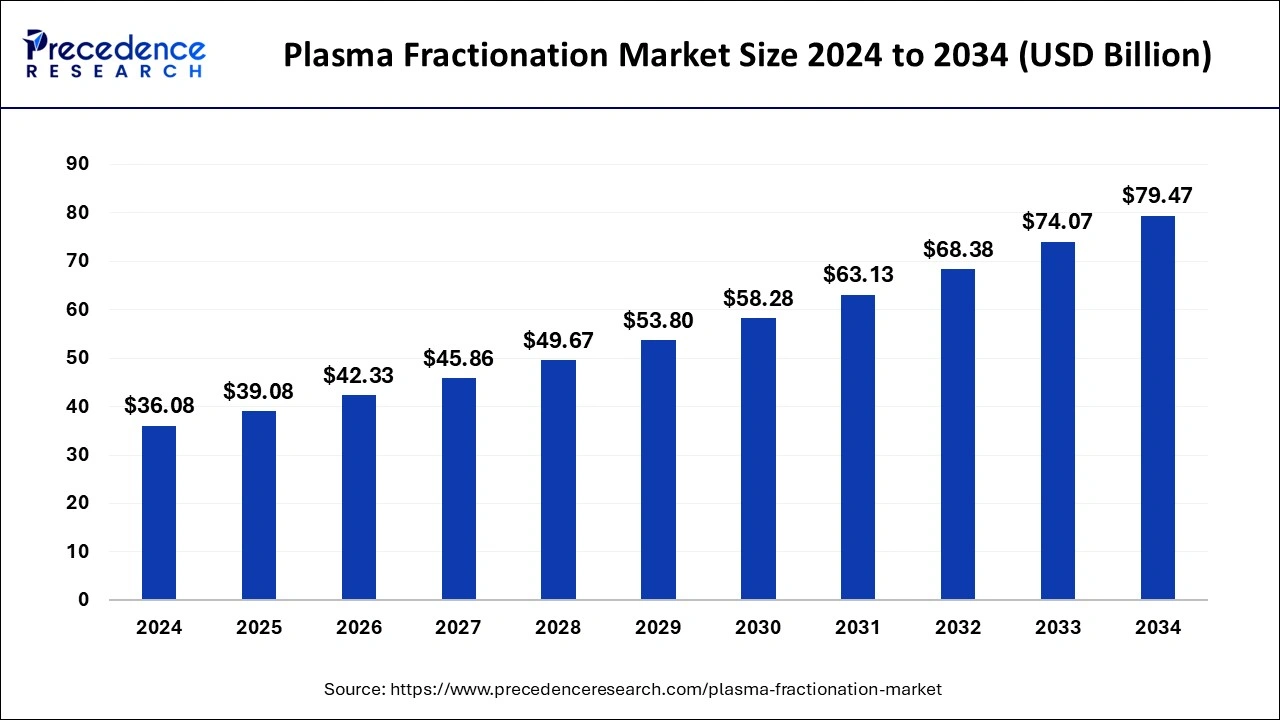

The global plasma fractionation market size was estimated at USD 33.31 billion in 2023 and is projected to be worth around USD 74.07 billion by 2033, growing at a CAGR of 8.32% from 2024 to 2033.

Key Points

- The North America plasma fractionation market size accounted for USD 18.32 billion in 2023 and is expected to attain around USD 41.11 billion by 2033, poised to grow at a CAGR of 8.41% between 2024 and 2033.

- North America led the market with the largest revenue share of 55% in 2023.

- Asia Pacific is expected to witness the fastest rate of growth in the market during the forecast period.

- By method, the centrifugation segment has contributed more than 35% of revenue share in 2023.

- By method, the chromatography will grow rapidly during the forecast period.

- By product, the immunoglobins segment dominated the market in 2023.

- By product, the coagulation factors segment is projected to witness the fastest growth during the forecast period.

- By application, the neurology segment dominated the market in 2023.

- By application, the oncology segment will grow at a considerable rate in the market during the forecast period.

- By end use, the hospitals & clinics segment has held a major revenue share of 52% in 2023.

- By end use, the clinical research segment is projected to grow rapidly in the market during the forecast period.

Plasma fractionation is a critical process in the biopharmaceutical industry, involving the separation of plasma from blood and its subsequent processing to obtain various therapeutic proteins and other products. These products are used in the treatment of a wide array of conditions, including immune deficiencies, bleeding disorders, and other chronic diseases. The market for plasma fractionation has seen substantial growth over the years, driven by increasing demand for plasma-derived products, advancements in technology, and a growing focus on research and development.

The process of plasma fractionation includes several steps: separation of plasma from whole blood, isolation of specific plasma proteins, purification of these proteins, and the formulation of final therapeutic products. Key products derived from plasma fractionation include immunoglobulins, albumin, clotting factors, and other plasma-derived proteins. These products are essential in the management of diseases such as hemophilia, primary immunodeficiency diseases, and chronic inflammatory demyelinating polyneuropathy.

Get a Sample: https://www.precedenceresearch.com/sample/4416

Growth Factors

The growth of the plasma fractionation market is driven by several factors. Firstly, there is an increasing prevalence of immunological and neurological diseases globally, necessitating the use of plasma-derived therapies. The aging population is also a significant factor, as older individuals are more prone to chronic diseases that require plasma products for treatment. Advances in technology have improved the efficiency and yield of plasma fractionation processes, making it possible to meet the growing demand more effectively.

Additionally, increased healthcare spending in developing regions and a growing awareness about the benefits of plasma-derived therapies are boosting market growth. Governments and healthcare organizations are investing in the development of advanced healthcare infrastructure, which includes the establishment of plasma fractionation facilities. Moreover, there is a rising trend of partnerships and collaborations among key players in the market, which is fostering innovation and expanding the reach of plasma products.

Region Insights

The plasma fractionation market exhibits significant regional variations. North America, particularly the United States, dominates the market due to the presence of a well-established healthcare system, high demand for plasma-derived products, and strong regulatory support. The region also benefits from a robust biopharmaceutical industry and substantial investments in research and development. Europe follows closely, with countries like Germany, France, and the UK being major contributors to the market growth due to their advanced healthcare infrastructure and increasing adoption of plasma therapies.

Asia-Pacific is expected to witness the fastest growth in the coming years. This growth is attributed to the increasing prevalence of chronic diseases, rising healthcare expenditure, and improving healthcare infrastructure in countries like China, India, and Japan. Additionally, government initiatives to enhance healthcare services and the establishment of new plasma fractionation facilities are contributing to the market expansion in this region. Latin America and the Middle East & Africa are also experiencing growth, albeit at a slower pace, due to improving healthcare systems and growing awareness of plasma-derived treatments.

Plasma Fractionation Market Scope

| Report Coverage | Details |

| Plasma Fractionation Market Size in 2023 | USD 33.31 Billion |

| Plasma Fractionation Market Size in 2024 | USD 36.08 Billion |

| Plasma Fractionation Market Size by 2033 | USD 74.07 Billion |

| Plasma Fractionation Market Growth Rate | CAGR of 8.32% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Method, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Plasma Fractionation Market Dynamics

Drivers

Several key drivers are propelling the plasma fractionation market forward. The rising incidence of rare diseases and the need for specialized treatments are primary factors. Plasma-derived therapies are often the only effective treatment option for patients with conditions such as hemophilia and primary immunodeficiency diseases. This creates a constant and growing demand for plasma products.

Technological advancements in plasma fractionation techniques have also played a crucial role. Innovations in chromatography, purification processes, and cold storage solutions have increased the efficiency, yield, and safety of plasma-derived products. These advancements have not only improved the availability of these products but have also made the processes more cost-effective.

Government support and favorable reimbursement policies in several countries are further driving market growth. Many governments have recognized the importance of plasma-derived therapies and have implemented policies to support the development and distribution of these products. Additionally, the biopharmaceutical industry’s focus on developing new and improved plasma-derived products is contributing to the expansion of the market.

Opportunities

The plasma fractionation market presents numerous opportunities for growth and development. One significant opportunity lies in the increasing demand for immunoglobulins. Immunoglobulins are used in the treatment of a wide range of conditions, including immune deficiencies, autoimmune diseases, and infectious diseases. The growing prevalence of these conditions and the expanding indications for immunoglobulin therapy are driving demand.

Another promising opportunity is the expansion of plasma collection centers. The availability of plasma for fractionation is a critical factor in the market. Increasing the number of plasma collection centers and improving collection techniques can significantly enhance the supply of plasma, thereby supporting market growth. Developing countries, in particular, present substantial opportunities for expanding plasma collection infrastructure.

Collaborations and partnerships among pharmaceutical companies, research institutions, and healthcare organizations are also creating opportunities for innovation. These collaborations can lead to the development of new plasma-derived products, improved fractionation techniques, and enhanced distribution networks. Additionally, advancements in biotechnology and genomics offer the potential for developing novel plasma-derived therapies tailored to specific genetic profiles, further expanding the market.

Challenges

Despite the positive outlook, the plasma fractionation market faces several challenges. One of the primary challenges is the high cost associated with plasma-derived therapies. The complex and resource-intensive nature of plasma fractionation processes contributes to the high cost of these products, making them less accessible to patients, particularly in developing regions. Efforts to reduce production costs and improve affordability are ongoing but remain a significant hurdle.

The supply of plasma is another critical challenge. Plasma collection relies on donations, and there are stringent regulations governing the collection, processing, and distribution of plasma. Ensuring a steady and sufficient supply of high-quality plasma is essential but can be challenging, especially during times of increased demand or in regions with limited donation infrastructure.

Regulatory challenges also pose a significant barrier to market growth. The plasma fractionation industry is heavily regulated to ensure the safety and efficacy of plasma-derived products. Navigating these regulations, obtaining approvals, and maintaining compliance can be time-consuming and costly for companies. Additionally, differences in regulatory requirements across regions can complicate the global distribution of plasma products.

Finally, the risk of infectious disease transmission is a concern in the plasma fractionation market. Although advanced screening and purification techniques have significantly reduced the risk, the potential for contamination and the transmission of blood-borne pathogens remains. Continuous monitoring, rigorous testing, and adherence to stringent safety protocols are essential to mitigate this risk.

Read Also: Interventional Radiology Market Size to Reach USD 27.14 Bn by 2033

Plasma Fractionation Market Recent Developments

- In December 2023, GC Biopharma announced that the Indonesian government approved the construction of a plasma fractionation plant in Jababeka Industrial Estate. This plant is expected to be operational in 2027 and will produce around 4000000 liters of plasma for medicinal use.

- In March 2023, CSL Limited opened a new plasma fractionation facility in Marburg, Germany. This manufacturing plant cost around 470 million USD and was opened with the aim of using human-donated plasma in useful medicines.

Plasma Fractionation Market Companies

- Grifols S.A.

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Kedrion S.p.A

- LFB S.A.

- Biotest AG

- Sanquin

- Bio Products Laboratory Ltd.

- Intas Pharmaceuticals Ltd

Segments Covered in the Report

By Product

- Albumin

- Immunoglobulins

- Intravenous Immunoglobulins

- Subcutaneous Immunoglobulins

- Others

- Coagulation Factors

- Factor viii

- Factor ix

- Von Willebrand Factor

- Prothrombin Complex Concentrates

- Fibrinogen Concentrates

- Others

- Protease Inhibitors

- Others

By Method

- Centrifugation

- Depth Filtration

- Chromatography

- Others

By Application

- Neurology

- Hematology

- Oncology

- Immunology

- Pulmonology

- Others

By End-use

- Hospitals & Clinics

- Clinical Research

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/