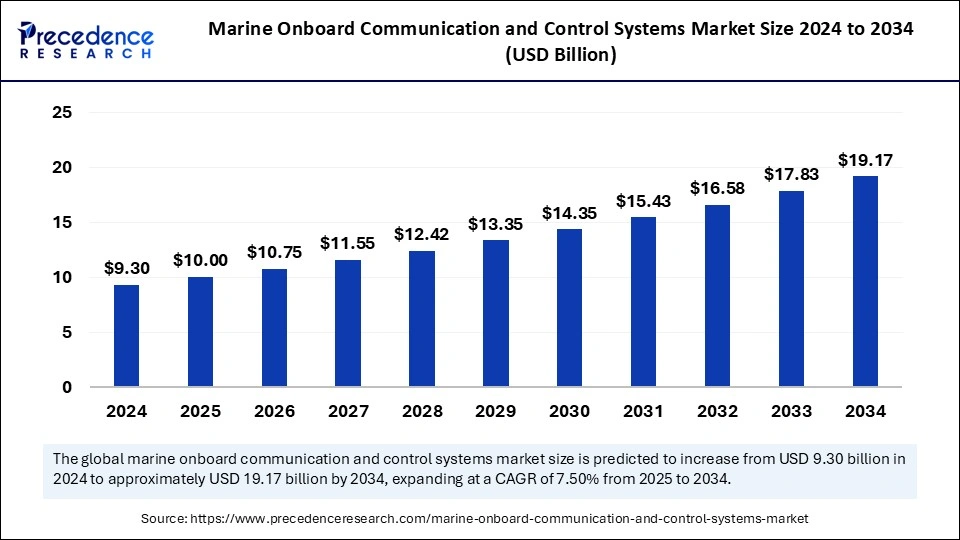

The global marine onboard communication and control systems market size stood at USD 9.30 billion in 2024 and is expected to expand to USD 19.17 billion by 2034, with a CAGR of 7.50%.

Marine Onboard Communication and Control Systems Market Key Takeaways

- Asia Pacific dominated the market with the largest market share in 2024.

- North America is expected to grow rapidly during the forecast period.

- By type, the communication systems segment led the market in 2024.

- By type, the control systems segment is anticipated to expand rapidly in the coming years.

- By platform, the commercial segment dominated the market in 2024.

- By platform, the defence segment is expected to grow the fastest throughout the forecast period.

- By end user, the OEM segment led the market in 2024.

- By end user, the aftermarket segment is anticipated to expand rapidly over the forecast period.

The Marine Onboard Communication and Control Systems Market is experiencing steady growth, driven by advancements in maritime technology, increasing global trade, and the rising need for efficient vessel communication and automation. These systems play a crucial role in ensuring seamless navigation, crew coordination, safety, and operational efficiency across commercial, defense, and recreational marine vessels. As the maritime industry transitions towards digitalization and automation, the demand for sophisticated onboard communication and control solutions continues to rise.

In 2024, the market was valued at approximately USD 9.30 billion and is projected to reach USD 19.17 billion by 2034, growing at a CAGR of 7.50%. The growing need for real-time data exchange, satellite-based navigation, and integrated control systems has fueled the adoption of advanced communication technologies across fleets worldwide. Additionally, stringent maritime safety regulations set by international authorities, such as the International Maritime Organization (IMO) and the Safety of Life at Sea (SOLAS) convention, have necessitated the implementation of high-performance onboard communication and control systems. As maritime operations become more complex and interconnected, shipowners and operators are investing in AI-driven automation, IoT-enabled monitoring solutions, and cyber-secure communication networks to enhance operational safety and efficiency. With the integration of cloud-based fleet management systems, autonomous navigation capabilities, and next-generation radio and satellite technologies, the market is poised for significant advancements in the coming years.

Sample Link: https://www.precedenceresearch.com/sample/5711

Key Drivers

The increasing volume of global maritime trade is a key driver of the marine onboard communication and control systems market. As international shipping activities expand, vessels require enhanced connectivity and automated control systems to streamline cargo movement, optimize fuel consumption, and ensure regulatory compliance. The demand for real-time fleet monitoring, emergency distress communication, and remote diagnostics is also rising, prompting shipping companies to adopt cutting-edge communication solutions.

The growing focus on maritime safety and security has further accelerated market growth. Governments and regulatory bodies are enforcing stringent safety protocols, necessitating the deployment of integrated communication systems, radar-based monitoring, and distress signaling technologies to prevent accidents and enhance emergency response times. Advanced automatic identification systems (AIS), global positioning systems (GPS), and radio-frequency communication networks are increasingly being installed on ships to ensure seamless coordination between vessels, ports, and coastal authorities.

The expansion of the defense and naval sector has also contributed to market growth, with military fleets requiring robust satellite-based communication, encrypted control systems, and real-time surveillance technologies for mission-critical operations. Defense agencies worldwide are heavily investing in autonomous vessel control, electronic warfare systems, and AI-powered situational awareness solutions, boosting demand for sophisticated onboard communication and control platforms.

Opportunities

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into marine onboard communication systems presents a significant growth opportunity. AI-powered predictive maintenance, IoT-enabled sensors, and remote monitoring capabilities are enhancing the efficiency and reliability of ship operations. These technologies allow shipowners to detect mechanical faults, optimize fuel consumption, and improve navigation accuracy, reducing downtime and operational costs.

The rapid development of autonomous and smart ships is another promising avenue for market expansion. The adoption of unmanned vessel control systems, automated docking solutions, and AI-driven decision-making software is revolutionizing the maritime industry. As automation gains traction, the demand for high-speed data transmission, cloud-based fleet analytics, and cyber-resilient communication networks is expected to surge.

The increasing investments in next-generation satellite communication (SATCOM) solutions are transforming maritime connectivity. With advancements in low-earth orbit (LEO) satellite networks, high-frequency radio transmission, and broadband-enabled ship communication, vessels can now maintain uninterrupted connectivity even in remote oceanic regions. The expansion of 5G-based maritime networks and real-time GPS tracking is set to further strengthen onboard communication infrastructure.

Challenges

Despite its growth potential, the marine onboard communication and control systems market faces several challenges, including high implementation costs and complex integration processes. The deployment of advanced satellite communication systems, automated vessel control platforms, and cybersecurity frameworks requires significant capital investment, which can be a barrier for small and medium-sized shipping companies.

Cybersecurity threats pose another major challenge for the market. As ships become more digitally connected, they are increasingly vulnerable to cyberattacks and data breaches. Hacking attempts, GPS spoofing, and network intrusions can compromise vessel operations, leading to potential safety risks and financial losses. The industry must continuously invest in robust cybersecurity protocols, end-to-end encryption, and AI-driven threat detection to mitigate these risks.

Regulatory compliance and stringent maritime safety standards also present hurdles for market players. Shipping companies must adhere to IMO regulations, SOLAS guidelines, and international cybersecurity frameworks, requiring ongoing upgrades to onboard communication systems. Compliance with these evolving regulations demands continuous R&D investments, software updates, and crew training, which can be resource-intensive.

Regional Insights

North America dominates the marine onboard communication and control systems market, driven by strong government investments in naval modernization, technological advancements in maritime cybersecurity, and the growing adoption of autonomous vessel systems. The United States leads the region in defense maritime innovation, with significant investments in satellite-based ship communication and AI-driven fleet management solutions. The region also benefits from strong collaborations between maritime tech companies and government agencies, accelerating market growth.

Europe holds a substantial share in the market, with countries such as Norway, Germany, and the UK at the forefront of smart ship technology and sustainable maritime solutions. The European maritime industry is focusing on decarbonization, digitalization, and automation, prompting investments in energy-efficient ship communication and control systems. The implementation of IMO’s low-emission shipping policies has further accelerated the adoption of AI-driven fleet optimization solutions.

The Asia-Pacific region is experiencing rapid growth in the market, fueled by rising trade activities, expanding shipbuilding industries, and increasing government support for maritime digitalization. Countries like China, Japan, and South Korea are leading investments in autonomous ship navigation, AI-powered vessel monitoring, and next-generation SATCOM networks. With a growing focus on smart ports and maritime logistics optimization, the demand for onboard communication systems is expected to rise significantly.

The Middle East & Africa and Latin America are emerging markets with increasing investments in coastal surveillance, naval defense modernization, and offshore communication infrastructure. The expansion of oil and gas exploration activities in offshore regions is driving demand for real-time marine control systems, high-frequency communication networks, and IoT-based offshore monitoring solutions.

Don’t Miss Out: Automated Storage and Retrieval System Market

Market Key Players

- Thales Group

- Wartsila

- General Dynamics Corporation

- RTX Corporation

- ABB Ltd.

- BAE Systems

- Northrop Grumman

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Emerson Electric Co.

- Navico

- Japan Radio

Recent News

The marine industry has witnessed notable advancements in autonomous vessel navigation, AI-driven fleet monitoring, and next-generation satellite connectivity. Leading maritime technology firms have introduced AI-powered collision avoidance systems, blockchain-based ship communication networks, and ultra-low-latency satellite communication platforms to enhance operational efficiency and security.

The integration of 5G technology in maritime communication has gained traction, with companies launching high-speed maritime internet solutions, real-time video surveillance systems, and cloud-based ship control platforms. These innovations enable seamless data exchange between vessels, ports, and maritime authorities, improving fleet efficiency and reducing communication delays.

Several maritime nations have also strengthened their cybersecurity policies to combat digital threats in the shipping industry. Governments and private enterprises are investing in cyber-resilient ship control systems, AI-driven threat detection frameworks, and encrypted vessel communication channels to safeguard against cyberattacks.

The development of green and sustainable maritime communication technologies has also gained momentum. Companies are introducing low-power IoT devices, energy-efficient satellite communication solutions, and AI-based fuel optimization systems to reduce environmental impact and enhance compliance with global sustainability goals.

Market Segmentation

By Type

- Communication Systems

- Control Systems

By Platform

- Commercial

- Defense

By End User

- OEM

- Aftermarket

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa