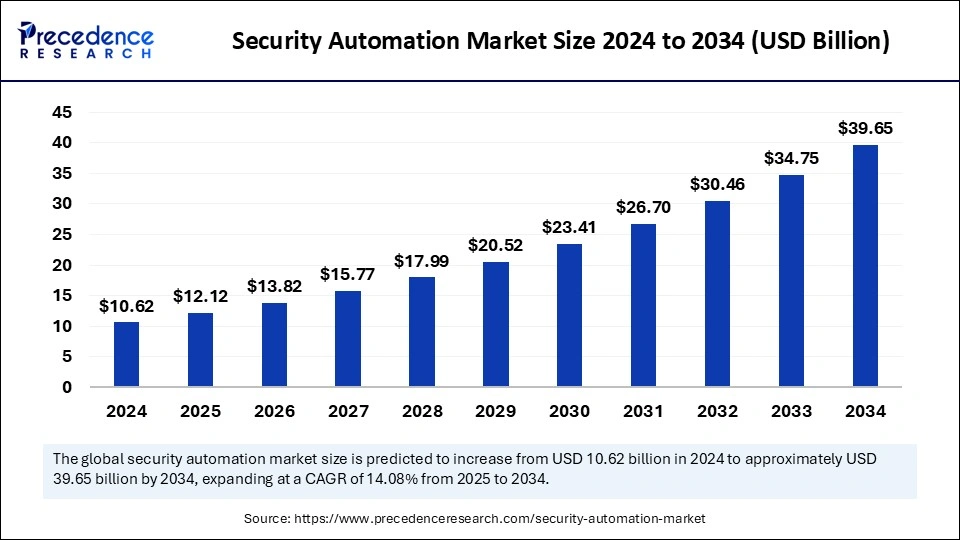

The security automation market size is expected to grow from USD 10.62 billion in 2024 to nearly USD 39.65 billion by 2034, with a CAGR of 14.08%.

Security Automation Market Key Takeaways

- North America dominated the security automation market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 15% in the market during the forecast period.

- By offering, the solutions segment contributed the biggest market share of 65% in 2024.

- By offering, the services segment is likely to grow at the highest CAGR over the studied period.

- By deployment mode, the cloud segment held the largest share of the market in 2024.

- By deployment mode, the on-promise segment is anticipated to witness significant growth in the coming years.

- By application, the endpoint security segment led the security automation market in 2024.

- By application, the incident response management segment is expected to show significant growth throughout the forecast period.

- By code type, the full code segment led the market with the largest share in 2024.

- By code type, the no code segment is projected to expand at the highest CAGR over the studied period.

- By vertical, the BSFI segment held the largest market share in 2024.

- By vertical, the healthcare and life sciences segment is expected to expand rapidly during the forecast period.

- By technology, the AI & ML segment led the market in 2024.

- By technology, the UEBA (User Behavior & Entity Behavior Analytics) segment is anticipated to grow at a significant rate in the coming years.

The security automation market is experiencing rapid growth as organizations increasingly adopt automated security solutions to protect their digital assets, streamline operations, and enhance threat response capabilities. With the rise in cyber threats, data breaches, and regulatory compliance requirements, businesses are turning to automation to improve efficiency, reduce human intervention, and accelerate incident detection and response. Security automation solutions, including Security Orchestration, Automation, and Response (SOAR), artificial intelligence (AI)-driven threat intelligence, and automated endpoint security, are transforming the way enterprises handle cybersecurity threats.

In 2024, the market was valued at USD 10.62 billion, and it is projected to reach approximately USD 39.65 billion by 2034, growing at a CAGR of 14.08%. The demand for advanced security frameworks, zero-trust architectures, and real-time threat mitigation solutions is fueling the market’s expansion. Organizations across industries, including banking, healthcare, government, and IT, are integrating automation into their cybersecurity strategies to strengthen defenses and ensure regulatory compliance. The shift toward cloud computing, hybrid work models, and the increasing sophistication of cyberattacks is further accelerating the need for automated security measures.

Sample Link: https://www.precedenceresearch.com/sample/5713

Key Drivers

The increasing frequency and complexity of cyber threats are one of the major drivers of the security automation market. Organizations are facing ransomware attacks, phishing schemes, insider threats, and data breaches at an unprecedented scale. Traditional security measures struggle to keep up with the speed and sophistication of these attacks, making automation a critical solution for proactive threat detection, response, and mitigation. AI-driven security automation helps security teams respond to threats faster while reducing manual workloads and human errors.

Regulatory compliance and data protection laws are also fueling the adoption of security automation. Governments and regulatory bodies worldwide have introduced stringent cybersecurity frameworks, such as GDPR, CCPA, HIPAA, and PCI DSS, requiring businesses to implement robust security measures. Automation enables organizations to meet compliance requirements efficiently by continuously monitoring, logging, and reporting security incidents while ensuring real-time risk assessment and remediation.

The adoption of cloud computing and digital transformation initiatives is another major factor driving security automation. As businesses migrate to cloud environments, the need for scalable and automated security solutions becomes paramount. Automated security tools help organizations detect vulnerabilities, enforce access controls, and secure workloads across hybrid and multi-cloud environments. The growing reliance on remote work, IoT devices, and interconnected networks further increases the attack surface, making automation a necessity for real-time monitoring and security management.

Opportunities

The rise of AI and machine learning in cybersecurity presents significant opportunities for the security automation market. AI-powered security solutions can analyze vast amounts of data, identify patterns, and predict threats before they occur. These advancements enhance anomaly detection, behavioral analytics, and automated decision-making, allowing security teams to proactively defend against cyberattacks. The increasing integration of AI-driven Security Information and Event Management (SIEM) and SOAR platforms is expected to create new growth opportunities.

The expansion of zero-trust security frameworks is another promising area for market growth. Organizations are shifting away from traditional perimeter-based security approaches toward zero-trust models, which require continuous authentication, micro-segmentation, and strict access controls. Security automation plays a crucial role in enforcing zero-trust principles by automating identity verification, network segmentation, and policy enforcement across distributed IT environments.

The demand for automated threat intelligence and response solutions is growing, particularly in industries that handle sensitive data, such as financial services, healthcare, and government agencies. With cybercriminals using AI-powered attack techniques, businesses are investing in advanced automated threat hunting, vulnerability management, and real-time attack prevention solutions. As security teams face an increasing number of alerts and incidents, automation helps reduce response times and prevents security fatigue, enabling a more efficient cybersecurity posture.

Challenges

Despite its benefits, security automation faces several challenges, including integration complexities with existing security infrastructure. Many organizations still rely on legacy security systems that are not designed for automation, making the transition to modern automated security frameworks difficult. Ensuring seamless integration between SIEM, firewalls, endpoint detection and response (EDR), and cloud security tools remains a significant hurdle for businesses adopting security automation.

The high cost of implementation and maintenance is another challenge. While automation enhances security operations, it requires substantial investment in technology, skilled personnel, and continuous updates to keep up with evolving threats. Small and medium-sized enterprises (SMEs) may struggle to afford advanced security automation platforms, limiting their adoption in cost-sensitive markets.

Another major concern is false positives and automation risks. AI-driven security solutions rely on large datasets and predefined rules to detect threats. However, excessive false alarms can overwhelm security teams, leading to alert fatigue and potential misinterpretations. Additionally, fully automated security responses must be carefully designed to avoid unintended consequences, such as accidentally blocking legitimate users or services.

Regional Insights

North America holds the largest share of the security automation market, driven by high cybersecurity investments, stringent regulatory requirements, and the presence of major cybersecurity firms. The United States is a leader in adopting security automation, with enterprises and government agencies implementing AI-driven threat intelligence, automated security orchestration, and zero-trust frameworks. The increasing adoption of cloud security solutions, endpoint protection, and automated compliance management is further accelerating market growth in the region.

Europe is also a key market for security automation, with countries such as Germany, the UK, and France prioritizing cybersecurity investments. The implementation of GDPR and other data protection laws has led organizations to adopt security automation solutions for compliance management and real-time threat detection. European enterprises are increasingly focusing on AI-based security analytics, automated network security, and cybersecurity automation for IoT environments.

The Asia-Pacific region is witnessing significant growth in security automation adoption, driven by rapid digitalization, increasing cyber threats, and expanding cloud infrastructure. Countries such as China, India, and Japan are investing in AI-driven security tools, automated endpoint security, and real-time monitoring solutions to combat the rising threat of cybercrime. The expansion of smart cities, fintech, and e-commerce industries is further driving demand for security automation technologies.

Latin America and the Middle East & Africa are emerging markets for security automation, with governments and businesses recognizing the need for advanced cybersecurity measures. The increasing adoption of cloud-based security solutions, AI-driven threat detection, and automated compliance tools is expected to contribute to the market’s growth. While challenges such as limited cybersecurity awareness and infrastructure gaps remain, investments in public-private cybersecurity partnerships and national security initiatives are creating opportunities for security automation adoption.

Don’t Miss Out: Autonomous Mobile Robots Market

Market Key Players

- Cisco Systems, Inc.

- CrowdStrike

- CyberArk Software Ltd.

- IBM Corporation

- Palo Alto Networks

- Red Hat, Inc.

- Secureworks, Inc.

- Splunk Inc.

- Swimlane Inc.

- Tufin

Recent News

The security automation industry has seen rapid advancements in AI-driven threat detection, SOAR solutions, and cloud-native security tools. Leading cybersecurity companies are investing in next-generation automation platforms, integrating behavioral analytics, threat intelligence, and predictive security capabilities to stay ahead of evolving threats. The rise of automated security testing, continuous compliance monitoring, and zero-trust security automation is shaping the future of cybersecurity strategies across industries.

Strategic mergers and acquisitions are driving market consolidation, with major cybersecurity firms acquiring AI-driven security startups, threat intelligence providers, and cloud security automation companies. Partnerships between cybersecurity vendors, cloud service providers, and managed security service providers (MSSPs) are expanding the availability of automated security solutions to businesses of all sizes.

The increasing focus on automated incident response and cybersecurity resilience is also leading to innovations in self-healing security systems, autonomous security orchestration, and predictive analytics for proactive defense. As cyber threats become more sophisticated, real-time automation, adaptive security models, and AI-powered risk assessment tools will play a crucial role in safeguarding organizations from emerging cyber risks.

Market Segmentation

By Offering

- Solutions

- SOAR

- XDR

- SIEM

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud

- On-premises

By Application

- Network Security

- Firewall Management

- Intrusion Detection & Prevention System

- Network Traffic Analysis

- Network Access Control

- Others

- Endpoint Security

- Threat Detection and Prevention

- Configuration Management

- Malware Detection and Protection

- Phishing and Email Protection

- Others

- Incident Response Management

- Incident Triage and Escalation

- Evidence Gathering

- Incident Categorization and Prioritization

- Workflow Orchestration

- Others

- Vulnerability Management

- Prioritization

- Vulnerability Scanning and Assessment

- Patch Management and Remediation

- Vulnerability Remediation and Ticketing

- Others

- Identity & Access Management

- Single Sign On (SSO)

- User Provisioning and Deprovisioning

- Access Policy Enforcement

- Multi-factor Authentication

- Others

- Compliance & Policy Management

- Automated Compliance Auditing

- Audit Trail Generation

- Regulatory Compliance Reporting

- Policy Enforcement Automation

- Others

- Data Protection & Encryption

- Encryption Key Management

- Data Loss Prevention

- File and Database Encryption

- Others

By Code Type

- No Code

- Low Code

- Full Code

By Vertical

- Manufacturing

- BFSI

- Healthcare & Life Sciences

- Media & Entertainment

- Energy & Utilities

- Retail & E-commerce

- Government & Defense

- IT & ITES

- Others

By Technology

- AI & ML

- Predictive Analytics

- Robotic Process Automation (RPA)

- User & Entity Behavior Analytics (UEBA)

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- MEA