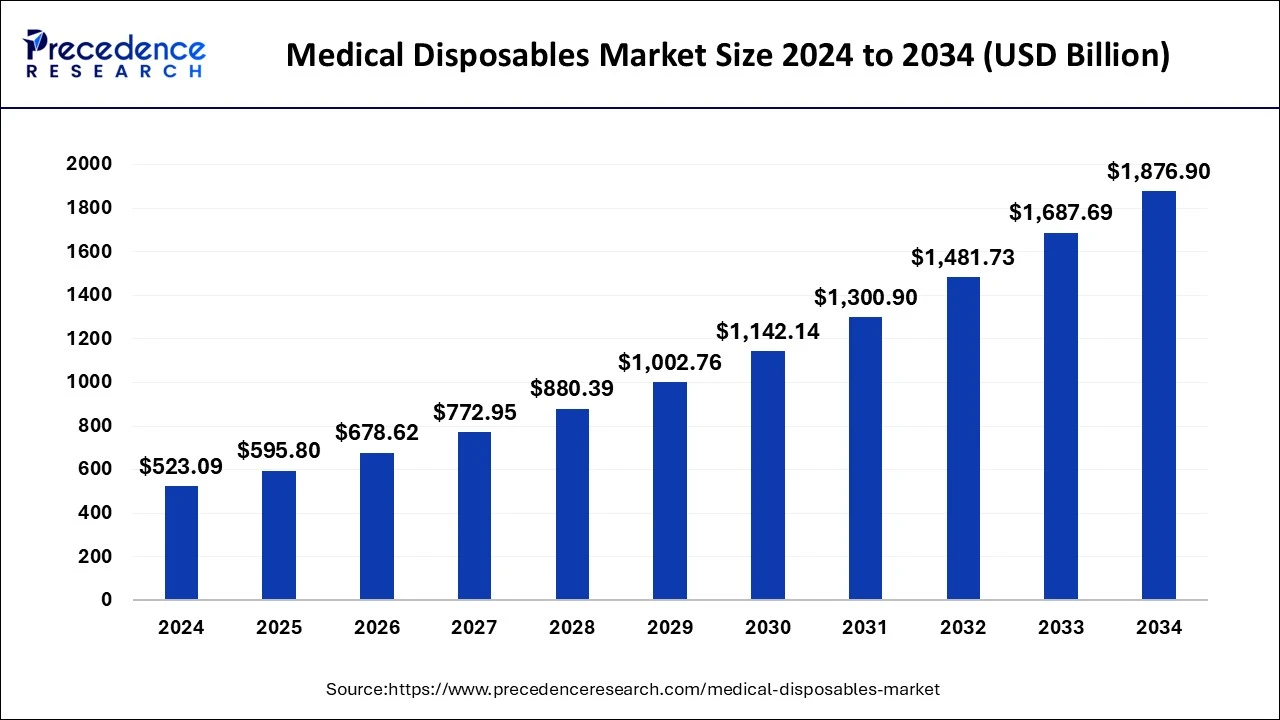

The medical disposables market valued at 523.09B in 2024 to soar to 1.876 Bn by 2034, fueled by an impressive CAGR of 13.90%.

Medical Disposables Market Key Takeaways

- North America dominated the market in 2024, contributing over 34.73% to the total revenue.

- The sterilization supplies segment showcased strong performance, capturing 15% of the market share in 2024.

- Plastic resins emerged as the leading raw material, accounting for an impressive 59% of revenue in 2024.

- Hospitals led the end-use segment with a significant revenue share of over 56% in 2024.

The global medical disposables market is experiencing significant growth, driven by factors such as the increasing prevalence of hospital-acquired infections, a rising number of surgical procedures, and an expanding geriatric population. Valued at approximately USD 523.09 billion in 2024, the market is projected to reach around USD 1,876.90 billion by 2034, with a compound annual growth rate (CAGR) of 13.90% from 2025 to 2034. North America leads the market, holding over 34.73% revenue share in 2024, while the hospital segment remains the dominant end-user, accounting for more than 56% of the revenue share in the same year.

Sample Link: https://www.precedenceresearch.com/sample/1014

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 595.80 Billion |

| Market Size by 2034 | USD 1,876.90 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 13.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and By Raw Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Drivers

The medical disposables market is primarily driven by the cost-effectiveness of single-use products, which reduce maintenance and sterilization expenses compared to reusable equipment. Additionally, the increasing prevalence of hospital-acquired infections has heightened the demand for disposable medical supplies to enhance infection control. Technological advancements by startups are introducing innovative single-use devices, further propelling market growth. Moreover, the rising number of surgical procedures and a growing geriatric population contribute to the expanding market for medical disposables.

Opportunities

- Technological Advances: Advances in disposable medical products, such as minimally invasive surgical tools, are improving the quality of care for patients and increasing market opportunity.

- Increased health and Hygiene Awareness: consciousness among people boosts demand for disposable medical products and thus provides a growth opportunity.

- Emerging markets: Countries in the developing world with improving health infrastructures represent a major source of expansion.

- Biodegradable Materials: Eco-friendly disposable products have helped address environmental concerns and met consumer preferences.

- Government Initiatives: Efforts of the government to enhance the quality of healthcare and infection control are also encouraging the use of medical disposables.

Challenges

- Environmental Impact: The increase in medical waste from disposable products poses significant environmental challenges.

- Stringent Regulatory Approvals: Navigating complex regulatory requirements can delay product launches and increase compliance costs.

- High Competition: The presence of numerous market players intensifies competition, affecting pricing strategies and profit margins.

- Supply Chain Disruptions: Global events, such as pandemics, can disrupt supply chains, leading to shortages and affecting market stability.

- Cost Constraints in Developing Regions: In some areas, the higher cost of disposable products compared to reusable ones can limit adoption.

Regional Insights

The medical disposables market is experiencing significant growth across various regions:

In North America, the U.S. market was valued at USD 128.12 billion in 2024 and is projected to reach approximately USD 484.84 billion by 2034, growing at a CAGR of 14.23% from 2025 to 2034. The Asia Pacific region is anticipated to expand rapidly due to increasing healthcare demands and a rising number of surgeries. In China, the market is dominated by basic disposables like plastic syringes, bandages, and surgical gloves, which are less complex and subject to fewer regulatory restrictions. India faces challenges such as inadequate cleanliness and awareness, contributing to a rise in infectious diseases, highlighting the need for improved healthcare practices and medical disposables. These regional dynamics underscore the diverse factors influencing the global medical disposables market.

Don’t Miss Out: Ball Valves Market

Market Key Players

- Cardinal Health

- Medline Industries, Inc.

- 3M

- MED-CON Inc.

- Medtronic

- Boston Scientific

Recent News

The U.S. medical disposables market was valued at USD 128.12 billion in 2024 and is projected to reach approximately USD 484.84 billion by 2034, growing at a CAGR of 14.23% from 2025 to 2034. The medical disposables market size was valued at USD 523.09 billion in 2024 and is expected to hit around USD 1,876.90 billion by 2034, growing at a CAGR of 13.90% from 2025 to 2034. The global disposable medical supplies market size is estimated to grow by USD 604.17 billion from 2023 to 2028, driven by factors such as the increasing prevalence of hospital-acquired infections and growing awareness of hygiene and infection control in healthcare settings.

Market Segmentation

By Product

- Wound Management Products

- Hand Sanitizers

- Gel Sanitizers

- Foam Sanitizers

- Liquid Sanitizers

- Other Sanitizers

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Drug Delivery Products

- Diagnostics and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Others

By Raw Material

- Plastic Resins

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals

- Glass

- Others

By End-use

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others