Precedence Research is a Canada/India-based company and one of the leading providers of strategic market insights. They offer executive-level blueprints of markets and solutions beyond flagship surveys.

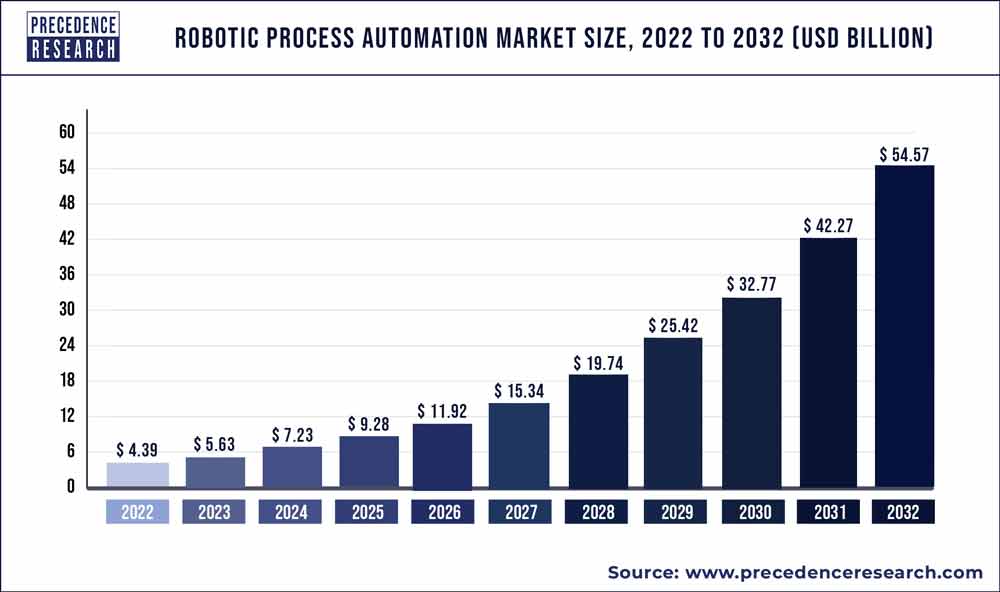

According to Precedence Research, the global robotic process automation market was valued at USD 2.65 billion in 2021 and is projected to hit around USD 23.9 billion by 2030. That means the RPA industry is poised to grow at a compound annual growth rate (CAGR) of 27.7% from 2021 to 2030.

- North America dominated the overall market with a share of 39% in 2020.

- Increasing Adoption of Artificial Intelligence and Cloud-Based Solutions and high demand for RPA services from the BFSI sector are the driving factors of the robotic process automation market.

- Based on the industry, the BFSI segment holds the largest market share, over 30% in 2020.

The cloud sector is anticipated to be the fastest-growing category in the next years due to benefits such as cheaper infrastructure costs, simplicity of deployment, minimal upgrading, and lower operational costs.

Crucial factors accountable for Robotic Process Automation Market growth are:

- Penetration of RPA to manage complicated unstructured data and automate any business operation

- Increasing Adoption of Artificial Intelligence and Cloud-Based Solutions

- High demand for RPA services from BFSI sector

- The innovation and technological advancement

- The increasing focus on reducing the burden of medical professionals

Scope of the Robotic Process Automation Market

| Report Coverage | Details |

| Market Size In 2021 | USD 2.65 Billion |

| Growth Rate From 2021 to 2030 | CAGR of 27.7% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

Market Dynamics of Robotic Process Automation

Driver

Large enterprises will increase the capacity of their existing RPA portfolios by 2024. The majority of new spend will come from large enterprises purchasing new add-on capacity from their original vendor or ecosystem partners. Organizations will need to add licenses to run RPA software on new servers as they grow, as well as additional cores to handle the strain. This tendency is a logical reflection of the increasing demands on an organization’s “everywhere” infrastructure. RPA use will expand as corporate users become more aware of its benefits.

In fact, Gartner projects that by 2024, over half of all new RPA clients would come from business buyers outside of the IT group. In the near future, such factors will drive the robotic process automation industry.The stats for KYC alone are staggering. In 2017, financial institutions spent USD 150 million on KYC procedures, with expenses likely to rise by 13% over the next year.

Similarly, onboarding new clients now takes 26 days, up from 24 days in 2016, and firms predict a 12% increase by the end of 2018. According to industry analysts, RPA can assist merging banks in easing compliance processes that require heavy lifting from banks. The increased demand in the BFSI industry would drive the RPA market throughout the forecast period.

Restraint

RPA Infrastructure and Customization Issues Will Restrain Market Growth

A corporation must have sufficient infrastructure and a professional team to oversee all operations before installing an RPA technology. It is tough, complex, and expensive to set up infrastructure, hire professionals, train existing personnel, and install thousands of bots. The platform on which RPA bots operate changes frequently, and the requisite adaptability isn’t always included into the bots. As a result, many firms resist implementing RPA in their operations.

Opportunities

The rising trend of cloud-based solutions and the increased usage of robot-based solutions

As enterprises pursue new IT architectures and operational philosophies, they lay the groundwork for new digital business prospects, including next-generation IT solutions. Organizations that embrace dynamic, cloud-based operational models will be more competitive, particularly in today’s fast changing business climate. These firms appreciate not only the short-term benefits of cloud computing, but also position themselves to be early adopters of disruptive developments that will shape the future.

Cloud services are rapidly being used by organizations for new initiatives or to replace current systems, implying that investment on traditional IT solutions is shifting to the cloud. According to the most recent Gartner IT spending report, investment on data center systems is expected to be USD 188 billion in 2020, a 10% reduction from 2019.

By 2024, traditional solutions will account for more than 45 percent of IT spending on system infrastructure, infrastructure software, application software, and business process outsourcing.Because of this growth, cloud computing has been one of the most persistently disruptive forces in IT industry since the dawn of the digital age. This creates an opportunity for the RPA market players.

Challenges

Organizational culture

While RPA will diminish the need for certain employment categories, it will also encourage the creation of new roles to handle more complicated tasks, allowing employees to focus on higher-level planning and creative problem-solving. As responsibilities within job positions alter, organizations will need to foster a culture of learning and innovation. The adaptability of a workforce will be critical to the success of automation and digital transformation programs. Employees may prepare teams for ongoing shifts in objectives by educating personnel and investing in training programs.

Regional Snapshots of Robotic Process Automation Market

North America is the market’s most dominant region, while Asia Pacific is the fastest expanding in the RPA industry. The financial markets in the United States are the world’s largest and most liquid. Finance and insurance accounted for 7.4 percent (or $1.5 trillion) of US GDP in 2018. Leadership in this vast, fast-growing sector generates significant economic activity and direct and indirect job creation in the United States.

Financial services and products aid in the facilitation and financing of the export of manufactured goods and agricultural products from the United States. The insurance industry’s net premiums written totaled $1.1 trillion in 2016.

According to NAIC data, premiums collected by life and health insurers accounted for roughly 53%, while premiums collected by property and liability insurers accounted for 47%. Furthermore, approximately one-third of all reinsurance sold globally is purchased by companies based in the United States. International insurance businesses are constantly seeking business agreements and collaborations with American insurers. The dominance of the BFSI industry in North America has a beneficial impact on the RPA market.

Read Also: Biotechnology Reagents & Kits Market May See a Big Move

Report Highlights of Robotic Process Automation Market

- Based on the type, Service segment is the most dominating in the RPA market due to the rise in demand for outsourcing RPA and installing software over the cloud for automation.

- The on-premises segment is the major contributor in the RPA market due to its in-house ownership.

- The BFSI segment held the largest share in the RPA market. Based on the industry, the BFSI segment holds the largest market share. Banking and insurance businesses use RPA for regulatory reporting and balance sheet reconciliation.

Key Companies & Market Share Insights

The market is very competitive, with many specialties small-scale market players as well as established large-scale vendors offering sophisticated robotic process automation systems. Leading industry competitors are providing sophisticated solutions that go beyond rule-based automation. As niche competitors emerge with different solutions to compete in the global market, the main firms are concentrating on providing more enhanced solutions. To obtain a big client base, prominent players are extending their businesses through partnerships.

Some of the major players in the robotic process automation market include:

- UiPath

- Automation Anywhere

- Blue Prism

- NICE

- Pegasytems

- Celaton Ltd.

- KOFAX, Inc.

- NTT Advanced Technology Corp.

- EdgeVerve Systems Ltd.

- FPT Software

- OnviSource, Inc.

- HelpSystems

- Xerox Corporation

Segments Covered in the Robotic Process Automation Market Report

By Type

- Software

- Service

- Consulting

- Implementing

- Training

By Deployment

- Cloud

- On-Premise

By Industry

- BFSI

- Pharma & Healthcare

- Retail & Consumer Goods

- Information Technology (IT) & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics, and Energy & Utilities

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1348

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

About Us

Precedence Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.