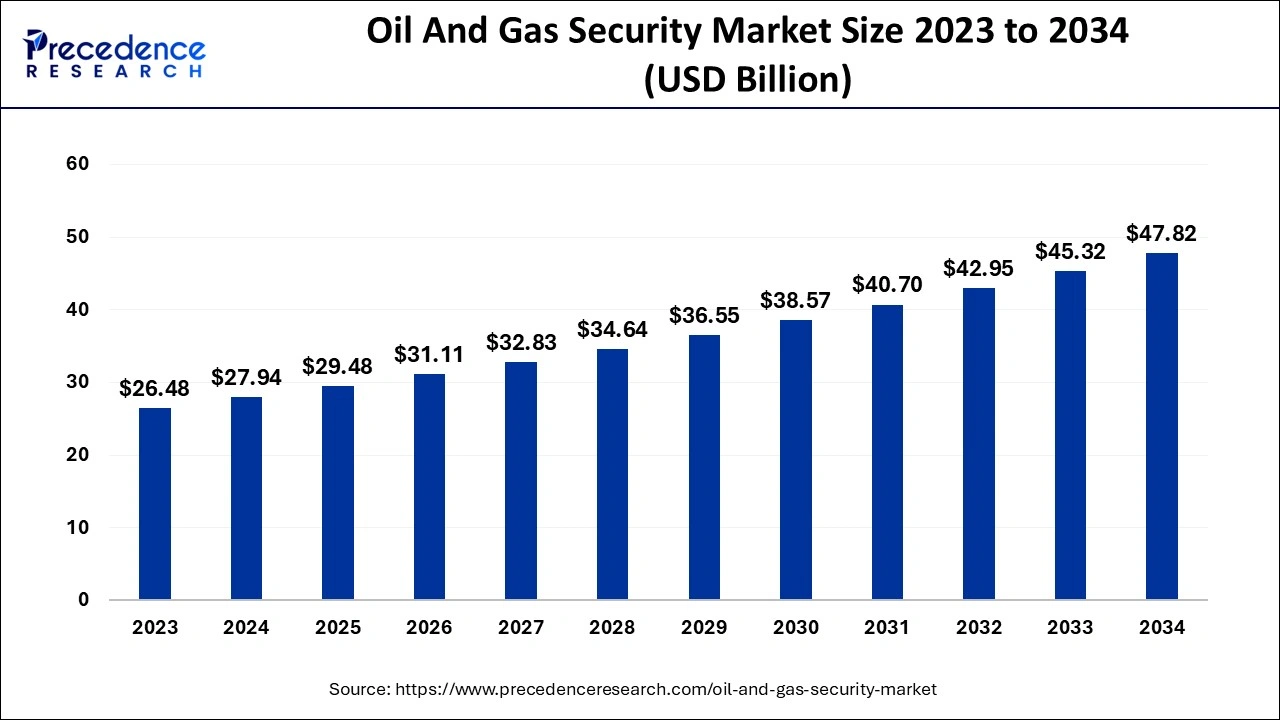

The global oil and gas security market size reached USD 27.94 billion in 2024 and is predicted to be Worth around USD 47.82 billion by 2034, growing at a CAGR of 5.52% from 2024 to 2034

Key Points

- North America dominated the oil and gas security market with the largest market share of 34% in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the studied period.

- By component, the hardware segment contributed the biggest market share of 52% in 2023.

- By component, the services segment will show significant growth in the market over the forecast period.

- By end use, the oil and gas companies segment generated the highest market share of 36% in 2023.

- By end use, the pipeline operators segment is expected to grow at the fastest rate in the market over the projected period.

The need for robust security solutions is driven by the critical importance of safeguarding infrastructure, data, and personnel across all stages of oil and gas operations, from exploration to distribution

Sample:https://www.precedenceresearch.com/sample/5220

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.82 Billion |

| Market Size in 2024 | USD 27.94 Billion |

| Market Size in 2025 | USD 29.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Drivers:

Key drivers of the market include the escalating geopolitical tensions, rising cyber threats, and increasing reliance on digital technologies within the oil and gas industry. As digitalization increases, the vulnerability to cyberattacks grows, necessitating stronger cybersecurity measures. Additionally, strict government regulations and the expansion of operations across diverse regions are contributing to the growth of security investments.

Opportunities:

The market offers substantial opportunities in advanced technological integration. The use of artificial intelligence, machine learning, and blockchain in security systems enhances threat detection and response, making operations more resilient. Moreover, the ongoing shift towards renewable energy in the sector creates the need for new security solutions tailored to these emerging assets.

Regional Insights:

North America holds a significant share of the market, driven by advanced security measures in place to protect oil and gas infrastructure from cyberattacks, particularly in the U.S. Geopolitical concerns and the rapid development of unconventional energy sources in the region further fuel the demand for security services. Other regions like Europe and Asia Pacific are also expanding their security frameworks due to similar concerns over infrastructure vulnerability

Read Also: Stationery Products Market Size to worth USD 180.65 Bn By 2034

Oil And Gas Security Market Companies

- ABB Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- Waterfall Security Solutions Ltd.

- Parsons Corporation

- P2 Energy Solutions

- KBR, Inc.

- DuPont de Nemours, Inc.

- Huawei Technologies Co., Ltd.

- Shell Catalysts & Technology

- Baker Hughes Company

- Halliburton Company

- Symantec Corporation

Recent News

- In August 2024, SLB and Palo Alto Networks declared an expansion of their partnership aimed at improving cybersecurity within the energy sector. The partnership seeks to boost SLB’s security infrastructure and develop innovative solutions to address emerging cyber threats.

- In July 2024, Accenture acquired True North Solutions, a U.S.-based provider of industrial engineering solutions, to improve its capabilities in helping clients in the oil, gas, and mining sectors produce and transport energy more safely and efficiently.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By End user

- Oil and Gas Companies

- Pipeline Operators

- Drilling Contractors

- Energy Infrastructure Providers

- Third-party Security Providers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa