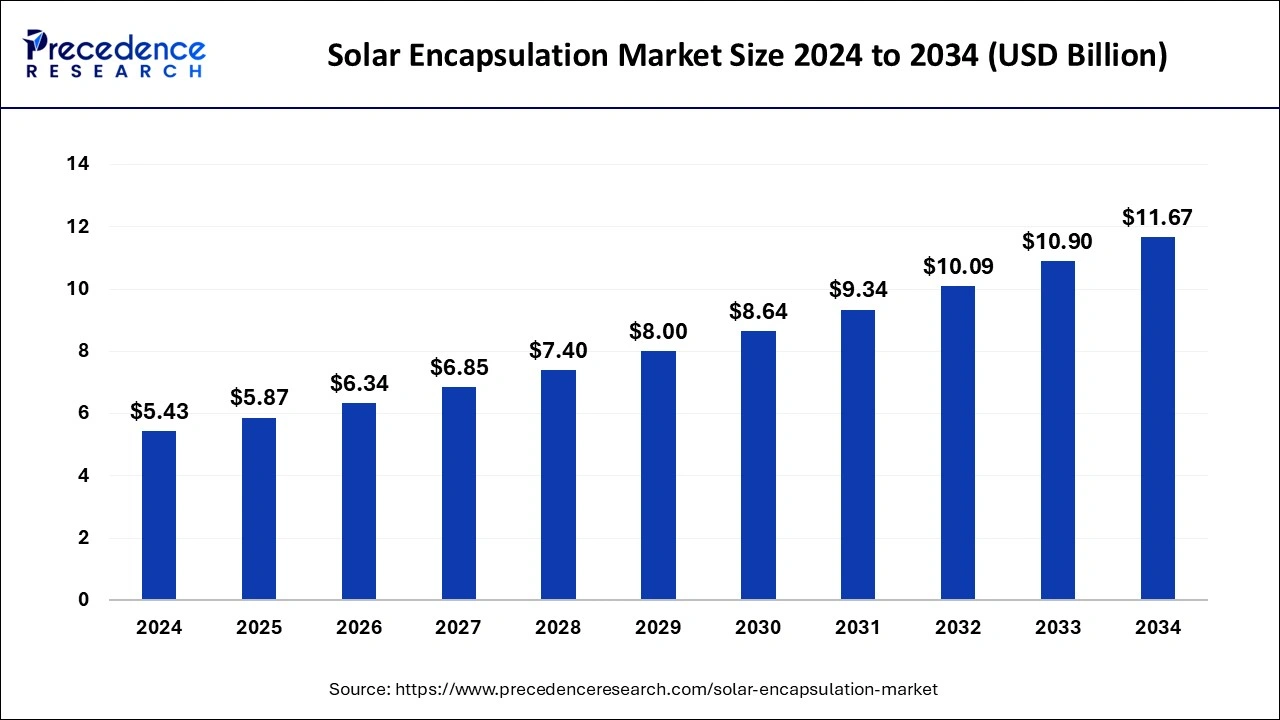

The global solar encapsulation market size is estimated to grow around USD 10.91 billion by 2033, growing at a CAGR of 8.05% from 2024 to 2033.

Key Points

- By region, Asia Pacific dominated the solar encapsulation market in 2023 with 36%.

- By region, Europe is expected to grow at the fastest rate during the forecast period.

- By materials, the ethylene vinyl acetate segment dominated the market in 2023.

- By materials, the thermoplastic polyurethane (TPU) segment is expected to grow at the fastest rate during the forecast period.

- By technology, the crystalline silicon solar technology segment dominated the market in 2023.

- By technology, the thin-film solar technology segment is expected to grow at the fastest rate during the forecast period.

- By end-user, the construction segment dominated the solar encapsulation market in 2023 and is also expected to grow at the fastest rate during the forecast period.

The solar encapsulation market is a vital segment within the renewable energy industry, primarily concerned with enhancing the durability and efficiency of solar photovoltaic (PV) modules. Solar encapsulation involves the use of materials to protect PV modules from environmental factors such as moisture, dust, and UV radiation, thereby ensuring their long-term performance and reliability. As the demand for clean energy continues to rise globally, the solar encapsulation market has witnessed significant growth, driven by advancements in technology, supportive government policies, and increasing environmental awareness.

Get a Sample: https://www.precedenceresearch.com/sample/4148

Growth Factors:

Several factors contribute to the growth of the solar encapsulation market. Technological innovations have led to the development of advanced encapsulation materials that offer improved efficiency and durability, thereby driving the adoption of solar PV modules. Additionally, the declining cost of solar energy and the growing focus on reducing carbon emissions have spurred investments in solar power projects, further fueling the demand for encapsulation materials. Moreover, favorable government initiatives and incentives aimed at promoting renewable energy adoption have created a conducive environment for market growth.

Region Insights:

The solar encapsulation market exhibits varying dynamics across different regions. Developed economies such as North America and Europe have been early adopters of solar energy technologies, leading to a mature market landscape. In contrast, emerging economies in Asia-Pacific, particularly China and India, are witnessing rapid growth in solar installations, driven by government initiatives to increase renewable energy capacity. Additionally, regions with abundant sunlight, such as the Middle East and Africa, are increasingly investing in solar power projects, thereby driving the demand for encapsulation materials in these regions.

Solar Encapsulation Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.05% |

| Global Market Size in 2023 | USD 5.03 Billion |

| Global Market Size in 2024 | USD 5.43 Billion |

| Global Market Size by 2033 | USD 10.91 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Materials, By Technology, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Solar Encapsulation Market Dynamics

Drivers:

Several drivers contribute to the expansion of the solar encapsulation market. The increasing global emphasis on reducing reliance on fossil fuels and mitigating climate change has propelled the adoption of renewable energy sources like solar power. Additionally, advancements in encapsulation technologies, such as the development of lightweight and flexible materials, have made solar PV modules more efficient and cost-effective, driving market growth. Furthermore, the growing integration of solar energy systems into mainstream electricity grids and the rising demand for off-grid solar solutions in remote areas are driving the demand for encapsulation materials.

Opportunities:

The solar encapsulation market presents numerous opportunities for industry players. With ongoing research and development activities focused on improving encapsulation materials and manufacturing processes, there is scope for innovation and product differentiation. Furthermore, the expansion of solar power generation capacity in emerging markets presents untapped opportunities for market penetration and business growth. Moreover, the increasing focus on building-integrated photovoltaics (BIPV) and solar-powered consumer electronics opens up new avenues for market expansion and diversification.

Challenges:

Despite its growth prospects, the solar encapsulation market faces certain challenges. One key challenge is the volatility of raw material prices, which can impact manufacturing costs and profit margins for encapsulation material suppliers. Additionally, concerns regarding the recyclability and environmental impact of encapsulation materials pose challenges for sustainable manufacturing practices. Moreover, regulatory uncertainties and trade barriers in certain regions may hinder market growth and investment in solar power projects.

Read Also: Bio-Detectors and Accessories Market Size, Share, Report 2033

Competitive Landscape:

The solar encapsulation market is characterized by intense competition among key players operating globally. Companies in the market compete based on factors such as product quality, innovation, pricing, and distribution networks. Major players often engage in strategic partnerships, mergers, and acquisitions to expand their product portfolios and geographical presence. Additionally, investments in research and development are crucial for companies to stay ahead of the competition and meet evolving customer demands. Key players in the solar encapsulation market include material suppliers, module manufacturers, and encapsulation equipment providers.

Solar Encapsulation Market Recent Developments

- In October 2023, Shanghai-based AIKO launched its cutting-edge solar cell products, including solar encapsulation technology, in Australia at the All-Energy exhibition in Melbourne.

- In March 2023, the Chemical conglomerate DOW, a US-based company, launched photovoltaic (PV) product solutions for PV module assembly and line with six silicone-based sealants.

Solar Encapsulation Market Companies

- Arkema

- Specialized Technology Resources

- RenewSys

- Solutia

- Mitsui Chemicals

- Borealis

- Kuraray

- Hanwha

- Targray

Segments Covered in the Report

By Materials

- Ethylene-vinyl Acetate (EVA)

- Thermoplastic polyurethane (TPU)

- Ionomers

- Polydimethylsiloxane

- Polyvinyl Butyral

- Polyolefin

By Technology

- Crystalline Silicon Solar

- Thin-film Solar

By End-User

- Construction

- Automotive

- Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/