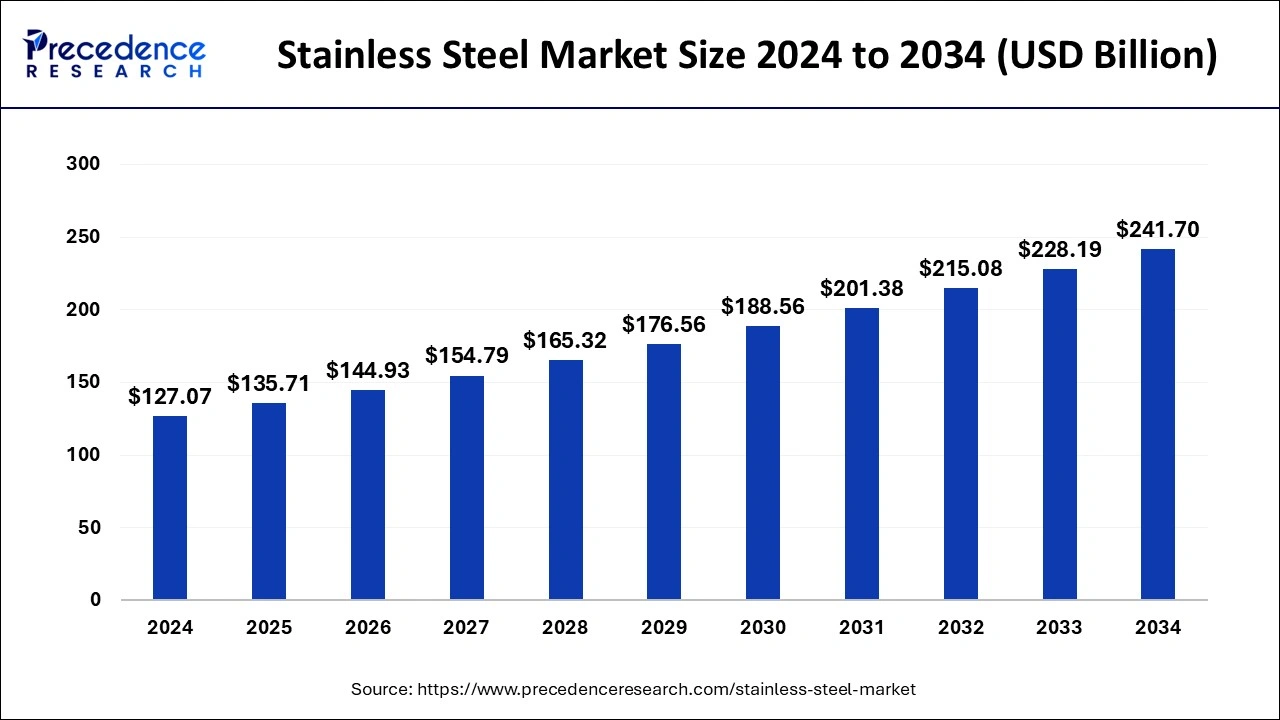

The global stainless steel market, valued at USD 127.07 billion in 2024, is expected to reach USD 241.70 billion by 2034, growing at a CAGR of 6.64%.

Stainless Steel Market Key Takeaways

- Asia Pacific dominated the market in 2024, holding a 67% share.

- The flat product segment accounted for the largest market share of 31% in 2024.

- The long product segment is projected to grow at a significant CAGR of 6.8% during the forecast period.

- The automotive & transportation sector is expected to witness the fastest growth during the forecast period.

In 2024, the Asia Pacific region led the stainless steel market with a dominant 67% share. Among product segments, flat stainless steel accounted for the largest market share at 31%, while the long segment is expected to grow at a notable CAGR of 6.8% during the forecast period. Additionally, the automotive and transportation sector is anticipated to experience the fastest growth, driving demand for stainless steel in the coming years.

Sample Link: https://www.precedenceresearch.com/sample/1097

Key Drivers

Opportunities

- Growing adoption of stainless steel in renewable energy projects and electric vehicles.

- Increasing demand from the healthcare and food processing industries due to its hygienic and corrosion-resistant properties.

- Advancements in manufacturing technologies, including 3D printing and recycling innovations, enhancing production efficiency.

- Expansion of infrastructure development, especially in emerging economies like India and China.

Challenges

- Fluctuating raw material prices, particularly nickel and chromium, impacting production costs.

- Environmental concerns and stringent regulations on carbon emissions in the steel industry.

- Intense market competition leading to pricing pressures and reduced profit margins.

- Supply chain disruptions and geopolitical uncertainties affecting global trade and material availability.

Regional Insights

The Asia Pacific region dominates the stainless steel market, holding the largest share due to rapid industrialization, infrastructure expansion, and strong demand from key industries like construction and automotive, particularly in China and India. North America is experiencing steady growth, driven by increased usage in aerospace, medical, and energy sectors, along with advancements in manufacturing technologies. In Europe, stringent environmental regulations and sustainability initiatives are influencing the market, with a focus on recycled stainless steel and green manufacturing processes. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual growth, supported by rising investments in construction, oil & gas, and industrial projects.

Don’t Miss Out: Solid Tumor Cancer Treatment Market

Market Key Players

- Jindal Stainless

- Aperam Stainless

- Nippon Steel Corporation

- Yieh United Steel Corp. (YUSCO)

- ThyssenKrupp Stainless GmbH

- Outokumpu

- ArcelorMittal

Recent News

In February 2025, Finland’s Outokumpu announced the cancellation of plans to expand stainless steel production capacity in the U.S. and halted the development of a small modular reactor in Finland. This decision was attributed to a weak stainless steel market and increased import pressures affecting earnings. The company reported a small core loss for the fourth quarter of 2024 and called on the European Union to protect its steel industry from unfair competition.

In December 2024, Procter & Gamble (P&G), the maker of Gillette razors, shifted its sourcing of specialized stainless steel to Indian manufacturer Jindal Stainless. This strategic move aimed to offset potential tariff increases under President-Elect Donald Trump’s administration and protect profit margins. During the first eight months of the fiscal year ending in March 2025, India’s imports of finished steel from China reached a record high of 1.96 million metric tons, primarily consisting of stainless steel and other products. This surge in imports has led India to consider imposing tariffs of up to 25% to curb the influx and protect domestic producers.

Market Segmentation

By Product

- Long

- Flat

By Grade

- Duplex Series

- 400 Series

- 300 Series

- 200 Series

- Others

By Application

- Automotive & Transportation

- Building & Construction

- Heavy Industry

- Consumer Goods

- Others