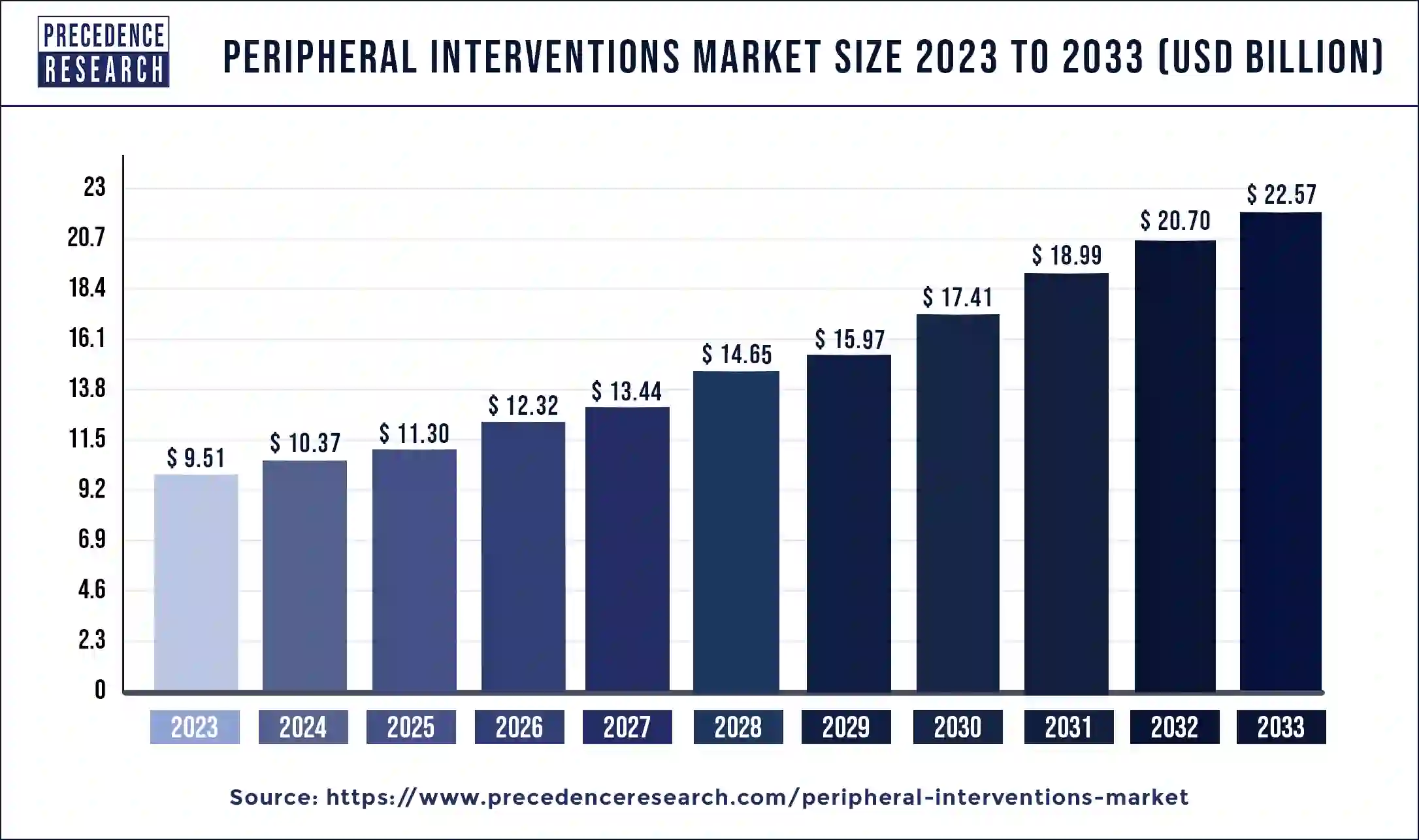

The global peripheral interventions market size was valued at USD 9.51 billion in 2023 and is predicted to reach around USD 22.57 billion by 2033. The market is expanding at a solid CAGR of 9.03% over the forecast period 2024 to 2033.

Key Points

- The North America peripheral interventions market size is exhibited at USD 3.42 billion in 2023 and is expected to attain around USD 8.24 billion by 2033, poised to grow at a CAGR of 9.19% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 36% in 2023.

- Asia- Pacific is the fastest growing in the peripheral interventions market during the forecast period.

- By type, the catheters segment dominated the market in 2023.

- By type, the stents segment shows a notable growth in the peripheral interventions market during the forecast period.

- By application, the peripheral artery disease segment dominated the market in 2023.

- By application, the venous thromboembolism segment is the fastest growing in the peripheral interventions market during the forecast period.

- By end- user, the hospitals segment dominated the peripheral interventions market.

- By end- user, the ambulatory surgical centers segment shows a significant growth in the peripheral interventions market during the forecast period.

The peripheral interventions market refers to the segment of the medical device industry focused on minimally invasive procedures for treating peripheral artery disease (PAD) and other conditions affecting the peripheral vasculature. Peripheral interventions encompass a range of devices and procedures designed to diagnose and treat blockages and other issues in the peripheral arteries and veins, which are the blood vessels located outside the heart and brain. These interventions are critical for restoring blood flow, reducing symptoms, and preventing severe complications such as limb amputation and stroke.

Peripheral artery disease is a common circulatory problem where narrowed arteries reduce blood flow to the limbs, often leading to symptoms such as leg pain when walking (claudication). The growing prevalence of PAD, largely driven by rising rates of diabetes, hypertension, and smoking, has significantly increased the demand for peripheral interventions. As the global population ages and the incidence of chronic diseases continues to rise, the need for effective treatments in the peripheral interventions market is expected to grow.

Get a Sample: https://www.precedenceresearch.com/sample/4463

Growth Factors

Several key factors are driving the growth of the peripheral interventions market. One of the primary drivers is the increasing prevalence of peripheral artery disease and other vascular conditions, which necessitate the use of intervention procedures to manage and treat these conditions. The aging global population is another significant factor, as elderly individuals are more prone to vascular diseases due to age-related changes in their blood vessels.

Technological advancements in medical devices have also played a crucial role in the market’s growth. Innovations such as drug-eluting stents, advanced catheters, and improved imaging techniques have enhanced the efficacy and safety of peripheral interventions. These advancements have made procedures less invasive, reduced recovery times, and improved patient outcomes, thereby increasing the adoption of peripheral interventions.

Furthermore, increasing awareness about the benefits of early diagnosis and treatment of peripheral artery disease is encouraging more patients to seek medical attention, thus driving market growth. Public health campaigns and education initiatives by healthcare organizations are contributing to greater awareness and early detection of vascular conditions.

Trends

Several notable trends are shaping the peripheral interventions market. One significant trend is the shift towards minimally invasive procedures. Minimally invasive techniques, such as endovascular interventions, are preferred over traditional open surgeries due to their reduced risk, shorter hospital stays, and faster recovery times. This trend is driving the development and adoption of new and advanced peripheral intervention devices.

Another trend is the integration of advanced imaging technologies with peripheral intervention procedures. Technologies such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) provide detailed images of the blood vessels, allowing for precise diagnosis and treatment. These imaging techniques are improving the accuracy and effectiveness of peripheral interventions, leading to better patient outcomes.

The market is also witnessing an increasing focus on personalized medicine. Tailoring treatment plans to individual patients based on their specific medical conditions and characteristics is becoming more common. This personalized approach is enhancing the effectiveness of peripheral interventions and improving patient satisfaction.

Region Insights

The peripheral interventions market exhibits significant regional variations, influenced by factors such as healthcare infrastructure, economic development, and prevalence of vascular diseases.

- North America: North America, particularly the United States, holds a significant share of the global peripheral interventions market. The region’s advanced healthcare infrastructure, high prevalence of vascular diseases, and strong presence of major medical device companies contribute to its dominant position. Additionally, the increasing adoption of advanced technologies and favorable reimbursement policies are driving market growth in this region.

- Europe: Europe is another major market for peripheral interventions, with countries like Germany, France, and the UK leading in terms of market size. The region’s well-established healthcare systems, high prevalence of chronic diseases, and growing aging population are key factors driving the demand for peripheral interventions. Moreover, ongoing research and development activities and the presence of key market players are supporting market growth in Europe.

- Asia-Pacific: The Asia-Pacific region is expected to witness the highest growth rate in the peripheral interventions market during the forecast period. Rapid economic development, improving healthcare infrastructure, and increasing awareness about vascular diseases are contributing to the market’s growth. Countries like China, India, and Japan are seeing a rise in the adoption of peripheral interventions due to their large patient populations and increasing healthcare investments.

- Latin America: The Latin American market for peripheral interventions is also growing, driven by improving healthcare access and rising prevalence of vascular diseases. Countries such as Brazil and Mexico are leading the market in this region, supported by government initiatives to enhance healthcare services and increase awareness about vascular health.

- Middle East and Africa: The Middle East and Africa region is expected to experience moderate growth in the peripheral interventions market. Factors such as improving healthcare infrastructure, increasing prevalence of lifestyle-related diseases, and rising healthcare expenditure are driving market growth in this region. However, limited access to advanced healthcare technologies and economic disparities may pose challenges to market expansion.

Peripheral Interventions Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 9.51 Billion |

| Market Size in 2024 | USD 10.37 Billion |

| Market Size by 2033 | USD 22.57 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Peripheral Interventions Market Dynamics

Drivers

The peripheral interventions market is driven by several key factors. One of the primary drivers is the increasing prevalence of peripheral artery disease and other vascular conditions. As the global population ages and the incidence of chronic diseases such as diabetes and hypertension rises, the demand for peripheral interventions is expected to increase.

Technological advancements in medical devices are also driving market growth. Innovations such as drug-eluting stents, advanced catheters, and improved imaging techniques have enhanced the efficacy and safety of peripheral interventions. These advancements have made procedures less invasive, reduced recovery times, and improved patient outcomes, thereby increasing the adoption of peripheral interventions.

Furthermore, increasing awareness about the benefits of early diagnosis and treatment of peripheral artery disease is encouraging more patients to seek medical attention, thus driving market growth. Public health campaigns and education initiatives by healthcare organizations are contributing to greater awareness and early detection of vascular conditions.

Opportunities

The peripheral interventions market presents several opportunities for growth and expansion. One significant opportunity lies in the development and adoption of new and advanced technologies. Innovations in medical devices, such as drug-coated balloons and bioresorbable stents, have the potential to improve the efficacy and safety of peripheral interventions. Companies that invest in research and development to bring these advanced products to market are likely to benefit from increased demand.

The growing trend towards personalized medicine also presents an opportunity for the peripheral interventions market. By tailoring treatment plans to individual patients based on their specific medical conditions and characteristics, healthcare providers can enhance the effectiveness of peripheral interventions and improve patient satisfaction. Companies that develop personalized treatment solutions and diagnostic tools are well-positioned to capitalize on this trend.

Additionally, expanding healthcare access in emerging markets presents a significant opportunity for the peripheral interventions market. As healthcare infrastructure improves and awareness about vascular diseases increases in regions such as Asia-Pacific, Latin America, and the Middle East and Africa, the demand for peripheral interventions is expected to rise. Companies that establish a strong presence in these regions and offer affordable and effective treatment options are likely to experience substantial growth.

Challenges

Despite the positive growth prospects, the peripheral interventions market faces several challenges. One of the primary challenges is the high cost of advanced medical devices and procedures. The cost of peripheral interventions can be a significant barrier for patients, particularly in low- and middle-income countries where healthcare resources are limited. Companies need to focus on developing cost-effective solutions to address this challenge and ensure broader access to peripheral interventions.

Regulatory challenges also pose a significant hurdle for the peripheral interventions market. The stringent regulatory requirements for medical devices can delay product approvals and market entry, impacting the speed at which new innovations reach patients. Companies need to navigate these regulatory frameworks effectively and invest in clinical trials and compliance to ensure their products meet the necessary standards.

Another challenge is the lack of skilled healthcare professionals trained in performing peripheral interventions. The success of these procedures largely depends on the expertise of the healthcare providers. Ensuring adequate training and education for healthcare professionals is crucial to improving patient outcomes and expanding the adoption of peripheral interventions.

Read Also: Age-related Macular Degeneration Treatment Market Size, Report By 2033

Peripheral Interventions Market Companies

- Biotronik SE & Co. KG

- Teleflex Incorporated

- Abbott Laboratories

- Boston Scientific Corporation

- Cook Medical

- W. L. Gore & Associates Inc

- Cardinal Health Inc

- Angio Dynamics Inc

- Medtronic

- B. Braun Melsungen AG

- Terumo Corporation

- Becton Dickinson and Company

Recent Developments

- In February 2024, the next-generation intermediate catheter with TruCourse, CEREGLIDE 71 Intermediate Catheter, has been launched by CERENOVUS, Inc., a Johnson & Johnson MedTech division. It is intended for the revascularization of individuals experiencing acute ischemic stroke.

- In June 2023, Blue Medical Devices, a Wellinq group company headquartered in Helmond, the Netherlands, has been acquired by Translumina, a leader in the global market for interventional cardiovascular medical devices with manufacturing facilities in Germany and India. The company was founded in 2013 and manufactures a cutting-edge assortment of balloon catheters, such as Drug-Coated Balloons (DCB) and other specialty balloons for intricate cardiac procedures.

Segments Covered in the Report

By Product

- Catheters

- Sheath

- Stents

- Bare Metal Stents

- Drug-eluting Stents

- Guide Wires

- Atherectomy Devices

- Embolic Devices

- IVC Filters

By Application

- Peripheral Artery Disease

- Venous Thromboembolism

- Others

By End-use

- Hospitals

- Catheterization Laboratories

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/