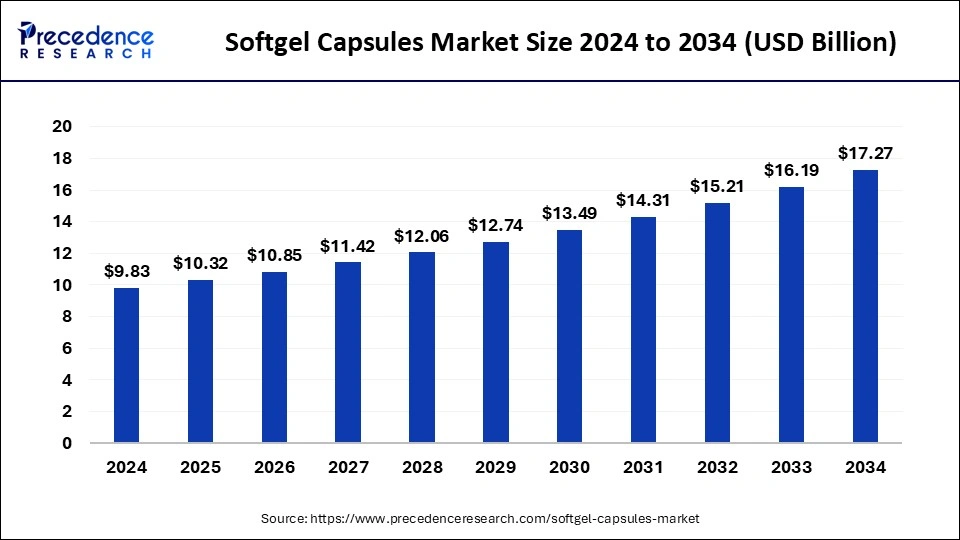

The global softgel capsules market size is projected to be worth around USD 17.19 billion by 2033 with a CAGR of 7.03% from 2024 to 2033.

- North America led the market with the largest market share of 43% in 2023.

- By type, the gelatin-based/animal-based segment has accounted biggest market share in 2023.

- By application, the vitamins and dietary supplements segment held the largest share of the market in 2023.

- By end-use, the nutraceutical companies segment has contributed more than 38% of market share in 2023.

Softgel capsules are a popular form of oral dosage widely used in the pharmaceutical, nutraceutical, and dietary supplement industries. These capsules are made from a gelatin-based shell filled with liquid or semi-solid active ingredients. The softgel encapsulation process involves encapsulating the active ingredients within the soft, easy-to-swallow gelatin shell, providing advantages such as improved bioavailability, enhanced stability, and precise dosage control. Softgel capsules are preferred by consumers due to their ease of swallowing and rapid disintegration, making them a convenient choice for various medications and supplements.

Get a Sample: https://www.precedenceresearch.com/sample/3929

Table of Contents

ToggleGrowth Factors

The softgel capsules market has witnessed significant growth in recent years, driven by several key factors. One of the primary growth drivers is the increasing demand for consumer-friendly dosage forms. Softgel capsules offer a convenient and palatable alternative to traditional tablets and pills, leading to their widespread adoption across various industries. Additionally, advancements in softgel encapsulation technology have enabled manufacturers to develop innovative formulations with improved efficacy and bioavailability, further fueling market growth. Moreover, the growing consumer awareness regarding the benefits of softgel capsules, such as easy swallowing and better absorption, has contributed to the expansion of the market.

Region Insights

The softgel capsules market is geographically segmented into regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the global softgel capsules market, attributed to the presence of a well-established pharmaceutical and dietary supplement industry, coupled with increasing consumer preference for softgel formulations. Europe follows closely, driven by the growing demand for natural and herbal supplements. The Asia Pacific region is expected to witness significant growth due to rising healthcare expenditure, increasing consumer awareness, and expanding pharmaceutical manufacturing capabilities in countries like China and India.

Softgel Capsules Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Global Market Size in 2023 | USD 8.71 Billion |

| Global Market Size by 2033 | USD 17.19 Billion |

| U.S. Market Size in 2023 | USD 2.81 Billion |

| U.S. Market Size by 2033 | USD 5.54 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Softgel Capsules Market Dynamics

Drivers

Several factors are driving the growth of the softgel capsules market. One of the primary drivers is the growing demand for dietary supplements and vitamins, fueled by increasing health consciousness and the aging population. Softgel capsules offer a convenient and effective way to deliver these supplements, driving their adoption among consumers. Additionally, the pharmaceutical industry’s shift towards novel drug delivery systems and the development of specialized formulations is driving the demand for softgel capsules. Furthermore, the expanding nutraceutical industry, coupled with the growing popularity of herbal and natural supplements, is creating opportunities for market growth.

Restraints

Despite the promising growth prospects, the softgel capsules market faces certain challenges that may hinder its expansion. One of the key restraints is the availability of alternative dosage forms such as tablets, powders, and liquids, which compete with softgel capsules in the market. Moreover, the high manufacturing costs associated with softgel encapsulation technology, including equipment and raw materials, pose a challenge for small and medium-sized manufacturers. Additionally, regulatory requirements and quality standards governing the production and distribution of softgel capsules may present barriers to entry for new players, limiting market growth to some extent.

Opportunities

Despite the challenges, the softgel capsules market presents several opportunities for growth and innovation. The increasing demand for personalized healthcare solutions and customized formulations offers opportunities for manufacturers to develop specialized softgel capsules tailored to specific patient needs. Furthermore, the expanding pharmaceutical and nutraceutical industries in emerging markets present untapped opportunities for market expansion. Additionally, technological advancements in softgel encapsulation techniques, such as the development of vegetarian and vegan-friendly alternatives to gelatin-based capsules, open up new avenues for product innovation and market growth. Moreover, strategic collaborations and partnerships between manufacturers, suppliers, and distributors can help expand market reach and drive growth in the global softgel capsules market.

Read Also: Smart Home Healthcare Market Size Surpass USD 212.55 Bn by 2033

Recent Developments

- In May 2022, the launch of SOLFEROL Softgel Capsules, a line of reimbursed vitamin D3 medications, for the treatment of vitamin D insufficiency was announced by Windzor Pharma Ireland Ltd. This product has the broadest array of presentations available on the market, with two distinct strengths: 400 IU for treating expectant and nursing mothers and 20,000 IU for those with severe vitamin D3 deficiency.

- In December 2023, Amneal Pharmaceuticals and Strides Pharma Science Limited announced the launch of Icosapent ethyl acid soft gel capsules, a product that refers VASCEPA. Strides, a multinational pharmaceutical producer, has granted an in-license for the medicine, which Amneal will begin marketing in the fourth quarter of 2023. An ethyl ester of eicosapentaenoic acid (EPA), isicosapent ethyl acid soft gel capsules, 0.5g and 1g, are recommended as a dietary supplement to lower triglyceride levels in adult patients with severe (≥ 500 mg/dL) hypertriglyceridemia.

Softgel Capsules Market Players

- CAPTEK Softgel International Inc.

- Sirio Pharma Co., Ltd.

- Fuji Capsule

- Thermo Fisher Scientific Inc.

- EyePoint Pharmaceuticals, Inc.

- EuroCaps

- Catalent, Inc.

- Aenova Group

- ProCaps Laboratories, LLC

- Lonza Capsules & Health Ingredientss

- Soft Gel Technologies, Inc.

Segments Covered in the Report

By Type

- Non-Animal-Based

- Gelatin-Based/Animal-Based

By Application

- Anti-Inflammatory Drugs

- Antacid and Anti-Flatulent Preparation

- Antibiotic and Antibacterial Drugs

- Cough and Cold Preparations

- Anti-Anemic Preparations

- Vitamin and Dietary Supplement

- Health Supplement

- Pregnancy

By End-use

- Cosmeceutical Companies

- Nutraceutical Companies

- Pharmaceutical Companies

- Contract Manufacturing Organizations

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/