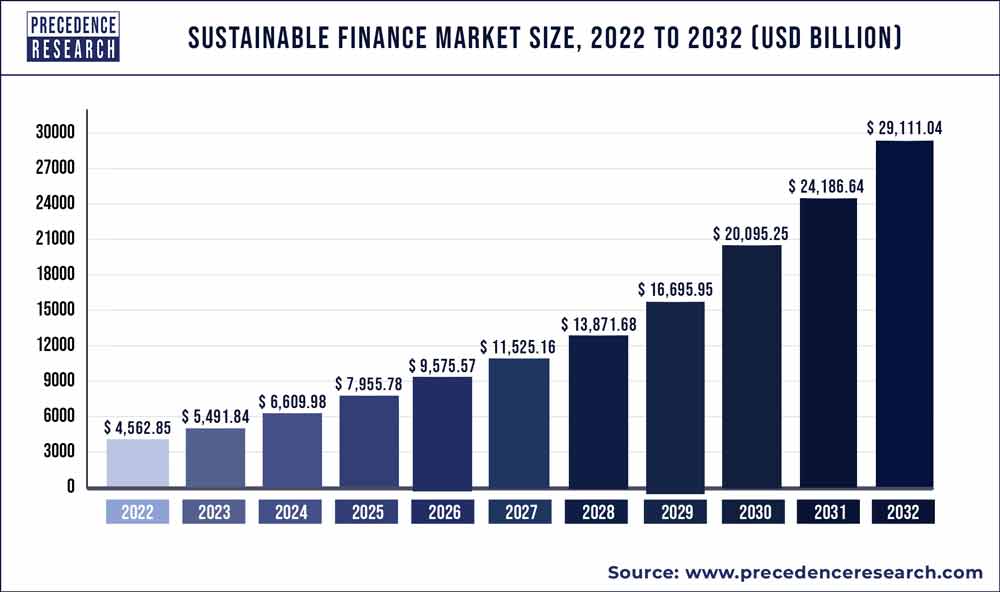

According to a recent research report titled “Sustainable Finance Market (By Investment Type: Equity, Fixed Income, Mixed Allocation; By Transaction Type: Green Bond, Social Bond, Mixed- sustainability Bond; By Industry Verticals: Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032″ published by Precedence Research, the global sustainable finance market size is projected to touch around USD 29,111.04 billion by 2032 and growing at a CAGR of 20.36% over the forecast period 2023 to 2032. This comprehensive study examines various factors and their impact on the growth of the sustainable finance market.

Key Takeaways:

- North America led the global market in 2022.

- Asia-Pacific region is expected to expand at the fastest CAGR from 2023 to 2032.

- By Transaction Type, the green bond segment led the market in 2022.

- By Industry Verticals, the transport and logistics segment led the market in 2022.

The report primarily focuses on the volume and value of the sustainable finance market at the global, regional, and company levels. At the global level, the report analyzes historical data and future prospects to present an overview of the overall market size. Regionally, the study emphasizes key regions such as North America, Europe, the Middle East & Africa, Latin America, and others.

Furthermore, the research report provides specific segmentations based on regions (countries), companies, and all market segments. This analysis offers insights into the growth and revenue trends during the historical period of 2017 to 2032, as well as the projected period. By understanding these segments, it becomes possible to identify the significance of different factors that contribute to market growth.

Download a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/3198

The research also highlights significant progressions in both organic and inorganic growth strategies within the global sustainable finance market. Numerous companies are placing emphasis on new product launches, gaining product approvals, and implementing various business expansion tactics. Moreover, the report presents detailed profiles of firms operating in the sustainable finance market, along with their respective market strategies. Additionally, the study concentrates on prominent industry participants, furnishing details such as company profiles, product offerings, financial updates, and noteworthy advancements.

Sustainable Finance Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 5,491.84 Billion |

| Market Size by 2032 | USD 29,111.04 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 20.36% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Investment Type, By Transaction Type, and By Industry Verticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Also read: Geospatial Imagery Analytics Market Size To Grow USD 44.26 Billion by 2032

Major Key Points Covered in Report:

Executive Summary: It includes key trends of the electric vehicle fuel cell market related to products, applications, and other crucial factors. It also provides analysis of the competitive landscape and CAGR and market size of the electric vehicle fuel cell market based on production and revenue.

Production and Consumption by Region: It covers all regional markets to which the research study relates. Prices and key players in addition to production and consumption in each regional market are discussed.

Key Players: Here, the report throws light on financial ratios, pricing structure, production cost, gross profit, sales volume, revenue, and gross margin of leading and prominent companies competing in the Electric vehicle fuel cell market.

Market Segments: This part of the report discusses product, application and other segments of the electric vehicle fuel cell market based on market share, CAGR, market size, and various other factors.

Research Methodology: This section discusses the research methodology and approach used to prepare the report. It covers data triangulation, market breakdown, market size estimation, and research design and/or programs.

Market Key Players

The report incorporates company profiles of key players in the market. These profiles encompass vital information such as product portfolio, key strategies, and a comprehensive SWOT analysis for each player. Additionally, the report presents a matrix illustrating the presence of each prominent player, enabling readers to gain actionable insights. This facilitates a thoughtful assessment of the market status and aids in predicting the level of competition in the sustainable finance market.

Some of the prominent players in the sustainable finance market include

- Green Banks

- Sustainable Asset Management Firms

- Impact Investing Funds

- Green Energy Companies

- Social Enterprises

- Sustainable Technology Companies

- Green Real Estate Developers

- Corporate Green Bond Issuers

- Sustainable Agriculture and Food Companies

Sustainable Finance Market Segmentations

By Investment Type

- Equity, Fixed Income

- Mixed Allocation

By Transaction Type

- Green Bond

- Social Bond

- Mixed- sustainability Bond

By Industry Verticals

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Why should you invest in this report?

This report presents a compelling investment opportunity for those interested in the global sustainable finance market. It serves as an extensive and informative guide, offering clear insights into this niche market. By delving into the report, you will gain a comprehensive understanding of the various major application areas for sustainable finance. Furthermore, it provides crucial information about the key regions worldwide that are expected to experience substantial growth within the forecast period of 2023-2030. Armed with this knowledge, you can strategically plan your market entry approaches.

Moreover, this report offers a deep analysis of the competitive landscape, equipping you with valuable insights into the level of competition prevalent in this highly competitive market. If you are already an established player, it will enable you to assess the strategies employed by your competitors, allowing you to stay ahead as market leaders. For newcomers entering this market, the extensive data provided in this report is invaluable, providing a solid foundation for informed decision-making.

Some of the key questions answered in this report:

- What is the size of the overall Sustainable finance market and its segments?

- What are the key segments and sub-segments in the market?

- What are the key drivers, restraints, opportunities and challenges of the Sustainable finance market and how they are expected to impact the market?

- What are the attractive investment opportunities within the Sustainable finance market?

- What is the Sustainable finance market size at the regional and country-level?

- Who are the key market players and their key competitors?

- What are the strategies for growth adopted by the key players in Sustainable finance market?

- What are the recent trends in Sustainable finance market? (M&A, partnerships, new product developments, expansions)?

- What are the challenges to the Sustainable finance market growth?

- What are the key market trends impacting the growth of Sustainable finance market?

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sustainable Finance Market

5.1. COVID-19 Landscape: Sustainable Finance Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sustainable Finance Market, By Investment Type

8.1. Sustainable Finance Market, by Investment Type, 2023-2032

8.1.1 Equity, Fixed Income

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Mixed Allocation

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sustainable Finance Market, By Transaction Type

9.1. Sustainable Finance Market, by Transaction Type, 2023-2032

9.1.1. Green Bond

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Social Bond

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Mixed- sustainability Bond

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sustainable Finance Market, By Industry Verticals

10.1. Sustainable Finance Market, by Industry Verticals, 2023-2032

10.1.1. Utilities

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Transport and Logistics

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Chemicals

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Food and Beverage

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Government

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Sustainable Finance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

Chapter 12. Company Profiles

12.1. Green Banks

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sustainable Asset Management Firms

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Impact Investing Funds

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Green Energy Companies

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Social Enterprises

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sustainable Technology Companies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Green Real Estate Developers

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Corporate Green Bond Issuers

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sustainable Agriculture and Food Companies

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com