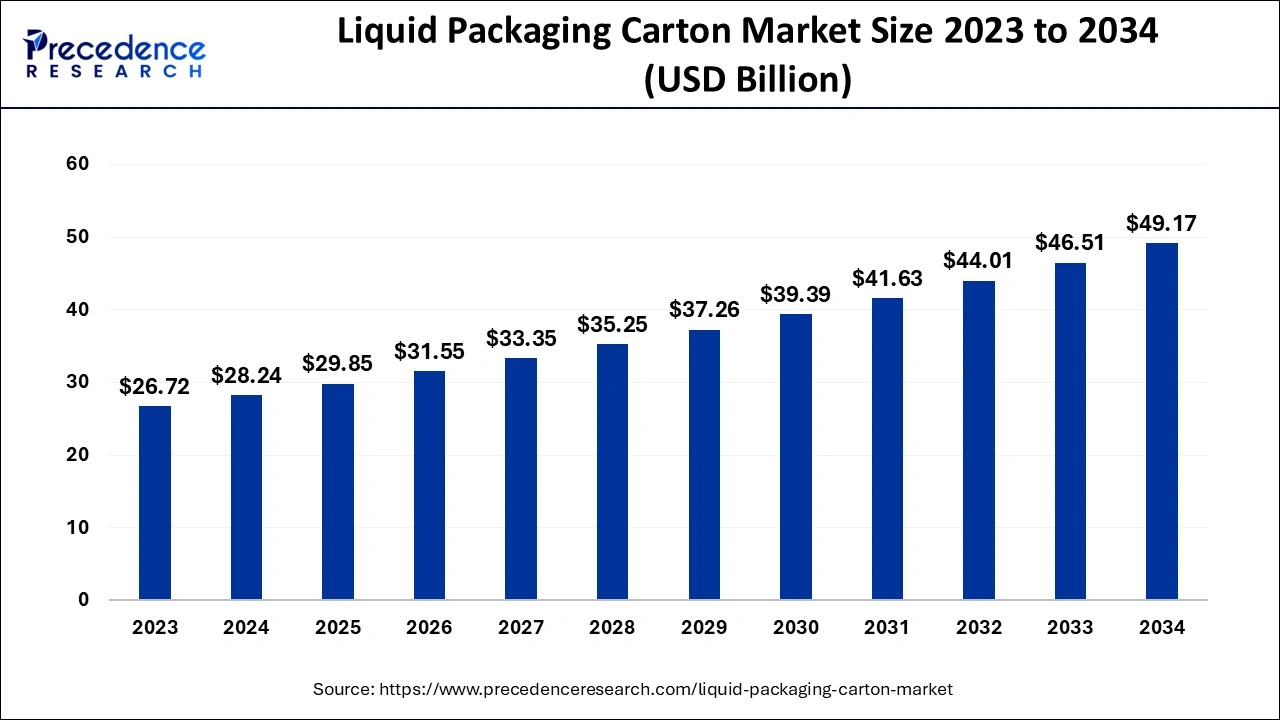

The global liquid packaging carton market size reached USD 28.24 billion in 2024 and is predicted to be hit around USD 49.17 billion by 2034, growing at a CAGR of 5.70% from 2024 to 2034.

Key Points

- Asia Pacific dominated the liquid packaging carton market with the largest market share of 39% in 2023.

- North America is expected to grow at the fastest rate in the market during the forecast period.

- By type, the brick liquid cartons segment held the largest market share in 2023.

- By type, the gable top segment is expected to grow at the fastest rate in the market during the forecast period.

- By shelf life, the liquid cartons segment dominated the global market in 2023.

- By shelf life, the short-term shelf life segment is expected to grow rapidly in the market during the forecast period.

- By application, the dairy products segment accounted for the biggest market share of 50% in 2023.

- By application, the juice & drinks segment is expected to grow significantly in the market during the forecast period.

The liquid packaging carton market has shown steady growth in recent years due to the rising demand for packaged beverages, milk, juices, and other liquid food products. These cartons, made from layered paperboard, plastic, and sometimes aluminum, provide durability, convenience, and an environmentally friendly option compared to traditional plastic and glass packaging. The market has witnessed significant innovations with the emergence of aseptic and gable-top cartons, both of which cater to diverse product needs and consumer preferences. With increasing environmental awareness, the shift toward sustainable packaging solutions is bolstering the growth of liquid packaging cartons worldwide.

Sample: https://www.precedenceresearch.com/sample/5219

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 49.17 Billion |

| Market Size in 2024 | USD 28.24 Billion |

| Market Size in 2025 | USD 29.85 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.70% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Shelf Life,Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Drivers:

One of the primary drivers of the liquid packaging carton market is the increasing preference for eco-friendly packaging among consumers and manufacturers. Cartons are typically recyclable and use less plastic, aligning well with the global focus on reducing plastic waste. Additionally, the growing demand for ready-to-drink beverages and on-the-go consumption habits fuels the need for convenient packaging formats like cartons. The rising urban population, particularly in developing countries, has further propelled the demand for such packaging due to the higher consumption of packaged beverages and milk products in these regions.

Opportunities:

The shift towards more sustainable packaging solutions presents significant growth opportunities. Manufacturers are innovating in bio-based materials and recyclable carton options to meet eco-conscious consumer demands. Additionally, the increasing penetration of aseptic liquid packaging—where liquids are preserved without refrigeration—opens opportunities in regions with limited cold storage infrastructure. Expanding into emerging markets, particularly in Asia-Pacific and Africa, can provide growth opportunities as demand for packaged foods and beverages continues to increase. Moreover, digital printing technologies offer customization possibilities, allowing brands to differentiate their products in a crowded market.

Challenges:

Despite the growth prospects, the liquid packaging carton market faces several challenges. Recycling infrastructure limitations, particularly in developing countries, can hinder the recycling of multilayer cartons. The market also faces competition from other packaging types, including plastic bottles and glass, which have established logistics and recycling networks. High initial costs associated with aseptic carton filling equipment pose another challenge, especially for small- and medium-sized beverage producers. Additionally, fluctuations in raw material costs can impact profitability for carton manufacturers.

Regional Insights:

The liquid packaging carton market has its largest presence in North America and Europe due to established recycling infrastructure and high demand for sustainable packaging solutions. Europe is particularly robust in this sector due to strong regulatory support for eco-friendly packaging materials. The Asia-Pacific region is expected to witness the fastest growth rate, driven by a rising middle class, urbanization, and increasing demand for packaged beverages. Countries like China and India offer vast growth opportunities due to their large consumer bases. Latin America and the Middle East & Africa are emerging markets where demand is steadily increasing, albeit with slower adoption due to limited recycling facilities and infrastructure.

Read Also: Oil and Gas Security Market Size to Worth USD 47.82 Bn By 2034

Liquid Packaging Carton Market Companies

- Tetra Pak International S.A.

- Elopak AS

- SIG Combibloc Group AG

- Oji Holdings Corporation

- Nippon Paper Industries Co. Ltd.

- Adam Pack S.A.

- Stora Enso Oyj

- H.B. Fuller Company

- LAMI PACKAGING CO., LTD

- Weyerhaeuser Company

- Smurfit Kappa Group plc

- Greatview Aseptic Packaging Co. Ltd.

- TidePak Aseptic Packaging Material Co. Ltd.

- Lami Packaging (Kunshan) Co. Ltd.

Recent News

- In February 2024, family-owned natural soap maker, Dr. Bronner’s launched its soap refill carton package of 32 oz. for its pure-castile liquid soap. This soap refill carton can be used to refill existing containers or bottles for home cleaning use and personal care.

- In May 2023, Dulce Vida, a U.S.-based tequila brand, launched three new ready-to-drink cocktails in sustainable carton packaging offered by Tetra Pak, a liquid packaging solutions company.

- In January 2022, SIG launched the world’s first aluminum-free full barrier packaging materials, Signature EVO, for aseptic carton packs. Signature EVO extends SIG’s lower-carbon aluminum-free packaging materials – for plain white milk – for wider use with oxygen-sensitive products such as plant-based beverages, flavored milk, nectars, or fruit juices.

Segments Covered in the Report

By Type

- Brick Liquid Cartons

- Gable top Liquid Cartons

- Shaped Liquid Cartons

By Shelf Life

- Short-term Shelf Life

- Long-term Shelf Life

By Application

- Dairy Products

- Wine and Spirits

- Juices and Drinks

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)