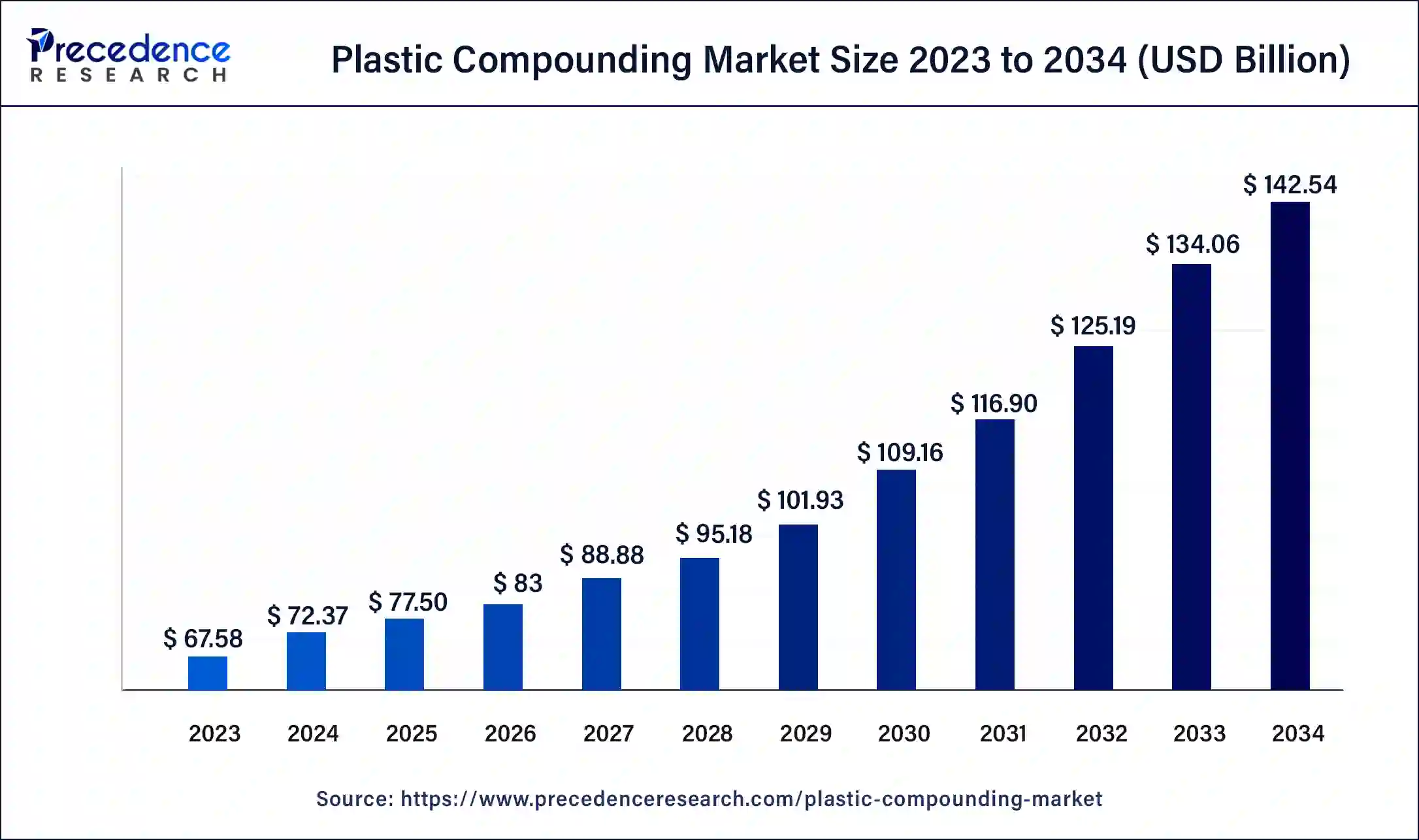

The plastic compounding market will grow from USD 72.37 Bn in 2024 to USD 142.54 Bn by 2034 at a CAGR of 7%.

Plastic Compounding Market Key Takeaways

- In 2023, Asia Pacific dominated the global market with a leading share of 46%.

- The automotive sector accounted for over 26% of the total revenue in 2023.

- Polypropylene (PP) was the top product, holding an estimated market share of 33% in 2023.

The plastic compounding market is driven by the growing demand for high-performance materials across industries like automotive, electronics, and packaging. Key drivers include the increasing adoption of advanced polymers and the need for lightweight, durable components. Innovations in compound formulations are expanding their applications, especially in industries prioritizing sustainability. Additionally, the market is witnessing a shift toward more eco-friendly solutions as environmental concerns rise globally.

Sample Link: https://www.precedenceresearch.com/sample/1015

Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 67.58 Billion |

| Market Size in 2024 | USD 72.37 Billion |

| Market Size by 2034 | USD 142.54 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Region |

Key Drivers

Key drivers in the plastic compounding market include the growing demand for sustainable building materials, especially in infrastructure development, as well as the increasing adoption of plastics in automotive manufacturing to reduce vehicle weight and improve fuel efficiency. The rise in consumer awareness of energy-efficient interiors is further boosting demand, particularly in construction. Additionally, the continued advancement in catalyst technology is enhancing resin performance, creating opportunities for market expansion. The versatility and cost-effectiveness of plastics, such as PVC and polypropylene, are key factors contributing to the market’s growth across multiple industries.

Opportunities

- Growing demand for sustainable, lightweight materials in infrastructure, especially in emerging markets.

- Technological advancements in catalysts enhance resin performance, creating competitive advantages.

- The rising popularity of bio-based polymers offers an avenue for sustainable alternatives in multiple industries.

- The automotive sector increasingly uses plastic compounds to reduce weight and improve fuel efficiency.

- The expanding packaging market boosts the use of versatile and cost-effective materials like PVC and polypropylene.

Challenges

- Bio-based polymers are gaining market share, posing a potential threat to conventional plastics.

- Stricter regulations on petrochemical-based plastics push the industry towards more sustainable options.

- Increased competition from bio-based polymer companies targeting sectors like healthcare and agriculture.

- Growing concerns about plastic waste require sustainable solutions and innovations in recycling.

- Fluctuating raw material costs, especially for petrochemical plastics, create market instability.

Regional Insights

The Asia Pacific plastic compounding market, led by China and India, is growing due to rising demand for biodegradable polymers, infrastructure development, and increased production in the automotive and electronics sectors. This region accounted for 46% of global revenue in 2023, driven by industrialization and rising disposable incomes.

Don’t Miss Out: Automated Immunoassay Analyzers Market

Market Key Players

- The Dow Chemical Company

- LyondellBasell Industries N.V.

- SABIC

- Covestro (Bayer Material Science)

Recent News

The plastic compounding industry has been experiencing significant developments. Geon Performance Solutions acquired Foster Corp., a medical-grade plastics compounder, strengthening its position in the medical market. A Cornish start-up, Fishy Filaments, is recycling discarded fishing nets into engineering-grade nylon for 3D printing, attracting interest from companies like Ford and Mercedes-Benz to reduce their carbon footprints. Borealis AG expanded its recycling capabilities by acquiring Integra Plastics AD, enhancing its capacity to produce high-quality polyolefin recyclates. However, European plastics manufacturers are facing challenges, with production declining by 8.3% in 2023 due to a global surplus of materials, high energy prices, and restrictive regulations. These developments highlight the industry’s ongoing efforts to innovate and adapt to market demands and environmental concerns.

Market Segmentation

By Application

- Electronics & Electrical

- Automotive

- Packaging

- Building & Construction

- Industrial Machinery

- Optical Media

- Consumer Goods

- Medical Devices

- Others

By Product

- Thermoplastic Polyolefins (TPO)

- Poly Vinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene

- Thermoplastic Vulcanizates (TPV)

- Polystyrene

- Polybutylene Terephthalate (PBT)

- Polycarbonate

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PET)

- Polyamide

- PA 6

- PA 66

- PA 46

- Others

By Source

- Fossil-based

- Bio-based

- Recycled