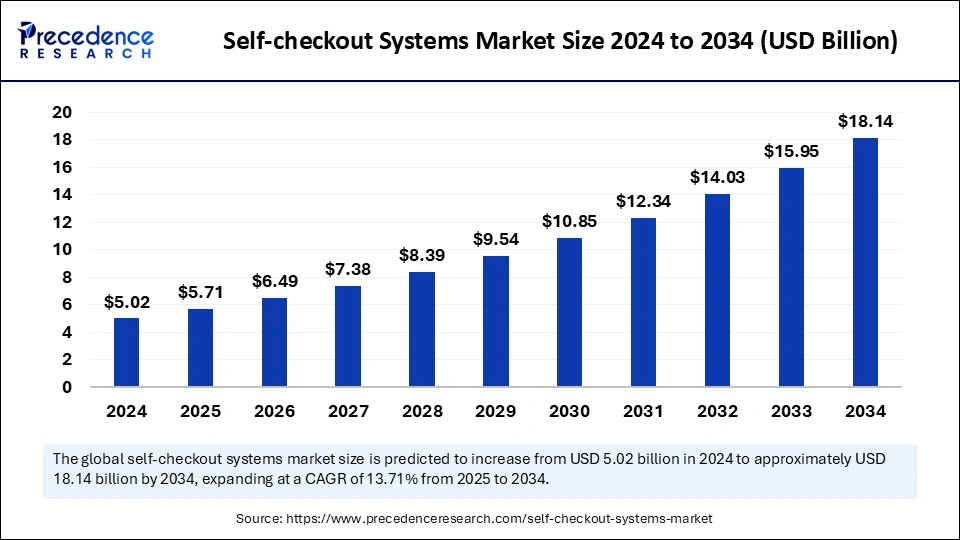

The global self-checkout systems market is projected to grow from USD 5.02 billion in 2024 to approximately USD 18.14 billion by 2034, registering a CAGR of 13.71%.

Self-Checkout Systems Market Key Takeaways

- North America dominated the market with the largest share of 43% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR 15.5% over the forecast period.

- By component, the systems segment held a major market share of 62% in 2024.

- By component, the services segment is projected to grow at a solid CAGR of 15% between 2025 and 2034.

- By type, the cash-based segment held the largest share of the market in 2024.

- By type, the cashless segment is anticipated to experience the fastest growth in the coming years.

- By application, the supermarkets and hypermarkets segment accounted for the biggest market share of 56% 2024.

- By application, the convenience stores segment is expected to grow at the fastest rate during the forecast period.

The self-checkout systems market has been experiencing significant growth due to increasing demand for automation in retail and hospitality sectors. Self-checkout systems allow customers to scan, bag, and pay for their purchases without the need for a cashier, leading to enhanced operational efficiency, reduced wait times, and improved customer experience. With advancements in artificial intelligence (AI), computer vision, and contactless payment technologies, self-checkout systems are evolving to offer a more seamless and secure shopping experience.

Retailers are increasingly adopting self-checkout solutions to streamline operations, optimize workforce management, and reduce operational costs. Supermarkets, convenience stores, and hypermarkets are leading adopters, while industries such as fast-food chains, pharmacies, and airports are also integrating self-service kiosks. As digital payment solutions become more widespread, self-checkout systems are expected to gain further traction, allowing for faster and more convenient transactions.

Technological advancements, including facial recognition, RFID scanning, and mobile wallet integration, are enhancing the efficiency and accuracy of self-checkout kiosks. Retailers are also leveraging AI-powered fraud detection systems to minimize theft and scanning errors, addressing one of the major concerns associated with self-checkout solutions. With increasing consumer preference for a faster and more autonomous shopping experience, the self-checkout systems market is set to expand significantly in the coming years.

Sample Link: https://www.precedenceresearch.com/sample/5724

Key Drivers

The rising demand for contactless transactions and cashier-less shopping experiences is a key driver of market growth. Consumers are increasingly looking for quick and convenient ways to complete their purchases, and self-checkout systems offer a faster alternative to traditional checkout counters. The shift towards digital payments, including mobile wallets and QR code-based transactions, has further accelerated adoption, making self-checkout systems more accessible to a wider audience.

Retailers are under constant pressure to reduce labor costs and enhance operational efficiency. Self-checkout systems help businesses optimize their workforce by reducing reliance on cashiers, allowing employees to focus on customer service and inventory management instead. Additionally, with the rise of labor shortages and increasing wages in many regions, retailers are increasingly turning to automation to manage store operations effectively.

Advancements in AI, machine learning, and computer vision have greatly improved the accuracy and security of self-checkout kiosks. These technologies help detect scanning errors, prevent fraud, and enhance overall transaction efficiency. Features such as voice assistance, weight sensors, and AI-powered item recognition make the self-checkout experience more user-friendly, reducing frustration and improving adoption rates.

Opportunities

The integration of self-checkout systems with AI-driven analytics presents significant opportunities for retailers. Data collected from self-checkout terminals can provide insights into customer preferences, purchasing patterns, and inventory demand. Retailers can leverage this data to personalize promotions, optimize stock levels, and enhance the overall shopping experience.

The expansion of self-checkout systems into smaller retail formats, such as convenience stores and fuel stations, presents another opportunity for market growth. As self-service solutions become more affordable and scalable, smaller retailers can implement them to improve efficiency and cater to customer demand for quick, hassle-free transactions. The increasing availability of compact and portable self-checkout solutions enables adoption in previously underserved market segments.

E-commerce and omnichannel retail strategies are driving new use cases for self-checkout technologies. Retailers are experimenting with hybrid models that combine in-store and online shopping experiences, such as buy-online-pickup-in-store (BOPIS) and self-checkout kiosks integrated with mobile apps. These solutions help bridge the gap between physical and digital retail, creating new growth opportunities for self-checkout system providers.

Challenges

One of the major challenges facing the self-checkout systems market is the risk of theft and fraud. Shoplifting, intentional mis-scanning, and accidental errors are common concerns associated with self-checkout kiosks. Retailers must invest in advanced security measures, such as AI-powered loss prevention systems and real-time monitoring, to mitigate these risks. However, implementing such technologies can add to the overall cost of deployment.

Another challenge is the customer learning curve and resistance to change. Some consumers, particularly older demographics, may find self-checkout systems difficult to use or prefer traditional cashier-assisted checkout lanes. Retailers must ensure that self-checkout systems are user-friendly and provide adequate assistance to customers unfamiliar with the technology.

High initial investment costs can be a barrier for smaller retailers looking to implement self-checkout solutions. While the long-term benefits of labor cost savings and increased efficiency are evident, the upfront expense of purchasing and integrating self-checkout kiosks can be significant. Manufacturers are working on more cost-effective solutions to cater to budget-conscious retailers, but affordability remains a key challenge.

Regional Insights

North America leads the self-checkout systems market due to the widespread adoption of automation technologies in retail. Major supermarket chains, such as Walmart, Target, and Kroger, have heavily invested in self-checkout solutions to improve efficiency and enhance the customer experience. The region also benefits from high consumer acceptance of digital payments and a strong presence of self-service technology providers.

Europe is another significant market, with countries such as the UK, Germany, and France driving adoption. The region has seen a growing emphasis on contactless payments and cashier-less store models, further fueling demand for self-checkout systems. European retailers are also integrating advanced AI-based fraud detection solutions to address concerns related to theft and mis-scanning.

The Asia-Pacific region is witnessing rapid growth, driven by rising urbanization, increasing digital payment penetration, and the expansion of modern retail chains. Countries like China, Japan, and South Korea are at the forefront of self-checkout adoption, with retailers embracing innovative store formats, including fully automated convenience stores. The growing middle-class population and changing consumer preferences are further propelling market expansion in the region.

Latin America and the Middle East & Africa are gradually adopting self-checkout systems, although growth is relatively slower due to cost constraints and infrastructure limitations. However, as mobile payment solutions gain traction and retailers invest in modernizing their stores, self-checkout adoption is expected to increase in these regions. Supermarkets and hypermarkets in urban centers are leading the charge, while smaller retailers are exploring mobile-based self-checkout solutions as a cost-effective alternative.

Don’t Miss Out: Power Electronics Market

Recent News

Retailers worldwide are increasingly investing in AI-powered self-checkout systems to enhance security and efficiency. Companies such as Amazon, Walmart, and Tesco have been testing AI-driven self-checkout solutions that use computer vision to automatically detect and charge customers for their purchases without requiring barcode scanning. These innovations aim to reduce checkout times and minimize human errors.

Several leading self-checkout system providers are expanding their product offerings with biometric authentication and facial recognition technology. These features help improve security and reduce fraud by ensuring that the person making a purchase matches the registered user profile. Retailers are also integrating loyalty programs and personalized promotions into self-checkout kiosks to enhance customer engagement.

The hospitality and fast-food industries are also embracing self-checkout solutions. Quick-service restaurants such as McDonald’s and Burger King have introduced self-service kiosks to improve order accuracy and reduce wait times. The trend is expected to expand to coffee shops, cinemas, and entertainment venues, where self-checkout solutions can streamline ticketing and ordering processes.

As the demand for contactless retail experiences continues to rise, self-checkout systems will play a crucial role in shaping the future of the shopping experience. With ongoing advancements in AI, automation, and payment technologies, the market is poised for continued expansion in the coming years.

Market Segmentation

By Component

- Systems

- Services

By Type

- Cash-based

- Cashless

By Application

- Supermarkets and Hypermarkets

- Department Stores

- Convenience Stores

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)