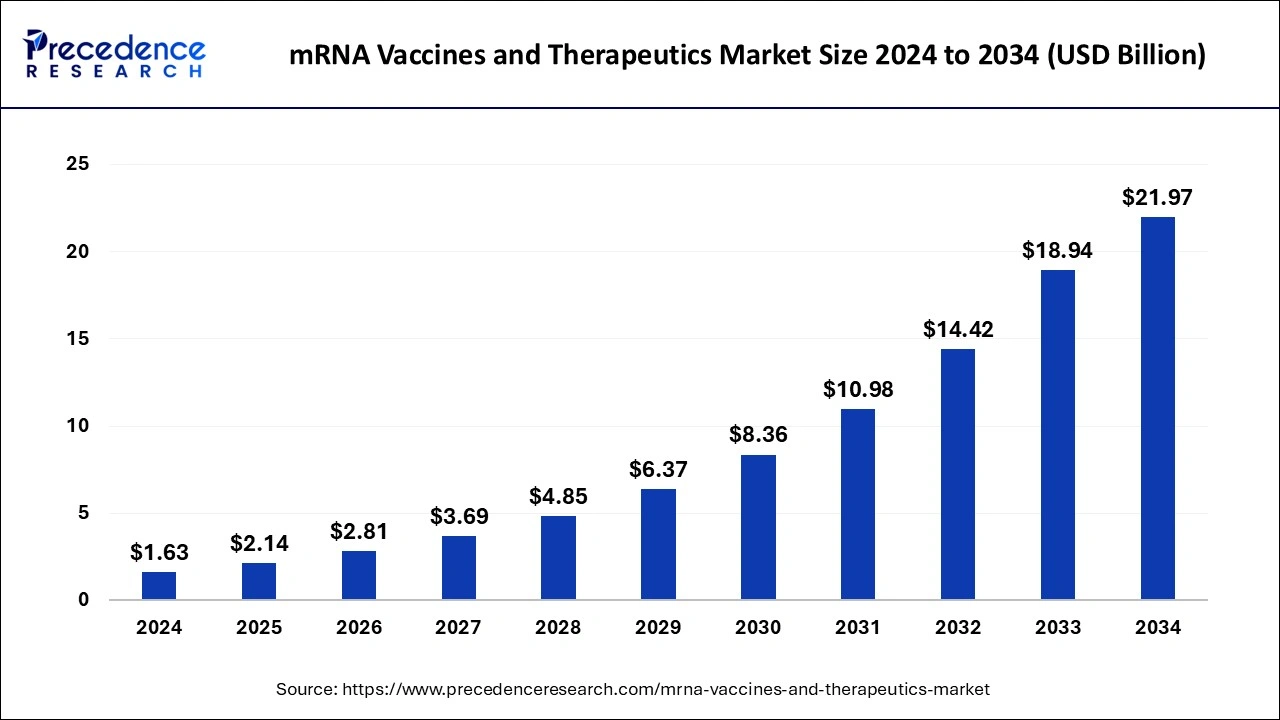

The global mRNA vaccines and therapeutics market size was valued at USD 1,241.64 million in 2023 and is predicted to reach around USD 18,936.64 million by 2033, expanding at a solid CAGR of 31.32% from 2024 to 2033.

Key Points

- North America dominated the mRNA vaccines and therapeutics market in 2023.

- Asia Pacific is estimated to be the fastest growing during the forecast period of 2024-2033.

- By disease type, the hereditary transthyretin-mediated amyloidosis genetic segment dominated the market in 2023.

- By disease type, the acute hepatic porphyria segment is the fastest growing during the forecast period.

- By route of administration type, the IV infusion segment dominated the market in 2023.

- By route of administration type, the subcutaneous segment is the fastest growing during the forecast period.

- By end-user type, the hospitals and clinics segment dominated the in 2023 and is also expected to be the fastest growing during the forecast period.

The mRNA vaccines and therapeutics market has witnessed remarkable growth and evolution in recent years, driven primarily by advancements in biotechnology and the urgent need for innovative vaccine platforms. mRNA (messenger RNA) technology has emerged as a revolutionary approach in vaccine development and therapeutic applications, offering significant advantages such as rapid development, scalability, and potential for customization. This market encompasses a range of products and applications, from COVID-19 vaccines to potential treatments for various diseases like cancer and infectious diseases.

Get a Sample: https://www.precedenceresearch.com/sample/4468

Growth Factors

Several key factors have fueled the growth of the mRNA vaccines and therapeutics market. Firstly, the successful development and emergency use authorization of mRNA-based COVID-19 vaccines, such as those developed by Pfizer-BioNTech and Moderna, have demonstrated the efficacy and safety of this technology on a global scale. This has accelerated investment and research in mRNA platforms for other infectious diseases and therapeutic areas. Additionally, advancements in lipid nanoparticle delivery systems, which are crucial for stabilizing and delivering mRNA molecules into cells, have significantly enhanced the feasibility and effectiveness of mRNA-based products. Moreover, collaborations between pharmaceutical companies, biotech firms, and academic institutions have fostered innovation and expanded the application potential of mRNA technology.

Trends

Several trends are shaping the mRNA vaccines and therapeutics market. One notable trend is the rapid adaptation of mRNA technology to target emerging infectious diseases. The ability to quickly modify mRNA sequences to match new viral variants has positioned mRNA vaccines as a flexible and adaptive solution in pandemic preparedness strategies. Another trend is the expansion of mRNA technology into therapeutic areas beyond infectious diseases, including oncology. Clinical trials are underway to explore mRNA-based cancer vaccines and therapies that stimulate the immune system to recognize and destroy cancer cells. Furthermore, investments in manufacturing capabilities for mRNA vaccines and therapeutics are increasing to meet global demand and ensure supply chain resilience.

Region Insights

North America currently dominates the mRNA vaccines and therapeutics market, driven by early adoption of mRNA technology, strong biotechnology infrastructure, and substantial investments in research and development. The region benefits from collaborations between government agencies, academic institutions, and pharmaceutical companies, facilitating rapid advancements and regulatory approvals. Europe follows closely, with significant investments in mRNA technology and a robust regulatory framework supporting clinical trials and commercialization. Asia-Pacific is also emerging as a key region, supported by increasing healthcare expenditure, growing biopharmaceutical industry, and strategic partnerships with global vaccine developers.

mRNA Vaccines and Therapeutics Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 1,241.64 Million |

| Market Size in 2024 | USD 1,630.52 Million |

| Market Size by 2033 | USD 18,936.64 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 31.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Disease Type, Route of Administration, End-user Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

mRNA Vaccines and Therapeutics Market Dynamics

Drivers:

Several drivers are propelling the growth of the mRNA vaccines and therapeutics market. Regulatory support and expedited approval processes for mRNA-based products have streamlined the path from research to commercialization, encouraging investment and innovation. The global focus on pandemic preparedness and vaccine equity has heightened demand for scalable and effective vaccine platforms like mRNA. Moreover, the potential of mRNA technology to address unmet medical needs in oncology, infectious diseases, and other therapeutic areas continues to attract interest and investment from pharmaceutical companies and biotech startups.

Opportunities:

The market presents numerous opportunities for growth and expansion. Expansion into pediatric and adolescent vaccination programs represents a significant opportunity, driven by ongoing clinical trials and regulatory approvals for mRNA vaccines in younger populations. Additionally, advancements in mRNA technology for personalized medicine, including individualized cancer vaccines tailored to a patient’s genetic profile, hold promise for improving treatment outcomes and patient outcomes. Furthermore, collaborations between public health agencies and private sector entities offer opportunities to enhance vaccine access and distribution in underserved regions globally.

Challenges:

Despite its promising outlook, the mRNA vaccines and therapeutics market faces several challenges. One critical challenge is the complex cold chain logistics required for mRNA vaccine distribution and storage, which can limit accessibility in remote and resource-limited settings. Manufacturing scalability and cost-effectiveness remain significant challenges, particularly in ramping up production to meet global demand during public health emergencies. Additionally, addressing public hesitancy and misinformation surrounding new vaccine technologies is essential to ensure widespread acceptance and uptake of mRNA-based products.

Read Also: Fabric Softener Sheet Market Size to Reach USD 31.54 Bn By 2033

mRNA Vaccines and Therapeutics Market Companies

- Kernal Biologics Inc

- Sanofi

- Argos Therapeutics Inc

- Charoen Pokphand Group

- AIM Vaccine Corporation

- CureVac SE

- Ethris GmbH

- Bohringer Ingelheim International GmbH

- Arcturus

- Daiichi Sankyo

- GSK Plc.

- Gennova Biopharmaceuticals Limited

- Moderna, Inc.

- BioNTech SE

- Pfizer Inc.

Recent Developments

- In May 2022, the first-in-Africa clinical trial of the mRNA HIV vaccine development program was launched by the non-profit scientific research organization, IAVI and a biotechnology company pioneering mRNA vaccines and therapeutics, Moderna, Inc. This is for immunogenicity, safety, and to strengthen regional scientific capacity.

- In March 2024, the Dr, Jeffrey S. Weber and the team at NYU Langone Health’s Perlmutter Cancer Center and other cancer centers around the world, clinical trial tests personalized to the mRNA vaccine for the treatment of metastatic melanoma.

- In April 2024, a biopharmaceutical company driven by immunology in the pursuit of powerful prevention and treatment of diseases, VBI Vaccines Inc., announced that expanded collaboration with the Government of Canada to advance mRNA-launched enveloped virus-like particle (eVLP) vaccine platform.

- In May 2024, a personalized mRNA cancer vaccine trial developed by Genentech and BioNTech for patients and launched by NHS.

Segments Covered in the Report

By Disease Type

- Hereditary Transthyretin-mediated Amyloidosis Genetic

- Acute Hepatic Porphyria

- Primary Hyperoxaluria Type 1

- Atherosclerotic Cardiovascular Disease

By Route of Administration

- IV Infusion

- Subcutaneous

By End-user Type

- Research Institutes

- Hospitals and Clinics

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/