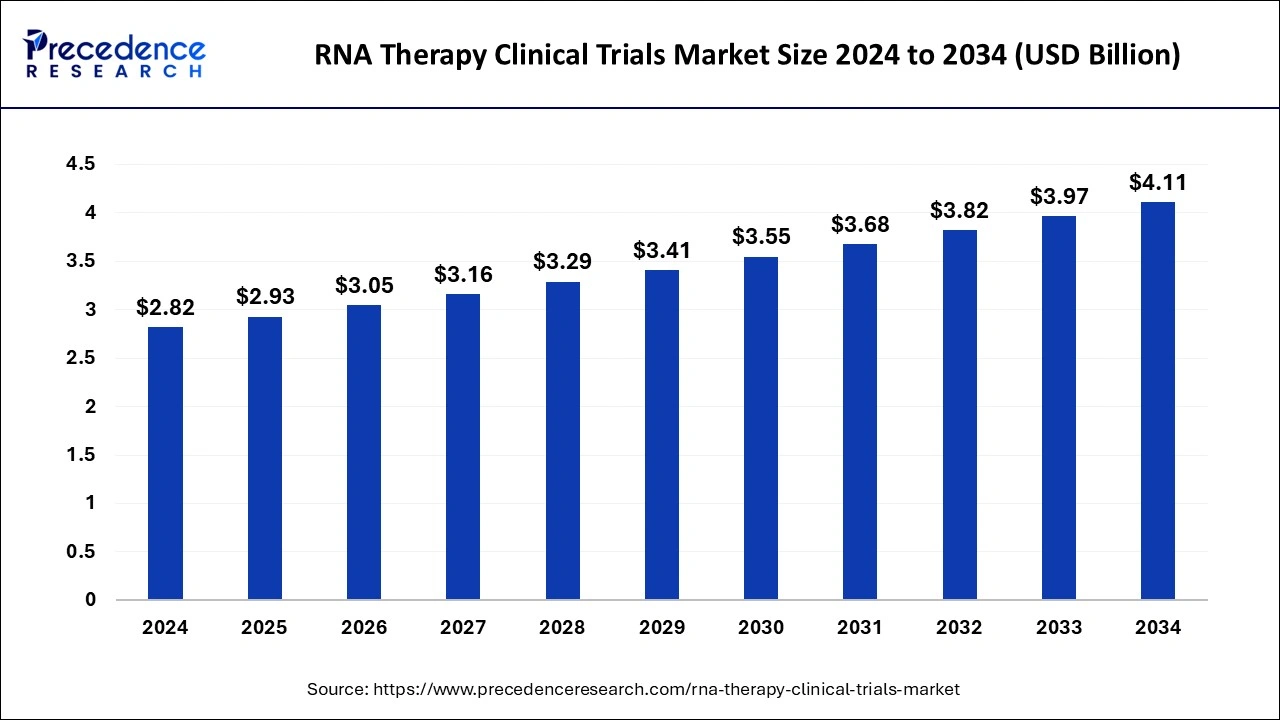

The global RNA therapy clinical trials market size was valued at USD 2.72 billion in 2023 and is predicted to reach around USD 3.97 billion by 2033, expanding at a CAGR of 3.86% from 2024 to 2033.

Key Points

- The North America RNA therapy clinical trials market size reached USD 1.01 billion in 2023 and is expected to attain around USD 1.49 billion by 2033, poised to grow at a CAGR of 3.96% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 37% in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 4.52% during the period studied.

- By therapeutic areas, the rare diseases segment has held a major revenue share of 22% in 2023.

- By therapeutic areas, the anticancer segment is expected to grow at the fastest rate during the forecast period.

- By modality, the messenger RNA segment has contributed more than 37% of revenue share in 2023.

- By modality, the RNA interference segment is expected to grow at a significant CAGR in the market during the forecast period.

- By phase, in 2023, the phase II segment has held a major revenue share of 43% in 2023.

- By phase the phase I segment is expected to grow substantially during the forecast period.

The RNA Therapy Clinical Trials Market is rapidly evolving as RNA-based treatments gain prominence for their potential in treating a variety of diseases, including genetic disorders, cancers, and viral infections. RNA therapy encompasses several approaches, such as mRNA vaccines, RNA interference (RNAi), antisense oligonucleotides (ASOs), and ribozymes. These therapies offer the promise of targeting diseases at the molecular level, providing more precise and effective treatment options. The market has seen significant growth due to advancements in biotechnology and increased investment in RNA research and development.

Get a Sample: https://www.precedenceresearch.com/sample/4557

Growth Factors

Several key factors are driving the growth of the RNA Therapy Clinical Trials Market. Firstly, the success of mRNA vaccines during the COVID-19 pandemic has validated the potential of RNA-based therapies, leading to increased interest and funding. Secondly, advancements in delivery technologies, such as lipid nanoparticles, have improved the stability and efficacy of RNA therapies. Additionally, the expanding understanding of genetic diseases and personalized medicine approaches are further propelling the demand for RNA-based treatments. Regulatory support and accelerated approval processes for innovative therapies also contribute to market growth.

Region Insights

North America, particularly the United States, dominates the RNA Therapy Clinical Trials Market due to its robust biotechnology sector, substantial research funding, and a favorable regulatory environment. Europe follows closely, with significant contributions from countries like Germany, the UK, and France. The Asia-Pacific region is emerging as a significant player, driven by increasing investments in biotech research, government initiatives, and growing clinical trial activities in countries like China, Japan, and South Korea. Other regions, including Latin America and the Middle East, are gradually entering the market, focusing on building infrastructure and research capabilities.

RNA Therapy Clinical Trials Market Trends

- Increased Interest in Targeted Therapies:

- miRNAs are being recognized for their potential in regulating gene expression, making them attractive targets for developing highly specific therapies. This has led to increased investment and research in miRNA-based therapeutics.

- Advancements in Delivery Technologies:

- One of the significant challenges in miRNA therapy is efficient and targeted delivery to specific tissues or cells. Recent advancements in delivery technologies, such as lipid nanoparticles and viral vectors, are improving the efficacy and safety of miRNA therapies.

- Focus on Cancer Treatment:

- A significant portion of miRNA therapy research and clinical trials is focused on oncology. miRNAs play crucial roles in cancer development and progression, making them potential targets for novel cancer therapies. Several trials are exploring miRNA-based treatments for various types of cancers.

- Collaborations and Partnerships:

- Collaborations between academic institutions, pharmaceutical companies, and biotech firms are becoming more common. These partnerships are essential for advancing miRNA research from the laboratory to clinical trials and eventually to market.

- Regulatory Challenges and Progress:

- miRNA therapies face stringent regulatory hurdles due to their novel nature. However, there has been progress in understanding the regulatory requirements, and some miRNA-based therapies are advancing through the clinical trial phases.

- Personalized Medicine Approach:

- miRNA therapies are increasingly being explored within the context of personalized medicine. Researchers are investigating how miRNA expression profiles can be used to tailor therapies to individual patients, particularly in cancer treatment.

RNA Therapy Clinical Trials Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 3.97 Billion |

| Market Size in 2023 | USD 2.72 Billion |

| Market Size in 2024 | USD 2.82 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 3.86% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Modality, Clinical Trials Phase, Therapeutic Areas, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

RNA Therapy Clinical Trials Market Dynamics

Drivers

The primary drivers of the RNA Therapy Clinical Trials Market include the rising prevalence of chronic and genetic diseases, which create a demand for novel therapeutic approaches. The demonstrated success and safety profile of mRNA vaccines have significantly boosted confidence in RNA-based treatments. Furthermore, increased funding from both public and private sectors for RNA research and the ongoing development of advanced RNA delivery systems are major drivers. The regulatory landscape is also evolving to support faster approval of innovative RNA therapies, further propelling market growth.

Opportunities

The RNA Therapy Clinical Trials Market presents several opportunities for growth and innovation. There is significant potential in expanding the therapeutic applications of RNA therapies to a broader range of diseases, including neurodegenerative disorders and cardiovascular diseases. Collaborations and partnerships between academia, biotech companies, and pharmaceutical firms can drive innovation and expedite clinical trial processes. Additionally, the development of novel RNA delivery systems and scalable manufacturing techniques presents opportunities for improving the efficacy and accessibility of RNA therapies. Emerging markets in Asia-Pacific and Latin America offer untapped potential for clinical trials and commercialization of RNA-based treatments.

Challenges

Despite the promising outlook, the RNA Therapy Clinical Trials Market faces several challenges. One major challenge is the delivery of RNA molecules to specific target cells in a stable and efficient manner, which remains a critical hurdle for many RNA therapies. The high costs associated with RNA therapy development and manufacturing can also be a barrier to widespread adoption. Additionally, the regulatory landscape, while supportive, still requires navigating complex approval processes that can delay market entry. Ensuring long-term safety and efficacy of RNA therapies through extensive clinical trials is another significant challenge that the market must address.

Read Also: Microwave Devices Market Size to Reach USD 14.13 Bn by 2033

RNA Therapy Clinical Trials Market Companies

- IQVIA

- ICON Plc.

- Laboratory Corporation of America Holdings

- Charles River Laboratories International, Inc.

- PAREXEL International Corp.

- Syneos Health

- Medpace Holdings, Inc.

- PPD Inc.

- Novotech

- Veristat, LLC.

Recent Developments

- In June 2023, Charles River Laboratories International, Inc. and Curigin established an alliance to manufacture adenoviral vectors. The gene therapy company will rely on Charles River’s market-leading experience in contract development and manufacturing organization (CDMO) solutions to support its preclinical and clinical studies.

- In June 2023, Moderna got the FDA’s green light for its mRNA-1273 vaccine. At the same time, Pfizer was also granted approval for their BNT162b2 vaccine. These vaccines were designed against COVID-19 for children aged from six months to five years old.

- In March 2023, Moderna submitted an IND application to the FDA regarding their mRNA-1273 vaccine against respiratory syncytial virus (RSV). This vaccine has helped reduce the possibility of respiratory tract infections in young children and infants.

Segments Covered in the Report

By Modality

- RNA Interference

- Antisense Therapy

- Messenger RNA

- Oligonucleotide, Non-antisense, Non-RNAi

By Clinical Trials Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Therapeutic Areas

- Rare Diseases

- Anti-infective

- Anticancer

- Neurological

- Alimentary/Metabolic

- Musculoskeletal

- Cardiovascular Respiratory

- Sensory

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/