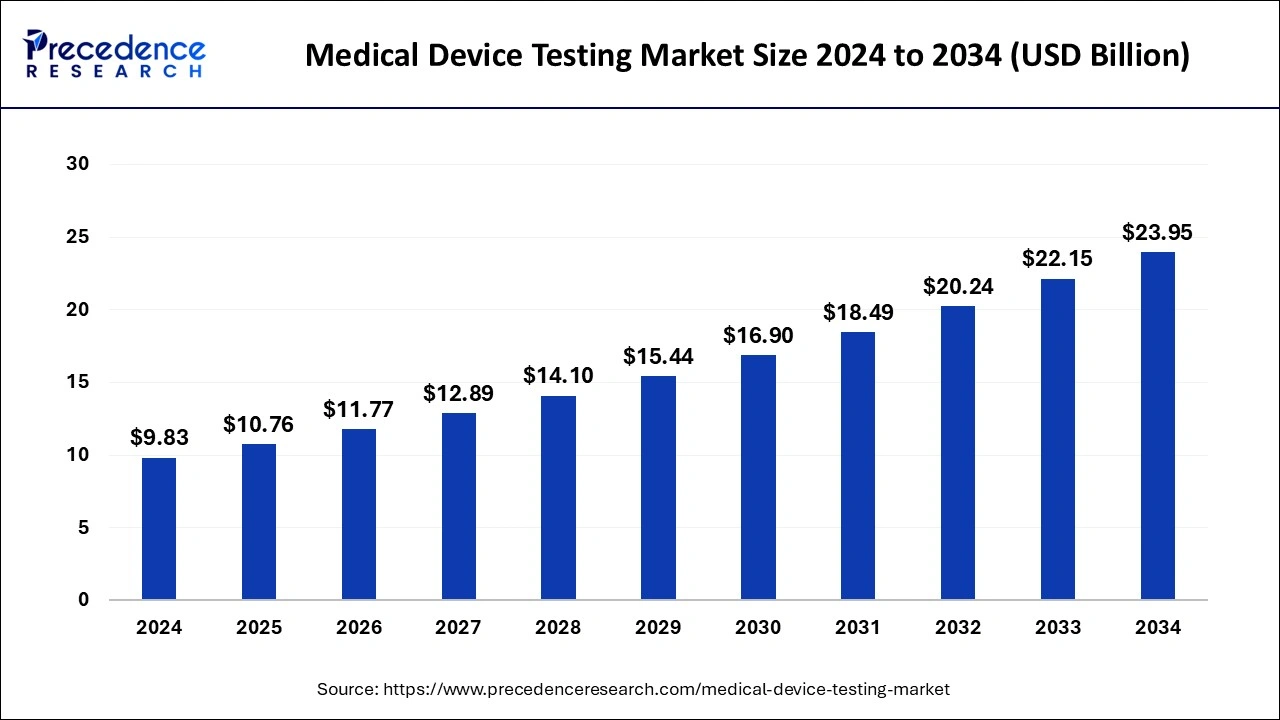

The global medical device testing market size was valued at USD 8.98 billion in 2023 and is expected to reach around USD 22.15 billion by 2033, expanding at a CAGR of 9.45% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 42% in 2023.

- North America is estimated to be the fastest-growing during the forecast period of 2024-2033.

- The biocompatibility tests segment dominated the market in 2023.

- The chemistry tests segment is expected to expand at the fastest CAGR of 9.73% during the forecast period.

- The clinical segment led the market with the major revenue share of 60% in 2023.

- The preclinical segment is the fastest-growing during the forecast period.

The medical device testing market plays a critical role in ensuring the safety, efficacy, and compliance of medical devices with regulatory standards. This market encompasses a broad range of testing services and methodologies applied at various stages of the product lifecycle, including design validation, prototype testing, clinical trials, and post-market surveillance. With the increasing complexity and diversity of medical devices, from simple bandages to sophisticated imaging systems and implants, the demand for rigorous and comprehensive testing is more significant than ever.

Medical device testing involves several key areas such as biocompatibility testing, mechanical testing, software validation, electrical safety testing, and performance evaluation. Each type of test addresses different aspects of a device’s functionality and safety profile. The market is driven by stringent regulatory requirements imposed by bodies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other regional authorities, which mandate thorough testing and certification before a device can enter the market.

Get a Sample: https://www.precedenceresearch.com/sample/4429

Growth Factors

Several factors are driving the growth of the medical device testing market. Firstly, the rising prevalence of chronic diseases and an aging population are leading to increased demand for medical devices, which in turn fuels the need for testing. Innovations in medical technology, including the development of wearable devices, implantable medical devices, and advanced diagnostic tools, are creating new testing requirements and expanding the market scope.

Moreover, the regulatory landscape is becoming increasingly stringent, with authorities worldwide tightening their requirements to ensure patient safety and device efficacy. This is particularly evident in the aftermath of high-profile device failures and recalls, which have underscored the importance of rigorous testing. The global push towards harmonization of standards, exemplified by initiatives like the Medical Device Single Audit Program (MDSAP), is also contributing to market growth by simplifying compliance processes across multiple jurisdictions.

Advancements in testing technologies, such as the integration of artificial intelligence (AI) and machine learning (ML) in testing protocols, are enhancing the efficiency and accuracy of testing processes. These technologies enable predictive analytics, early detection of potential issues, and more comprehensive data analysis, thereby improving overall test outcomes. Additionally, the growing trend of outsourcing testing services to specialized third-party providers is driving market expansion, as companies seek to leverage external expertise and infrastructure to meet stringent regulatory requirements.

Region Insights

The medical device testing market exhibits significant regional variations, driven by differences in healthcare infrastructure, regulatory environments, and market demand. North America, particularly the United States, holds a dominant position in the global market due to its advanced healthcare system, robust regulatory framework, and high adoption rate of innovative medical technologies. The presence of major medical device manufacturers and testing service providers further consolidates the region’s leading status.

Europe is another key market, characterized by stringent regulatory standards and a strong emphasis on patient safety and product quality. The implementation of the European Union Medical Device Regulation (EU MDR) has intensified the demand for comprehensive testing services, as manufacturers strive to comply with the new, more rigorous requirements. Countries like Germany, the UK, and France are leading contributors to the European market.

The Asia-Pacific region is experiencing rapid growth, driven by factors such as increasing healthcare expenditure, expanding medical device manufacturing capabilities, and rising awareness about the importance of device safety and efficacy. Countries like China, Japan, and India are at the forefront of this growth, with significant investments in healthcare infrastructure and regulatory reforms aimed at aligning with global standards. The region’s burgeoning middle-class population and growing prevalence of chronic diseases are further propelling market expansion.

Latin America and the Middle East & Africa are emerging markets with substantial growth potential. These regions are witnessing improvements in healthcare infrastructure and regulatory frameworks, which are creating favorable conditions for market development. However, challenges such as limited access to advanced testing technologies and regulatory harmonization remain barriers to faster growth.

Medical Device Testing Market Scope

| Report Coverage | Details |

| Medical Device Testing Market Size in 2023 | USD 8.98 Billion |

| Medical Device Testing Market Size in 2024 | USD 9.83 Billion |

| Medical Device Testing Market Size by 2033 | USD 22.15 Billion |

| Medical Device Testing Market Growth Rate | CAGR of 9.45% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service Type, Phase Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Device Testing Market Dynamics

Drivers

Several key drivers are propelling the medical device testing market forward. The foremost driver is the increasing regulatory scrutiny and the need for compliance with stringent standards. Regulatory bodies like the FDA and EMA mandate comprehensive testing to ensure that medical devices are safe and effective, thereby creating a continuous demand for testing services.

Technological advancements in medical devices are another significant driver. As medical devices become more sophisticated, incorporating cutting-edge technologies such as AI, IoT, and advanced materials, the complexity and scope of testing requirements increase. This drives the demand for specialized testing services capable of addressing these advanced technologies.

The rising incidence of chronic diseases such as diabetes, cardiovascular diseases, and cancer is leading to a higher demand for medical devices for diagnosis, treatment, and monitoring. This, in turn, necessitates extensive testing to ensure that these devices meet safety and performance standards, thereby driving market growth.

Additionally, the increasing adoption of home healthcare and wearable medical devices is contributing to market expansion. These devices require rigorous testing to ensure they are safe and effective for use outside traditional healthcare settings, further fueling the demand for testing services.

Opportunities

The medical device testing market presents several lucrative opportunities for growth and innovation. One of the primary opportunities lies in the development and adoption of advanced testing technologies. The integration of AI and ML in testing protocols can significantly enhance the accuracy and efficiency of testing processes. These technologies can enable predictive analytics, automate routine tasks, and provide deeper insights into test data, thereby improving test outcomes and reducing time-to-market for medical devices.

Another promising opportunity is the growing trend of outsourcing testing services to specialized third-party providers. This trend allows medical device manufacturers to leverage external expertise, state-of-the-art facilities, and advanced testing methodologies, thereby enhancing their testing capabilities and ensuring compliance with regulatory standards. The outsourcing model also provides cost advantages and operational efficiencies, making it an attractive option for many companies.

The increasing focus on personalized medicine and the development of patient-specific medical devices present new opportunities for the testing market. These devices require customized testing approaches to ensure they meet individual patient needs and regulatory requirements. This trend is expected to drive demand for innovative testing solutions tailored to the unique characteristics of personalized medical devices.

The expanding regulatory landscape in emerging markets, such as Asia-Pacific, Latin America, and the Middle East & Africa, also offers significant growth opportunities. As these regions continue to enhance their healthcare infrastructure and regulatory frameworks, the demand for comprehensive testing services is expected to rise. Companies that can establish a strong presence and offer high-quality testing services in these markets are likely to benefit from the growing demand.

Challenges

Despite the promising growth prospects, the medical device testing market faces several challenges. One of the primary challenges is the high cost associated with testing services. Comprehensive testing processes, especially for complex and advanced medical devices, can be expensive and time-consuming. This poses a financial burden on manufacturers, particularly small and medium-sized enterprises (SMEs), which may struggle to bear the costs.

Another significant challenge is the constantly evolving regulatory landscape. Keeping up with the changes in regulatory requirements across different regions can be daunting for manufacturers and testing service providers. The need for continuous updates and compliance with varying standards adds complexity and can lead to delays in product approval and market entry.

The rapid pace of technological advancements in medical devices also presents a challenge for the testing market. As devices become more complex and integrate emerging technologies, developing appropriate testing methodologies and ensuring they keep pace with innovation becomes increasingly difficult. This requires continuous investment in research and development to stay ahead of technological trends and maintain testing accuracy and relevance.

The shortage of skilled professionals with expertise in medical device testing is another challenge facing the market. As the demand for testing services grows, so does the need for qualified personnel capable of conducting specialized tests and interpreting complex data. Addressing this skills gap is crucial for the sustained growth of the market.

Lastly, the market faces challenges related to data security and privacy. With the increasing use of digital technologies in medical devices, ensuring the protection of sensitive patient data during the testing process is of paramount importance. Companies must implement robust cybersecurity measures to safeguard data and comply with regulatory requirements related to data protection.

Read Also: Cable Cars and Ropeways Market Size to Reach USD 13.54 Mn by 2033

Medical Device Testing Market Companies

- WuXi AppTec

- Intertek Group Plc

- Pace Analytical Services LLC

- Eurofins Scientific

- North America Science Associates Inc. (NAMSA)

- Element Minnetonka

- Charles River Laboratories

- TÜV SÜD

- Nelson Laboratories, LLC

- Laboratory Corporation of America Holdings

- SGS SA

Medical Device Testing Market Recent Developments

- In July 2023, the three made-in-Telangana medical devices were launched by IT Minister KT Rama Rao and Industries, including Blue Semi, Huwel Lifesciences, and EMPE Diagnosis, to facilitate medical device testing and prototyping services.

- In January 2024, a single-window portal or one-stop-shop portal was designed by the IT major TCS (Tata Consultancy Services) and launched by India to streamline the import of medical devices in the country.

- In March 2024, a pilot study for an asthma diagnosis device was launched by the UK-based respiratory device firm TidalSense. This device is used for the testing of respiratory conditions like asthma in children.

- In April 2024, India’s first mobile medical devices calibration facility was launched by the Indian Institute of Technology Madras (IIT-M). It helps to ensure the accuracy of medical devices for precise disease diagnosis and effectiveness and to improve healthcare access.

Segments Covered in the Report

By Service Type

- Biocompatibility Tests

- Cardiovascular Device’s Biocompatibility Tests

- Orthopedic Device’s Biocompatibility Tests

- Dental Implant Devices’ Biocompatibility Tests

- Dermal Filler’s Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device’s Biocompatibility Tests

- Others

- Chemistry Tests

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

By Phase Type

- Preclinical

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/