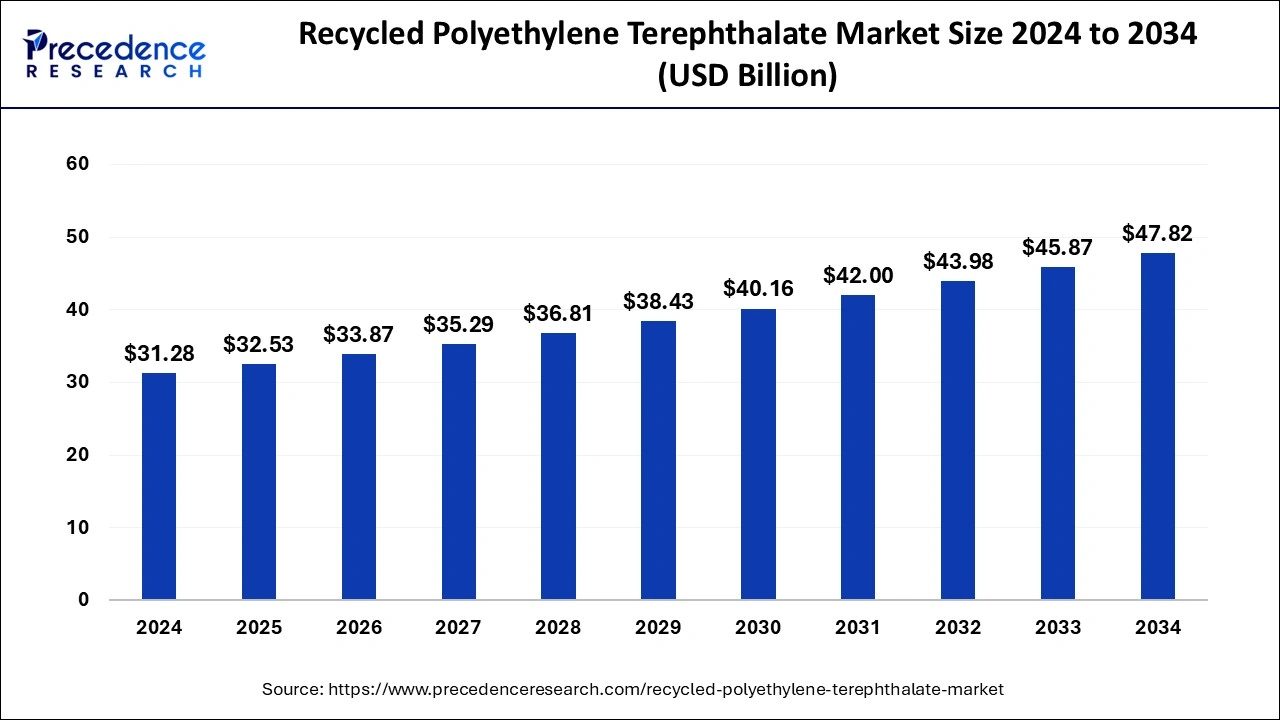

The recycled Polyethylene Terephthalate market is projected at USD 47.82B by 2034, with a 4.33% CAGR from USD 31.28B in 2024.

Recycled Polyethylene Terephthalate Market Key Takeaways

- Asia Pacific commands approximately 40% of the revenue share in 2024.

- The fiber segment accounts for 40.4% of the market share in 2024.

- The clear segment makes up 76% of the revenue share in 2024.

The recycled polyethylene terephthalate (PET) market is set for strong growth, fueled by increasing demand for environmentally friendly materials. Valued at USD 31.28 billion in 2024, it is expected to hit USD 47.82 billion by 2034, with a CAGR of 4.33%. The Asia Pacific region holds a 40% share of the market, while the fiber segment represents 40.4% of the market share. Clear recycled PET products remain dominant, generating 76% of the market’s revenue.

Sample Link: https://www.precedenceresearch.com/sample/1022

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 32.53 Billion |

| Market Size by 2034 | USD 47.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.33% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Drivers

The growing demand for eco-friendly packaging in the food and beverage industry is a key driver of the recycled polyethylene terephthalate (PET) market. Coca-Cola India’s launch of 100% recycled PET bottles in August 2023, with a goal to use 50% recycled material, reflects the shift toward sustainability. As consumer concerns about the environment increase, the food and beverage sector is turning to PET for packaging due to its durability and lightweight properties, which has amplified the need for recycled PET material, boosting market growth

Opportunities

- Rising consumer awareness of environmental issues and sustainable products.

- Increasing demand for recycled materials in the packaging industry.

- Government support through subsidies and policies encouraging the use of recycled PET.

- Innovations in recycling technologies enhance the recyclability of PET.

- The potential for new applications of recycled PET in industries such as textiles and automotive.

Challenges

- Perception of lower quality and safety concerns about recycled PET.

- Insufficient global infrastructure for effective PET recycling.

- High operational costs involved in recycling and processing PET materials.

- Limited availability of clean and sorted PET waste for recycling.

- Price volatility in the recycled PET market is influenced by supply and demand factors.

Regional Insights

Market Key Players

- BariQ

- Zhejiang AnshunPettechsFibre Co. Ltd.

- PolyQuest

- Clear Path Recycling LLC

- Verdeco Recycling, Inc.

- Sorema

- Evergreen Plastics, Inc.

Recent News

S&P Global Commodity Insight launched India’s first R-PET price assessment in April 2023, offering market analysis and benchmark prices for the energy sector. Between January and November 2022, India exported 10,000 metric tons of R-PET. In March 2023, Russia’s oil exports hit their highest levels since April 2020, leading to a $1 billion increase in export revenue. Coca-Cola announced in October 2023 that by early 2024, all 500-milliliter bottles of its sparkling beverages sold in Canada would be made entirely from recycled plastic. Meanwhile, Biffa, a UK-based leader in sustainable waste management, acquired PET recycler Esterpet Ltd in North Yorkshire, bolstering its closed-loop food-grade plastic recycling operations, which process 165,000 tonnes of plastic annually.

Market Segmentation

By Product Type

- Clear

- Colored

By End Use Type

- Food & Beverage Containers and Bottles

- Fiber

- Sheet and Film

- Strapping

- Non-Food Containers and Bottles

- Others