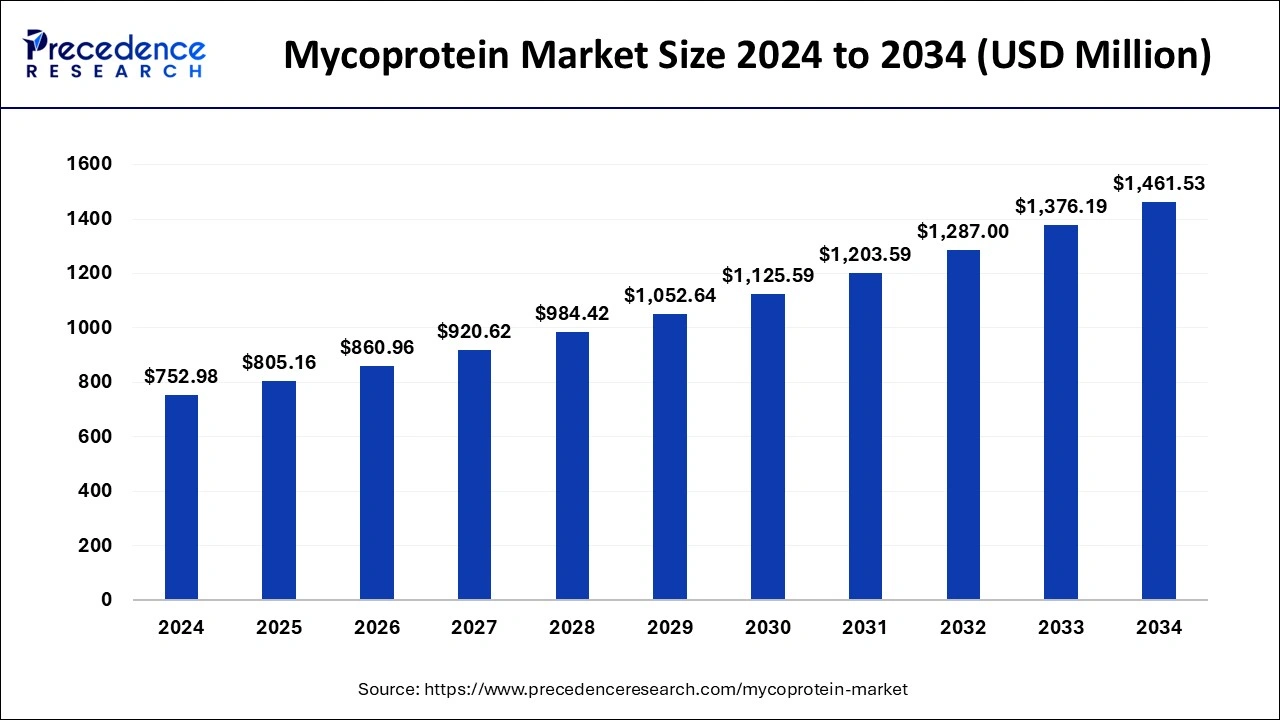

The global mycoprotein market size is estimated to rake around USD 1,376.19 million by 2033, growing at a CAGR of 6.93% from 2024 to 2033.

Key Points

- Asia Pacific dominated the mycoprotein market with the largest market share in 2023.

- North America is expected to grow at the fastest pace during the forecast period.

- By type, the food-grade mycoprotein segment dominated the market with the largest share in 2023.

- By type, the feed-grade mycoprotein segment is observed to grow at a notable rate during the forecast period.

- By form, the minced segment dominated the market with the largest share in 2023.

- By sales channel, the supermarket/hyper market segment dominated the market with the largest market share in 2023.

The mycoprotein market is a dynamic sector within the food industry that revolves around the production and utilization of mycoprotein, a protein-rich ingredient derived from fungi, particularly filamentous fungi like Fusarium venenatum. Mycoprotein is known for its high protein content, low fat levels, and potential health benefits, making it an attractive alternative to traditional protein sources like meat and soy. The market for mycoprotein has seen significant growth in recent years due to increasing consumer demand for plant-based protein options and the rising popularity of meat substitutes.

Get a Sample: https://www.precedenceresearch.com/sample/4272

Growth Factors

Several factors are driving the growth of the mycoprotein market. One key factor is the growing consumer awareness and adoption of plant-based diets for health and environmental reasons. Mycoprotein offers a sustainable protein source that requires fewer resources like water and land compared to animal-based proteins. Additionally, the rising prevalence of lifestyle-related diseases such as obesity and cardiovascular issues has spurred interest in healthier food alternatives, further propelling the demand for mycoprotein.

Region Insights

The mycoprotein market is expanding globally, with notable growth in regions like North America, Europe, and Asia-Pacific. In North America, the market is driven by a strong trend towards plant-based eating, particularly in the United States and Canada. Europe is a significant market due to stringent regulations on meat production and increasing consumer preferences for sustainable food options. In Asia-Pacific, rising disposable incomes and changing dietary preferences are fueling demand for alternative protein sources, including mycoprotein.

Mycoprotein Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.93% |

| Mycoprotein Market Size in 2023 | USD 704.18 Million |

| Mycoprotein Market Size in 2024 | USD 752.98 Million |

| Mycoprotein Market Size by 2033 | USD 1,376.19 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Form, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mycoprotein Market Dynamics

Drivers

Several drivers are shaping the mycoprotein market’s growth trajectory. The increasing availability of mycoprotein-based products in retail stores and online platforms has widened consumer accessibility. Moreover, collaborations and partnerships between food companies and mycoprotein manufacturers have accelerated product innovation and market penetration. Technological advancements in fermentation processes and biotechnology have also contributed to improving the scalability and cost-effectiveness of mycoprotein production, further driving market expansion.

Opportunities

The mycoprotein market presents several opportunities for industry players. Expansion into new geographical markets, especially in emerging economies, offers significant growth potential. Innovations in product formulations and applications, such as mycoprotein-based meat analogs and snacks, can attract a broader consumer base. Additionally, strategic investments in research and development to enhance production efficiency and nutritional profiles can unlock new opportunities in the functional food and dietary supplement sectors.

Challenges

Despite its promising outlook, the mycoprotein market faces certain challenges. Regulatory complexities related to novel food approvals and labeling requirements vary across regions and can impact market entry. Consumer acceptance and taste preferences also pose challenges, as mycoprotein-based products need to emulate the taste and texture of traditional meat to gain widespread adoption. Furthermore, scalability and production scalability remain key hurdles that require ongoing technological advancements and investment.

Read Also: Medical Foam Market Size To Rake USD 59.03 Billion By 2033

Mycoprotein Market Recent Developments

- In April 2024, Edonia Parisian food tech startup raised the funding of €2 million in a pre-seed funding round for the production of sustainable, nutrient-dense, plant-based protein from microalgae.

- In May 2024, Walmart, America’s 20 years largest retailers are introducing the chef-inspired, high culinary quality, free-from and plant-basednew Bettergoods brand.

- In April 2024, Rival Foods, Dutch startup are producing the whole cuts of plant-based meat without binders with the use of “Shear Cell” technology.

- In March 2024, the billionaire Amazon founder Jeff Bezos initiated the investment of US$60 million from its Bezos Earth Fund established in 2020. The investment is initiated for improving the availability and quality of alternative proteins like plant-based meat.

- In May 2024, Waitrose, a leading supermarket chain in the UK, expanded the range PlantLiving with 12 more products for catering to the increasing demand for the less processed plant-based foods.

- In May 2024, THIS, cult-favorite plant-based meat challenges brand in UK is launching the first to the market chicken thigh SKU. The product will launch in the Tesco UK’s largest retailer.

- In April 2024, Plantaway, the company working on the realm of plant-based foods, announced to launch its latest range of plant-based gelatos made with the 100% of the plant-based ingredients, the flavored gelatos are completely dairy free and no added sugar.

- In April 2024, Nasoya, the developer of the plant-based foods revolution and the producers of number 1 brand in Tofu, expands its range of portfolio in new plant-based meat category with the introduction of Plantspired Plant-Based Chick’n.

- In April 2024, Alpro the Danone-owned brand has introduced the 6 SKUs including plant-based protein drinks, a yogurt substitute, and two bestselling variants, Almond No-Sugars, and Creamy Oat in a latest 500ml pack size.

Mycoprotein Market Companies

- Enough

- Tempty Foods

- The Better Meat Co.

- Quorn Foods

- Symrise

- Mycorena AB

- An ACME Group Company

- Bright Green Partners B.V.

- KIDEMIS GmbH

- Mycovation

- MycoTechnology, Inc.

Segments Covered in the Report

By Type

- Feed Grade Mycoprotein

- Food Grade Mycoprotein

By Form

- Minced

- Slices

By Sales Channel

- Supermarkets/Hyper Markets

- Convenience Stores

- Specialty Stores

- Online Stores

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/