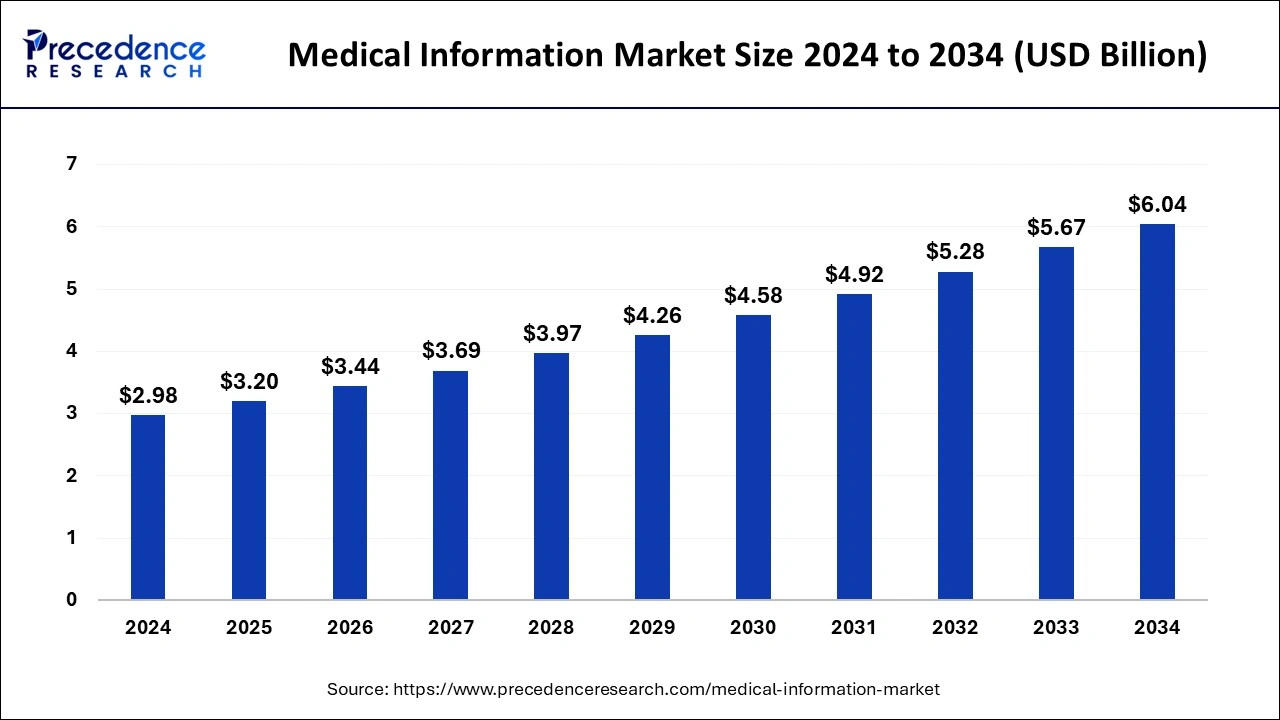

The global medical information market size was valued at USD 2.78 billion in 2023 and is expected to reach around USD 5.67 billion by 2033, expanding at a CAGR of 7.41% from 2024 to 2033.

Key Points

- The North America medical information market size was evaluated at USD 1.08 billion in 2023 and is expected to attain around USD 2.24 billion by 2033, poised to grow at a CAGR of 7.56% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 39% in 2023.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By service provider, the outsourcing segment holds the largest revenue share of 58% in 2023.

- By service provider, the in-house segment is expected to witness the fastest growth in the market during the forecast period.

- By therapeutic area, the oncology segment has held a biggest revenue share of 34% in 2023.

- By therapeutic area, the immunology segment is expected to grow rapidly in the market during the forecast period.

- By product life cycle, the clinical phase segment led the market with the major revenue share of 50% in 2023.

- By product life cycle, the post-market approval segment is expected to expand significantly in the market during the forecast period.

- By company size, the medium-sized segment has contributed more than 51%of revenue share in 2023.

- By company size, the small-sized segment is expected to grow at a considerable CAGR in the market during the forecast period.

- By end-use, the pharmaceuticals segment has held a major revenue share of 42% in 2023.

- By end-use, the innovators segment is expected to grow at the fastest rate in the market during the forecast period.

The medical information market encompasses a broad range of services, technologies, and platforms designed to facilitate the management, dissemination, and utilization of medical data and knowledge within the healthcare industry. This market includes software solutions for electronic health records (EHR), medical coding and billing systems, clinical decision support systems (CDSS), telemedicine platforms, patient engagement tools, and health information exchanges (HIEs). These technologies play a crucial role in enhancing the efficiency of healthcare delivery, improving patient outcomes, and reducing costs associated with healthcare administration.

Get a Sample: https://www.precedenceresearch.com/sample/4451

Growth Factors

Several key factors contribute to the growth of the medical information market. Firstly, the increasing adoption of digital health solutions by healthcare providers and institutions worldwide is driving demand for advanced medical information systems. These systems not only streamline administrative processes but also support clinical decision-making through real-time access to patient data and analytics.

Moreover, regulatory requirements and government initiatives aimed at promoting interoperability and data standardization further propel market growth. For instance, initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act in the United States have incentivized healthcare organizations to adopt EHR systems, boosting the market for medical information technologies.

Additionally, the growing prevalence of chronic diseases and the aging population globally create a heightened need for efficient healthcare delivery systems. Medical information technologies enable remote monitoring, telemedicine consultations, and personalized healthcare interventions, which are increasingly important in managing chronic conditions and providing timely care to elderly patients.

Regional Insights

The adoption and development of medical information technologies vary significantly across regions. North America, particularly the United States, holds the largest market share due to early adoption of EHR systems and stringent regulatory requirements such as the Health Insurance Portability and Accountability Act (HIPAA). The presence of major healthcare IT companies and strong government support for healthcare IT infrastructure also contribute to the region’s dominance in the market.

Europe follows closely, driven by initiatives promoting digital health transformation across member states of the European Union. Countries like Germany, the UK, and France are key contributors to the market, with investments in telemedicine and interoperable health information systems gaining traction.

In Asia-Pacific, rapid economic growth, increasing healthcare expenditure, and expanding access to healthcare services are driving market growth. Countries like China, Japan, and India are witnessing significant investments in healthcare IT infrastructure to support their large and diverse populations.

Medical Information Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 2.78 Billion |

| Market Size in 2024 | USD 2.98 Billion |

| Market Size by 2033 | USD 5.67 Billion |

| Market Growth Rate From 2024 to 2033 | CAGR of 7.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service Provider, Therapeutic Area, Product Life Cycle, Company Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Information Market Dynamics

Drivers

Several drivers propel the growth of the medical information market globally. One of the primary drivers is the need to improve healthcare quality and patient outcomes. Medical information technologies enable healthcare providers to access comprehensive patient data, make informed clinical decisions, and coordinate care effectively across different settings.

Furthermore, the shift towards value-based care models encourages healthcare organizations to adopt technologies that enhance care coordination and population health management. Medical information systems play a crucial role in supporting these models by facilitating data-driven approaches to healthcare delivery and reimbursement.

Technological advancements such as artificial intelligence (AI), machine learning, and blockchain are also driving market growth by enabling innovative applications in healthcare information management. These technologies improve the accuracy of diagnoses, optimize operational efficiencies, and enhance data security and interoperability across healthcare systems.

Opportunities

The medical information market presents numerous opportunities for growth and innovation. One significant opportunity lies in the expansion of telemedicine and virtual care platforms, which have gained prominence especially in light of the COVID-19 pandemic. Telemedicine offers convenient access to healthcare services, reduces geographical barriers, and improves patient engagement, presenting a lucrative growth avenue for providers of medical information technologies.

Moreover, the integration of AI and machine learning into medical information systems opens up opportunities for predictive analytics, personalized medicine, and population health management. These technologies can analyze large datasets to identify disease trends, predict patient outcomes, and optimize treatment protocols, thereby enhancing clinical decision-making and patient care.

Furthermore, the increasing focus on interoperability and data exchange presents opportunities for vendors offering solutions that facilitate seamless communication and integration across disparate healthcare IT systems. Standards such as Fast Healthcare Interoperability Resources (FHIR) are promoting interoperability initiatives globally, creating a demand for interoperable EHR systems and health information exchanges.

Challenges

Despite its growth prospects, the medical information market faces several challenges that warrant consideration. One of the primary challenges is the complexity and cost associated with implementing and maintaining medical information systems. Healthcare organizations often encounter difficulties in integrating new technologies with existing infrastructure, ensuring data security and privacy, and training staff to use these systems effectively.

Interoperability remains a significant challenge as healthcare IT systems often operate in silos, hindering seamless data exchange and care coordination. Variations in data standards and regulations across different regions further complicate efforts to achieve interoperability on a global scale.

Moreover, concerns related to data privacy and cybersecurity pose substantial risks to the adoption of medical information technologies. Healthcare organizations must adhere to stringent regulatory requirements to safeguard patient information from unauthorized access, data breaches, and cyber threats.

Lastly, disparities in healthcare access and digital literacy among populations can limit the widespread adoption of medical information technologies, particularly in developing regions. Addressing these disparities requires targeted investments in infrastructure, education, and policy frameworks to ensure equitable access to healthcare IT solutions.

Read Also: Surface Mining Market Size to Reach USD 43.08 Bn By 2033

Medical Information Market Companies

- Black Rock

- UTI Mutual Fund

- Morgan Stanley

- PIMCO

- DSP Mutual Fund

- Trustee

- JPMorgan Chase & Co

- Capital Group

- Vanguard

Recent Developments

- In January 2024, Swoop, a pioneer in creating accurate audiences for pharmaceutical and life sciences products through direct-to-consumer (DTC) and healthcare provider (HCP) marketing, today announced the release of its conversational agent driven by artificial intelligence. This innovative development in healthcare marketing raises the bar for lower funnel engagement by providing instantaneous brand. com-based virtual consumer encounters that comply with MLR.

- In May 2024, with immediate effect, DNA Communications, a division of The Weber Shandwick Collective, introduced the DNA Medical Education Center, a health education communications product, in the United States. Since the agency’s founding in 2011, the UK version of the center has been operational, according to DNA President Mike Rosich.

Segment Covered in the Report

By Service Provider

- In House

- Contract Outsourcing

By Therapeutic Area

- Oncology

- Neurology

- Cardiology

- Immunology

- Others

By Product Life Cycle

- Pre-clinical

- Clinical

- Post-market Approval

By Company Size

- Small

- Medium

- Large Scale

By End-use

- Pharmaceuticals

- Biotechnology Companies

- Medical Device Manufacturers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/