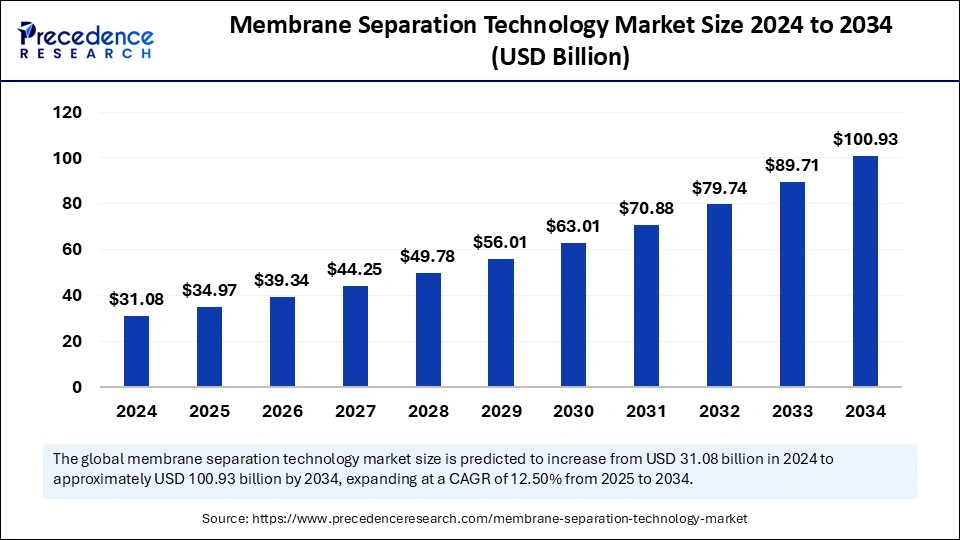

The global membrane separation technology market, valued at USD 31.08 billion in 2024, is projected to reach approximately USD 100.93 billion by 2034, growing at a CAGR of 12.50% from 2025 to 2034.

Membrane Separation Technology Market Key Takeaways

- Asia Pacific dominated the market with the largest market share of 37% in 2024.

- North America is expected to grow at a solid CAGR of 11% during the forecast period.

- By process, the microfiltration segment held the biggest market share in 2024.

- By process, the reverse osmosis segment is anticipated to expand rapidly in the coming years.

- By type, the polymeric membranes segment led the market in 2024.

- By type, the ceramic membranes segment is expected to grow the fastest throughout the forecast period.

- By application, the water treatment segment contributed the highest market share in 2024.

- By application, the food and beverage processing segment is anticipated to expand rapidly over the forecast period.

- By end user, the industrial segment dominated the market in 2024.

- By end user, the municipal segment is expected to be the fastest-growing in the market during the forecast period.

- By technology, the pressure-driven membranes segment dominated the market in 2024.

- By technology, the electrodialysis membranes segment will be the fastest-growing over the forecast period.

Several key factors are driving the growth of the membrane separation technology market

- Rising Demand for Water & Wastewater Treatment – With increasing water scarcity and pollution levels, the need for effective filtration technologies in municipal and industrial wastewater treatment is surging.

- Stringent Environmental Regulations – Governments worldwide are enforcing strict regulations on wastewater discharge and industrial emissions, encouraging the adoption of membrane separation solutions.

- Growth in the Pharmaceutical & Biotechnology Sectors – The pharmaceutical industry relies heavily on membrane separation for drug formulation, purification, and sterilization processes.

- Advancements in Membrane Technologies – Innovations in polymeric and ceramic membranes, along with enhanced efficiency in filtration processes, are making membrane separation more effective and cost-efficient.

- Expansion in Food & Beverage Processing – The increasing demand for dairy products, beverages, and processed foods is fueling the use of membrane technology for purification, concentration, and quality control.

Opportunities

The membrane separation technology market presents several growth opportunities

- Adoption of Membrane Technology in Emerging Markets – Developing economies in Asia, Africa, and Latin America are investing in water treatment and industrial filtration, creating new market opportunities.

- Integration of AI & IoT for Smart Filtration Systems – The adoption of smart membrane technologies with real-time monitoring and predictive maintenance capabilities is opening new avenues for market growth.

- Expansion of Renewable Energy Applications – Membrane separation is increasingly used in hydrogen production and energy storage applications, providing a boost to the clean energy sector.

- Development of Sustainable & Energy-Efficient Membranes – Researchers are focusing on next-generation membranes with lower energy consumption and enhanced filtration efficiency to meet sustainability goals.

- Growing Investment in Desalination Projects – The increasing reliance on desalination for freshwater supply, particularly in water-scarce regions, is driving demand for membrane-based solutions.

Challenges

Despite its promising growth, the membrane separation technology market faces several challenges

- High Initial Investment & Operational Costs – The installation and maintenance of membrane systems can be expensive, particularly for small-scale industries and municipalities.

- Membrane Fouling & Scaling Issues – Contaminants and particles can clog membranes over time, reducing efficiency and increasing maintenance costs.

- Limited Lifespan of Membranes – The periodic replacement of membranes adds to operational expenses and poses a challenge for long-term sustainability.

- Energy Consumption Concerns – Some membrane processes, such as reverse osmosis, require high energy inputs, impacting operational efficiency.

- Regulatory Hurdles & Compliance Issues – Different regions have varying regulations for wastewater treatment and industrial emissions, which can pose adoption challenges for businesses.

Regional Insights

- North America – The region leads the market, driven by stringent environmental policies, advanced water treatment infrastructure, and high demand from industries such as pharmaceuticals, food processing, and chemicals. The U.S. and Canada are key players in adopting membrane technologies.

- Europe – Countries like Germany, the UK, and France are at the forefront of membrane separation adoption due to strict EU regulations on wastewater treatment and industrial emissions. The region also focuses on sustainable and energy-efficient filtration solutions.

- Asia-Pacific – This region is experiencing the fastest growth, with increasing investments in water treatment, food processing, and industrial filtration. Countries like China, India, and Japan are expanding their use of membrane separation technologies to address water pollution and industrial needs.

- Latin America & Middle East & Africa – The adoption of membrane separation technology is gradually rising, particularly in desalination projects, water treatment facilities, and industrial processes. Governments are investing in water security initiatives to combat water scarcity issues.

Don’t Miss Out: Benzene Market

Market Key Players

- AMI International

- Osmonics

- Lenntech

- Pentair

- Genesis Water Technologies

- Pall Corporation

- Inge Water Technologies

- Hydranautics

- Toray Industries

Recent News

- Advancements in Membrane Technology – Companies are developing next-generation membranes with enhanced durability, efficiency, and energy-saving capabilities.

- Growth in Desalination Projects – Several nations, particularly in the Middle East, are expanding their desalination capacity using membrane separation technology to ensure a stable freshwater supply.

- Strategic Mergers & Acquisitions – Key industry players are engaging in mergers and acquisitions to strengthen their market position and expand their technology portfolios.

- Government & Private Sector Investments – Various government and corporate initiatives are focusing on sustainable water treatment and industrial filtration, boosting market growth.

- R&D in Bio-Based Membranes – Research institutions and companies are exploring bio-based and biodegradable membranes to enhance sustainability in filtration processes.

The membrane separation technology market is poised for substantial growth, driven by increasing environmental concerns, technological advancements, and rising demand across various industries. As innovations continue to enhance membrane efficiency and sustainability, the market is expected to play a crucial role in addressing global water and industrial filtration challenges.

Market Segmentation

By Process

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

By Type

- Polymeric Membranes

- Ceramic Membranes

- Metal Membranes

By Application

- Water Treatment

- Food and Beverage Processing

- Chemical and Pharmaceutical

- Medical and Healthcare

By End-User

- Municipal

- Industrial

- Residential

By Technology

- Pressure-Driven Membranes

- Electrodialysis Membranes

- Membrane Distillation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa