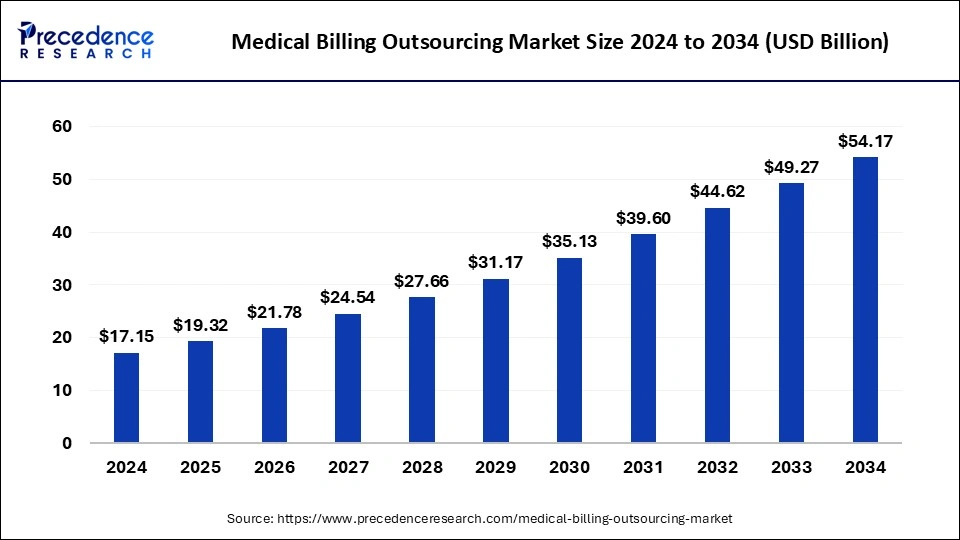

The medical billing outsourcing market is valued at USD 17.15 billion in 2024 and is expected to reach USD 54.17 billion by 2034, growing at a CAGR of 12.00%.

Medical Billing Outsourcing Market Key Takeaways

- North America dominated the global market in 2024, holding the largest share of 48%.

- The outsourcing segment is led by component, capturing a 53% revenue share in 2024.

- The front-end segment held the highest market share of 39% by service in 2024.

- The hospital segment accounted for the largest market share of 47% by end-use in 2024.

The medical billing outsourcing market is experiencing significant growth, driven by the rising need for efficient revenue cycle management in the healthcare sector. In 2024, the market is valued at USD 17.15 billion and is projected to reach USD 54.17 billion by 2034, expanding at a CAGR of 12.00%. North America holds the largest market share, attributed to advanced healthcare infrastructure and increasing adoption of outsourcing services.

The outsourcing segment dominates by component, while the front-end service segment leads in revenue. Hospitals remain the primary end-users, benefiting from streamlined billing processes and reduced administrative burdens. Technological advancements, automation, and AI integration are further fueling market expansion.

Sample Link: https://www.precedenceresearch.com/sample/1103

Key Drivers

Opportunities

- Integration of AI & Automation: Advanced technologies can enhance accuracy, reduce errors, and improve billing efficiency.

- Expansion of Telemedicine: The rise of virtual healthcare services increases demand for seamless billing solutions.

- Growth in Healthcare Infrastructure: Emerging markets with improving healthcare facilities present new outsourcing opportunities.

- Increasing Adoption by Small & Mid-Sized Healthcare Providers: Smaller clinics and independent practitioners are turning to outsourcing for cost efficiency.

- Cloud-Based Billing Solutions: The shift towards cloud-based platforms enhances accessibility, security, and scalability.

- Rising Medical Tourism: An increase in cross-border healthcare services drives demand for efficient billing and claims processing.

Challenges

- Data Security & Privacy Concerns: Handling sensitive patient information raises risks related to cybersecurity and compliance.

- Regulatory Complexity: Frequent changes in healthcare regulations require continuous adaptation and compliance efforts.

- High Dependence on Third-Party Vendors: Over-reliance on outsourcing partners may lead to operational risks and service disruptions.

- Integration with Existing Systems: Compatibility issues between outsourced billing solutions and internal hospital systems can create inefficiencies.

- High Initial Investment Costs: Implementing outsourced billing solutions may require significant upfront investments, limiting adoption by smaller providers.

- Concerns Over Service Quality: Variability in service standards among outsourcing providers can impact revenue cycle efficiency.

Regional Insights

North America dominates the medical billing outsourcing market, holding the largest share due to its advanced healthcare infrastructure, high adoption of outsourcing services, and stringent regulatory requirements. The presence of major market players and increasing healthcare expenditures further drive growth in the region. Europe follows as a key market, with countries like Germany, the UK, and France witnessing growing adoption of outsourced billing services. The rising need for cost-effective revenue cycle management and compliance with complex healthcare regulations contribute to market expansion.

Asia-Pacific is expected to register the fastest growth, driven by increasing healthcare investments, the expansion of medical tourism, and the growing adoption of digital healthcare solutions in countries like India, China, and Japan. The availability of skilled labor at lower costs makes the region a favorable outsourcing hub. Latin America is experiencing steady growth, supported by improving healthcare systems, rising medical expenditures, and increasing awareness of the benefits of outsourcing billing processes. Countries like Brazil and Mexico are leading the market in this region. The Middle East & Africa is also witnessing gradual adoption, with advancements in healthcare infrastructure and rising demand for efficient billing solutions. The growing privatization of healthcare services and government initiatives to modernize medical billing processes are contributing to market growth.

Don’t Miss Out: Solid Tumor Cancer Treatment Market

Market Key Players

- Cerner Corporation

- Experian Information Solutions, Inc.

- eClinicalWorks LLC

- GE Healthcare

- Kareo, Inc.

- Genpact

- McKesson Corporation

- Quest Diagnostics

Recent News

The medical billing outsourcing market is experiencing significant growth, driven by the increasing complexity of billing processes and the need for healthcare providers to focus on patient care. In 2023, the global market was valued at approximately USD 13.43 billion and is projected to reach around USD 30.17 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 12.3% from 2024 to 2030. In the United States, the market is expected to grow from USD 5.9 billion in 2024 to USD 16.9 billion by 2033, at a CAGR of 12.5%.

This growth is attributed to rising healthcare expenditures and regulatory complexities, prompting healthcare organizations to outsource billing functions to improve operational efficiency and reduce administrative burdens. Technological advancements, particularly the integration of artificial intelligence (AI) and machine learning, are enhancing the efficiency and accuracy of medical billing systems. These technologies aid in analyzing large datasets to identify patterns, ensure correct code assignments, and reduce claim denials.

Market Segmentation

By Component

- Outsourced

- In-house

By Service

- Back End

- Middle End

- Front End

By End-User

- Physician Office

- Hospital

- Others