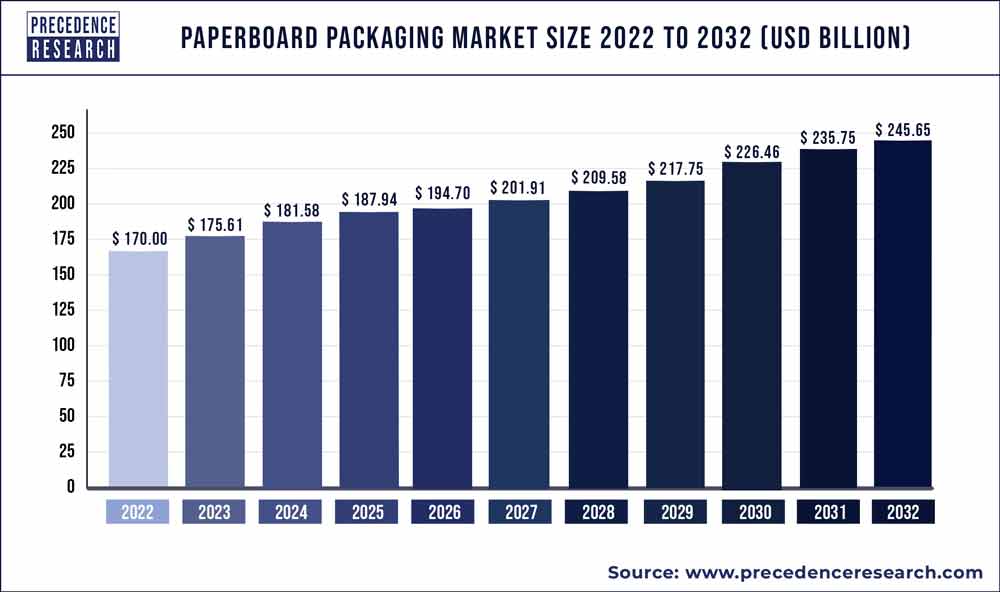

The paperboard packaging market recorded a notable revenue share in the market in 2021 and is set to be worth more than USD 206.5 billion by the end of 2030. It is poised to grow at a healthy CAGR of 3.5% from 2021 to 2030. Due to the expansion of the sustainable packaging sector and higher packaged food consumption.

The report contains 150+ pages with detailed analysis. The market report also covers the estimated market sizes and trends for different countries across major regions, globally.

Crucial factors accountable for Paperboard Packaging market growth are:

- The expansion of the e-commerce business

- Consumers rising worries about the environmental impact of packaging wastes

- Growth in food packaging and ever-increasing need for corrugated packaging

Download the Sample Pages of this Report for Better Understanding (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1346

Scope of the Paperboard Packaging Market Report

| Report Highlights | Details |

| Market Size In 2030 | USD 206.5 Billion |

| Growth Rate From 2021 to 2030 | CAGR of 3.5% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Raw Material, Product, Geography |

Paperboard Packaging Market Report Highlights

- Based on raw materials, the recycling sector accounted for almost half of the market in 2020, owing to the fact that it can be recycled as fiber and utilized to produce new paperboard goods.

- Solid unbleached board (SUB) is the most dominating segment in the paperboard packaging market. SUB (Solid Unbleached Board) is a type of boxboard manufactured from unbleached chemical pulp. It is often offered with two or three layers of color coatings.

- Food and beverages have emerged as the leading application sector in the paperboard packaging industry, accounting for almost half of the market share in 2020.

Paperboard Packaging Market Dynamics

Driver – The food and beverage sector are the most important end-user of paperboard packaging, accounting for more than half of the global market share. The food and beverage sector mostly uses coated unbleached boards for beverage packaging and corrugated container boards for fruit, vegetable, and food product packaging. The increasing popularity of frozen meals is expected to stimulate demand for folding carton packaging.

Changes in lifestyle and an increasing youthful population drive up demand for branded and packaged goods. According to the Flexible Packaging Association, the beverage industry accounts for about half of the packaging market in the United States. Currently, more than 30% of Americans order meals twice a week, and this figure is predicted to rise by 3% in the coming years.

Restraint – Intense rivalry among paper and paperboard packaging producers is a major factor limiting market expansion. Furthermore, the industry’s present fragmentation as a result of rising concentration of small and medium size producers and converters is a significant factor acting as a limitation on the growth of the worldwide paper and paperboard packaging market.

Opportunity – The government’s efforts to minimize plastic will open up new chances for the paperboard packaging business. The government is encouraging paper recycling, which will help the environment. For example, the government announces the Plastic Waste Management Amendment Rules, 2021, which limit the use of some single-use plastic goods by 2022.

The thickness of plastic carry bags increased from 50 to 75 millimeters on September 30, 2021, and to 120 microns on December 31, 2022. Such regulations will have an influence on the expansion of businesses in the paperboard packaging industry.

Paper and paperboard have had a renaissance, spurred by anti-plastic sentiment and a growing worldwide need for built-in recyclability. Paper is not only a naturally renewable, recyclable, and biodegradable material; it can also add value to packaging by giving it a “natural” appearance in an increasingly eco-conscious consumer market. For example, in the UK introduction of the JUST water brand, a product packaged in 54% paper, 28% plant-based plastic, 3% aluminum, and 15% protective plastic film (with a sugarcane cap), paper is used to lower the total plastic percentage, hence enhancing the pack’s overall renewability.

Challenges – The unpredictability of raw material availability will provide a challenge to sectors that rely on paperboard packaging. The demand for paperboard packaging is increasing, but the supply is insufficient. End-users such as bioenergy firms are expanding their demand for household wood supplies. Increasing the sustainable mobilization of wood and developing new technologies for further optimizing the added value from raw materials through cascading use of wood (cascading contributes to greater resource efficiency and, as a result, reduces pressure on the environment) would aid in matching wood supply and demand.

The rising volume of recovered paper exports to non-European nations may potentially put a strain on supplies. The rise in European energy prices, along with the rise in gas prices in North America, has put the sector at a global competitive disadvantage. Energy, environmental, and transportation policy will all have a big impact on the sector’s future. A strong regulatory framework is essential for long-term growth and investor confidence.

Read Also: Chitosan Market 2022 Newest Industry Data, Growth Prospects, Future Trends And Forecast 2030

Recent Developments

- September 2020 – Mondi PLC teamed with BIOhof Kirchweidach, a Bavarian organic farm, to create a sustainable packaging solution for 500g packets of tomatoes on the vine to be delivered to PENNY stores operated by major German retailer REWE Group. The project’s goal is to replace the existing packaging, which contained 2.5 g of plastic film each box, with a recyclable and plastic-free alternative.

- DS Smith just installed an EFI Nozomi C18000 Plus digital printer at its Lisbon factory in January 2021. The new technology will enable the supply of 100 percent bespoke, sustainable packaging with photographic printing quality and reduced delivery times, as well as image revisions within the same order.

Some of the major players in the paperboard packaging market include:

- Nippon Paper Industries Co., Ltd.

- Stora Enso

- South African Pulp & Paper Industries

- Mondi plc

- ITC Limited

- Smurfit Kappa Group

- Oji Holding Corporation

- International Paper Group

- Svenska Cellulosa Aktiebolaget

Segments Covered in the Report

By Raw Material

- Fresh Source

- Wood pulp

- Others

- Recycled Waste Paper

By Product

- Boxboard

- Folding boxboard (FBB)

- Solid unbleached board (SUB)

- Solid bleached board (SBB)

- White lined chipboard (WLC)

- Containerboard

By Application

- Food & beverages

- Non-durable goods

- Durable goods

- Medical

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Purchase Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1346

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Follow us on LinkedIn | Twitter | Facebook