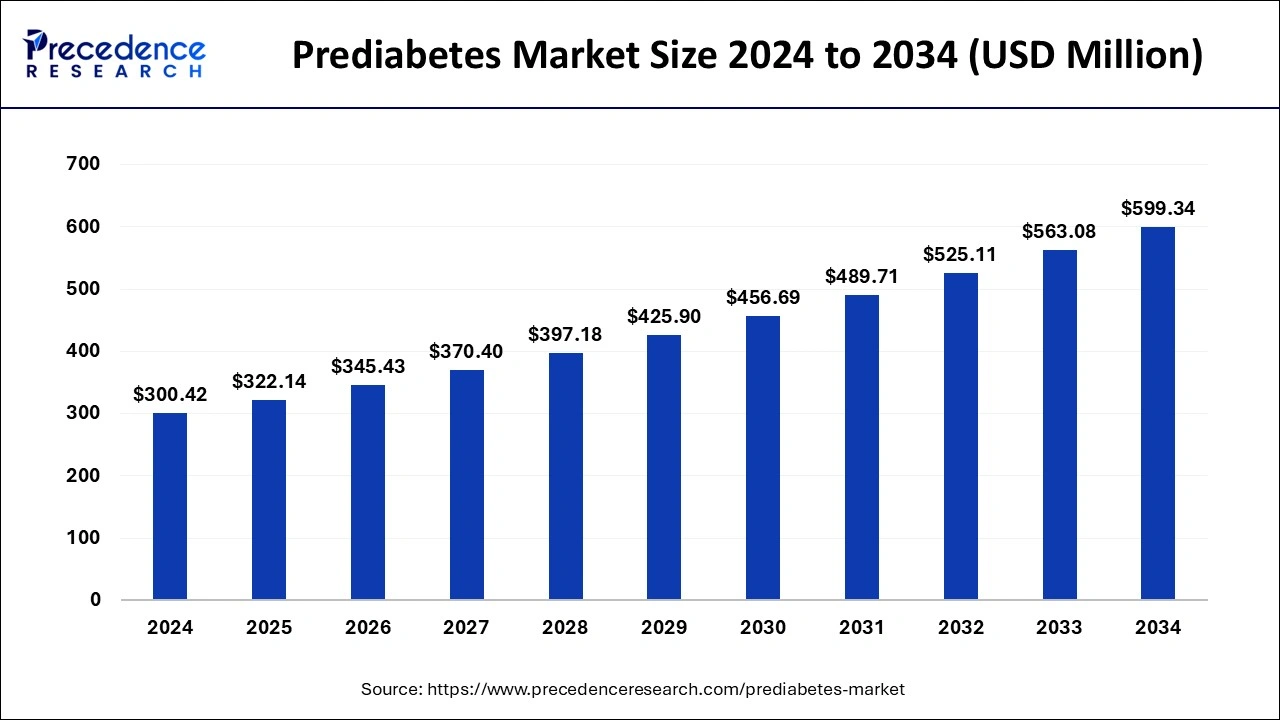

The global prediabetes market size was valued at USD 280.16 million in 2023 and is predicted to reach around USD 563.08 million by 2033. The market is expanding at a solid CAGR of 7.23% over the forecast period 2024 to 2033.

Key Points

- The North America prediabetes market size was evaluated at USD 117.67 million in 2023 and is expected to attain around USD 239.31 million by 2033, poised to grow at a CAGR of 7.35% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 42% in 2023.

- Asia Pacific is projected to expand at a rapid pace during the forecast period.

- By drug class, the diguanide segment accounted for the highest revenue share of 85% in 2023.

- By drug class, the SGLT2 Inhibitors segment is expected to witness significant growth during the forecast period.

- By age group, the adults (18-49) segment has held a major revenue share of 49% in 2023.

- By age group, the elderly (50+) segment is expected to expand robustly during the forecast period.

Prediabetes, a condition characterized by blood glucose levels higher than normal but not high enough to be classified as diabetes, presents a significant public health concern globally. With the rising prevalence of obesity, sedentary lifestyles, and poor dietary habits, the incidence of prediabetes is escalating, leading to a growing demand for effective management and prevention strategies. The prediabetes market encompasses various diagnostic tools, therapeutic interventions, lifestyle modification programs, and educational initiatives aimed at mitigating the risk of progression to type 2 diabetes and associated complications.

Get a Sample: https://www.precedenceresearch.com/sample/4441

Growth Factors

Several factors contribute to the growth of the prediabetes market. Firstly, the increasing awareness about the health consequences of prediabetes and its link to type 2 diabetes encourages individuals to seek early detection and intervention. Moreover, healthcare providers are emphasizing proactive screening for prediabetes during routine health assessments, driving the demand for diagnostic tests such as fasting plasma glucose (FPG), oral glucose tolerance test (OGTT), and glycated hemoglobin (HbA1c). Additionally, advancements in medical technology have led to the development of innovative diagnostic devices and point-of-care testing kits, facilitating early detection and intervention in diverse healthcare settings.

Furthermore, the growing focus on preventive healthcare and wellness initiatives, coupled with government-led public health campaigns, underscores the importance of lifestyle modifications in managing prediabetes. This has spurred the adoption of structured lifestyle intervention programs encompassing dietary counseling, exercise regimens, and behavior modification techniques. Additionally, the integration of digital health platforms and mobile applications for remote monitoring and coaching has enhanced patient engagement and adherence to lifestyle interventions, thereby driving market growth.

Region Insights

The prediabetes market exhibits regional variations influenced by demographic trends, healthcare infrastructure, regulatory frameworks, and cultural factors. Developed economies such as North America and Europe account for a significant share of the market, driven by well-established healthcare systems, robust screening protocols, and high awareness levels among the population. In these regions, government initiatives and private sector collaborations promote early detection and management of prediabetes through comprehensive healthcare programs and reimbursement policies for diagnostic tests and preventive services.

In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid urbanization, changing dietary patterns, and increasing prevalence of obesity, contributing to the escalating burden of prediabetes. While awareness about prediabetes is gradually improving in these regions, limited access to healthcare services and financial constraints pose challenges to early detection and intervention. However, concerted efforts by governments, non-profit organizations, and pharmaceutical companies to expand healthcare infrastructure, raise awareness, and promote affordable screening and treatment options are expected to fuel market growth in these regions.

Prediabetes Market Scope

| Report Coverage | Details |

| Prediabetes Market Size in 2023 | USD 280.16 Million |

| Prediabetes Market Size in 2024 | USD 300.42 Million |

| Prediabetes Market Size by 2033 | USD 563.08 Million |

| Prediabetes Market Growth Rate | CAGR of 7.23% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Drug Class, Age Group, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Prediabetes Market Dynamics

Drivers

Several drivers propel the growth of the prediabetes market. Firstly, the escalating global prevalence of obesity, a major risk factor for prediabetes, underscores the urgent need for effective prevention and management strategies. The rising incidence of sedentary lifestyles, unhealthy dietary habits, and metabolic disorders further exacerbate the burden of prediabetes, creating a significant market opportunity for diagnostic and therapeutic interventions.

Moreover, the economic burden associated with diabetes and its complications, including healthcare costs and productivity losses, incentivizes stakeholders to invest in early detection and intervention programs for prediabetes. By preventing or delaying the onset of type 2 diabetes and its associated complications such as cardiovascular disease, neuropathy, and nephropathy, interventions targeting prediabetes offer substantial cost savings and improved quality of life for individuals and healthcare systems alike.

Additionally, the increasing emphasis on value-based healthcare models and population health management strategies encourages healthcare providers and payers to prioritize preventive interventions for prediabetes. By focusing on risk stratification, personalized interventions, and long-term outcomes, stakeholders aim to optimize resource allocation, enhance patient outcomes, and mitigate the long-term burden of chronic diseases.

Opportunities

The prediabetes market presents significant opportunities for innovation, collaboration, and market expansion. Firstly, advancements in biomarker research and genetic profiling hold promise for the development of novel diagnostic tools and predictive algorithms for identifying individuals at high risk of prediabetes and type 2 diabetes. By leveraging big data analytics, artificial intelligence, and machine learning algorithms, healthcare providers can enhance risk assessment, customize intervention strategies, and improve patient outcomes.

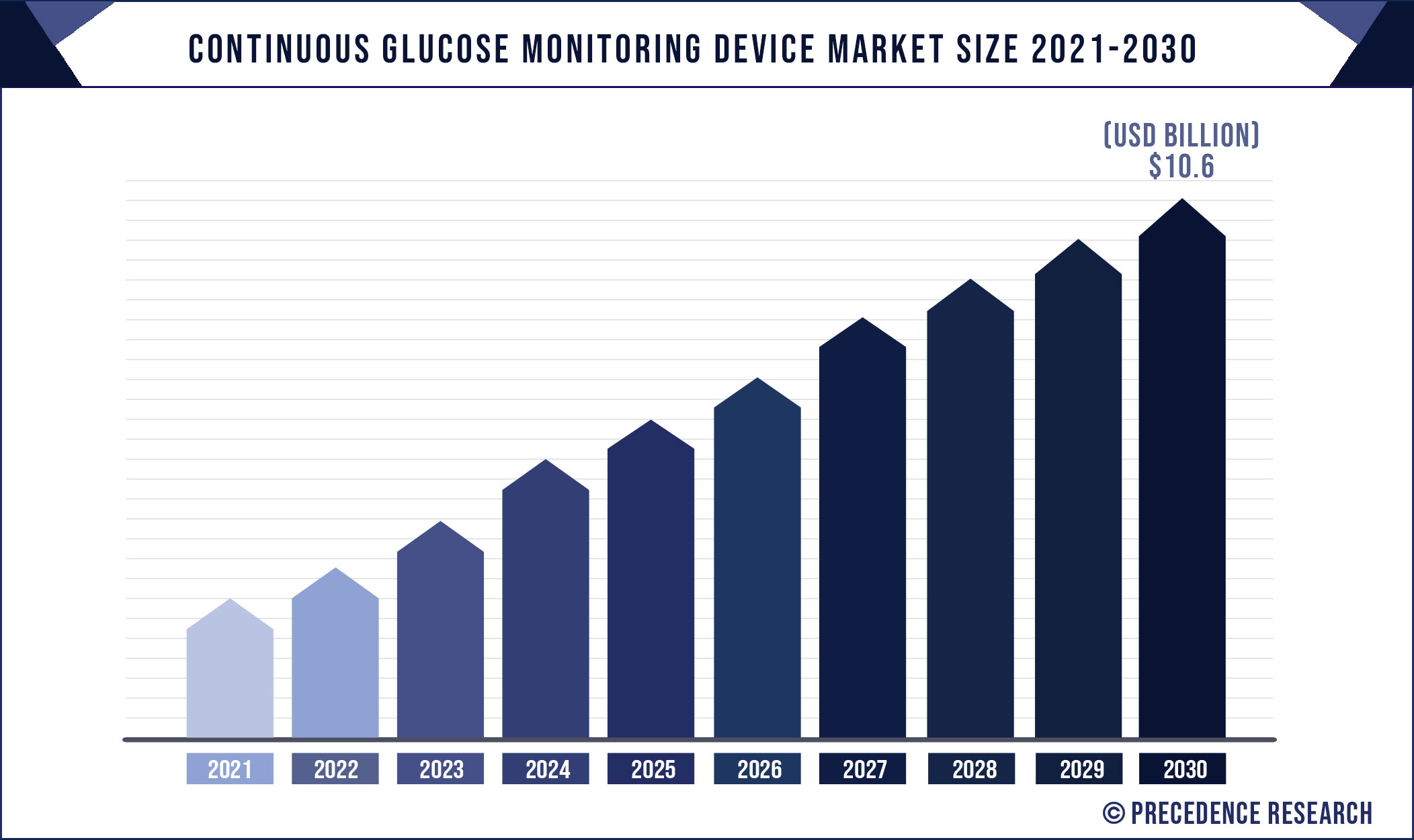

Furthermore, the integration of digital health technologies, telemedicine platforms, and wearable devices enables remote monitoring, real-time feedback, and personalized coaching for individuals with prediabetes. By empowering patients to take control of their health and adhere to lifestyle modifications, digital health solutions enhance engagement, accountability, and long-term behavior change, thereby improving clinical outcomes and reducing healthcare costs.

Moreover, collaborations between pharmaceutical companies, healthcare providers, and technology firms facilitate the development of comprehensive care pathways and integrated solutions for prediabetes management. By combining pharmacological therapies with lifestyle interventions, patient education, and support services, stakeholders can offer holistic approaches to prediabetes care, address the multifactorial nature of the condition, and improve patient adherence and outcomes.

Challenges

Despite the opportunities, the prediabetes market faces several challenges that impede its growth and sustainability. Firstly, limited awareness among healthcare providers and the general population about the significance of prediabetes and the importance of early intervention poses a barrier to effective screening and management efforts. Addressing misconceptions, stigma, and cultural beliefs surrounding prediabetes requires targeted education campaigns, community engagement initiatives, and healthcare professional training programs.

Additionally, access to affordable diagnostic tests, medications, and preventive services remains a challenge in many regions, particularly in low- and middle-income countries with resource constraints. Disparities in healthcare access, insurance coverage, and reimbursement policies further exacerbate inequities in prediabetes care, hindering efforts to reach underserved populations and vulnerable communities at high risk of prediabetes and type 2 diabetes.

Furthermore, the complex interplay of genetic, environmental, and behavioral factors influencing prediabetes risk and progression necessitates personalized and multidisciplinary approaches to care. However, limited healthcare infrastructure, fragmented care delivery systems, and siloed healthcare models often impede collaboration and coordination among healthcare providers, resulting in suboptimal outcomes and gaps in continuity of care for individuals with prediabetes.

Read Also: Vital Signs Monitoring Devices Market Size, Share, Report by 2033

Prediabetes Market Companies

- SciMar

- Boston Therapeutics

- Valbiotis

- RESVERLOGIX

- Caelus Health

- Aphaia Pharma

- AstraZeneca

- Bristol-Myers Squibb

Recent Developments

- In October 2023, UAE launched free screening at workplaces in a new campaign targeting prediabetic residents titled ‘Show the Red Card to Diabetes.’ The health authorities in the country have joined hands with private entities for the one-year battle to prevent diabetes from occurring in prediabetic individuals by conducting mass-free screening programs at workplaces followed by intervention through lifestyle modification to reduce the risk factors for diabetes.

- In November 2023, Valbiotis unveiled the success of the TOTUM 63 mode of action clinical study against prediabetes and the early stages of type 2 diabetes.

- In April 2023, Aphaia Pharma announced the dosing of the first patient in its phase 2 trial evaluating its lead candidate APH-012 for prediabetes.

- In February 2024, Know Labs announced the launch of KnowU, its latest wearable non-invasive continuous glucose monitor (CGM). The device enhances the user experience with features such as a rechargeable battery and a companion mobile app. The KnowU can be attached to the body using an adhesive patch or worn on the wrist with sensors that use radio waves to gauge the body’s glucose levels.

Segments Covered in the Report

By Drug Class

- Diguanide

- Thiazolidinediones

- Glucagon-like Peptide-1 Agonists (GLP-1)

- SGLT2 Inhibitors

- DPP-4 Inhibitors

- Others

By Age Group

- Children (12-18 years)

- Adults (18-49)

- Elderly (50+)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/