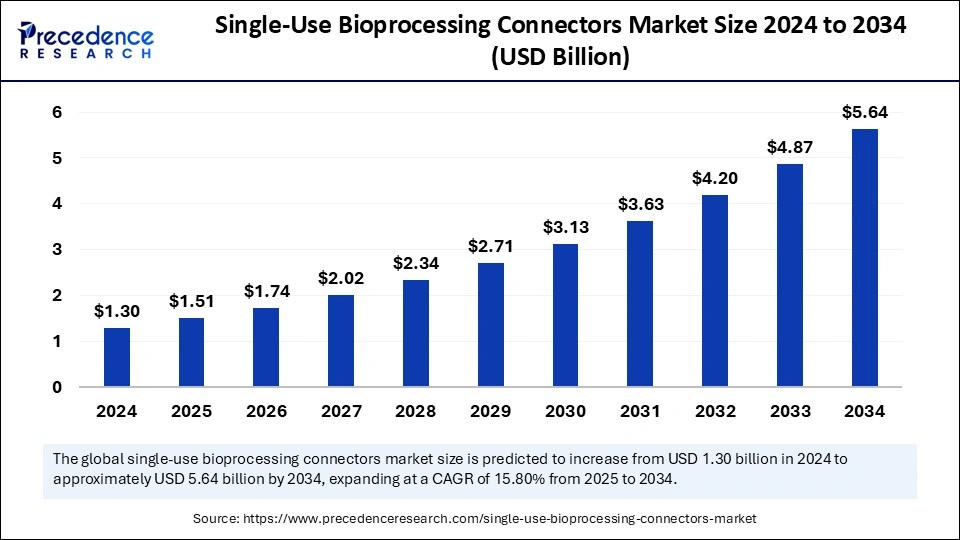

The global single-use bioprocessing connectors market is projected to reach approximately USD 5.64 billion by 2034, up from USD 1.30 billion in 2024, growing at a CAGR of 15.80%.

Single-Use Bioprocessing Connectors Market Key Takeaways

- North America led the market by holding the largest market share of 48% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 17% over the forecast period.

- By product, the aseptic connectors segment held a major market share of 66% in 2024.

- By product, the conventional connectors segment is anticipated to grow at the fastest rate over the forecast period.

- By application, the upstream bioprocessing segment contributed the highest market share of 46% in 2024.

- By end use, the biopharmaceutical and pharmaceutical companies segment held the largest market share of 45% in 2024.

- By end use, the CMOs and CROs segment is projected to grow at the fastest rate during the forecast period.

Key Drivers

One of the key drivers of the single-use bioprocessing connectors market is the increasing demand for biopharmaceuticals, including monoclonal antibodies, recombinant proteins, and vaccines. The rapid development of personalized medicine and cell & gene therapies has accelerated the need for flexible, scalable, and contamination-free manufacturing processes, making single-use connectors an essential component. Additionally, the cost advantages associated with single-use technologies, such as reduced capital investment, lower energy consumption, and minimal cleaning requirements, are driving their adoption across the industry.

The growing emphasis on Good Manufacturing Practices (GMP) and stringent regulatory requirements regarding product sterility and quality assurance have further increased reliance on high-performance bioprocessing connectors. The biopharmaceutical sector’s continued expansion, along with the increasing investments in research & development (R&D), is also fostering market growth. Furthermore, the rise in outsourcing biomanufacturing to contract development and manufacturing organizations (CDMOs) is creating a favorable environment for single-use technologies, as they provide enhanced flexibility and quicker turnaround times for production.

Opportunities

The rapid evolution of continuous bioprocessing and automation in biomanufacturing presents significant opportunities for the single-use bioprocessing connectors market. The integration of smart sensors and real-time monitoring capabilities into single-use systems is expected to enhance process efficiency, ensuring better control over bioproduction. Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing increased investments in biopharmaceutical manufacturing, creating lucrative opportunities for market expansion.

The rising focus on single-use technologies in vaccine production, especially after the COVID-19 pandemic, has reinforced the importance of flexible and efficient bioprocessing solutions. Additionally, the development of modular bioprocessing facilities is increasing the adoption of disposable connectors, as they allow faster facility setup and enable seamless scale-up. Collaborations between biopharmaceutical companies and single-use technology providers are fostering innovation and expanding product offerings, paving the way for new market entrants and technological advancements.

Challenges

Despite its rapid growth, the single-use bioprocessing connectors market faces several challenges. One of the primary concerns is the waste management associated with disposable bioprocessing components. The increasing volume of plastic waste generated by single-use systems has raised environmental concerns, leading to calls for sustainable and recyclable solutions. Another challenge is the high cost of specialized single-use connectors, which may limit their adoption in small and mid-sized biopharma companies with budget constraints.

Additionally, supply chain disruptions and raw material shortages can impact the availability of single-use components, posing a risk to biomanufacturing operations. Compatibility issues between different single-use systems and connectors from various manufacturers can create inefficiencies, necessitating standardization efforts across the industry. Furthermore, concerns regarding leachables and extractables in single-use components continue to be a challenge, as regulatory agencies impose strict guidelines to ensure product safety.

Regional Insights

North America dominates the single-use bioprocessing connectors market, driven by the presence of leading biopharmaceutical companies, well-established healthcare infrastructure, and significant investments in biotechnology R&D. The United States is at the forefront of single-use technology adoption, with increasing reliance on disposable systems in biologics production. Europe is another key region, with major biomanufacturing hubs in Germany, the UK, and France investing heavily in bioprocessing innovations. The growing adoption of personalized medicine and advanced biologics is further fueling demand for single-use connectors in this region.

Asia-Pacific is expected to witness the highest growth rate due to the rapid expansion of biopharmaceutical manufacturing in China, India, South Korea, and Japan. Favorable government initiatives, increasing foreign direct investments (FDI), and the presence of emerging biopharma players are contributing to market expansion. Latin America and the Middle East & Africa (MEA) are also showing growth potential, primarily driven by rising healthcare investments, improving biomanufacturing capabilities, and the increasing focus on vaccine production.

Don’t Miss Out: Solid Tumor Cancer Treatment Market

Market Key Players

- Sartorius AG

- Merck KGaA

- Danaher

- Saint-Gobain

- Colder Products Company (Dover Corporation)

- Liquidyne Process Technologies, Inc.

- Foxx Life Sciences

- Watson-Marlow Fluid Technology Solutions

Recent News

The single-use bioprocessing connectors market has witnessed several notable developments in recent years. Major bioprocessing companies have been actively launching new products to enhance process efficiency and meet the growing demand for advanced single-use technologies. For example, leading players such as Thermo Fisher Scientific, Sartorius AG, Danaher Corporation (Pall Corporation), and Merck KGaA have expanded their single-use product portfolios, offering innovative connector designs and improved compatibility features. The industry has also seen increased mergers, acquisitions, and partnerships aimed at strengthening manufacturing capabilities and expanding global reach. Recent advancements in 3D printing and smart bioprocessing technologies have enabled the development of customized single-use connectors, further driving market innovation. Additionally, sustainability initiatives are gaining traction, with companies exploring biodegradable and recyclable materials to address the environmental concerns associated with single-use systems.

Regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) continue to emphasize stringent quality standards for single-use bioprocessing components, prompting manufacturers to invest in high-performance materials and compliance-driven innovations. The ongoing expansion of biologics manufacturing facilities worldwide, particularly in response to the rising demand for mRNA vaccines and cell & gene therapies, is expected to sustain the growth momentum of the single-use bioprocessing connectors market in the coming years.

Market Segmentation

By Product

- Aseptic Connectors

- Conventional Connectors

By Application

- Upstream Bioprocessing

- Downstream Bioprocessing

- Fill-finish Operations

By End Use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa