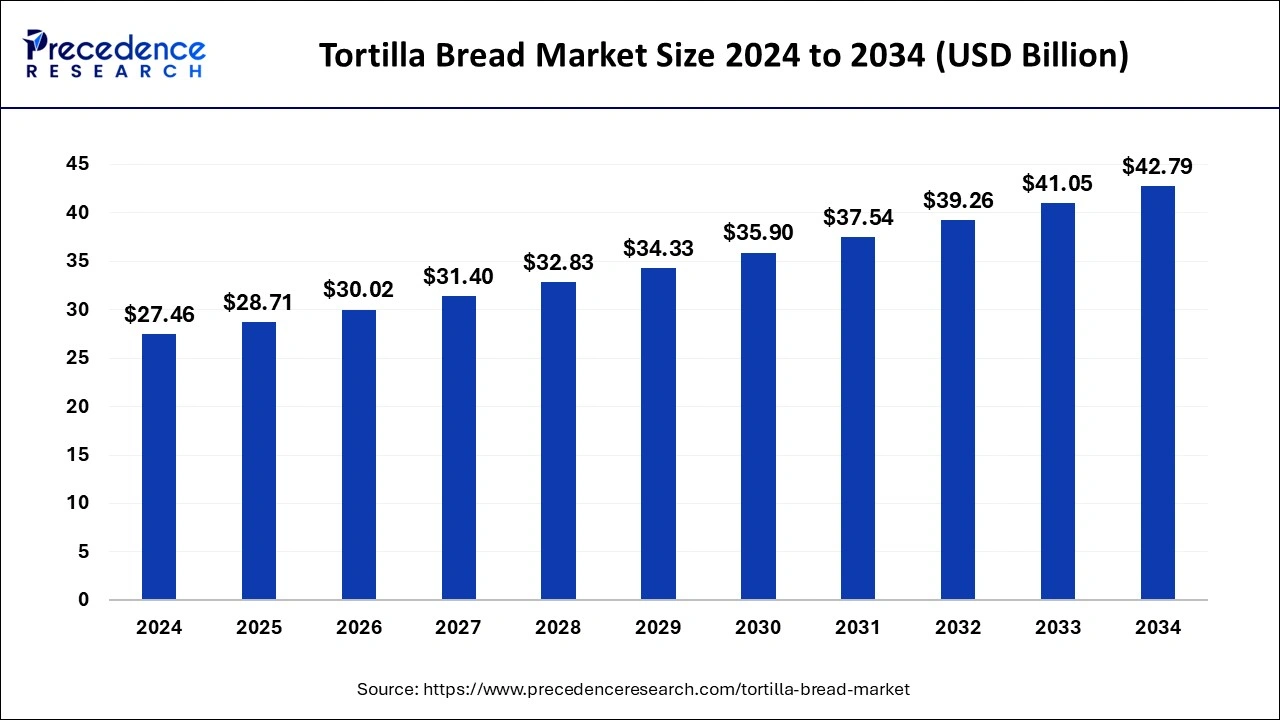

The global tortilla bread market size is anticipated to attain around USD 41.05 billion by 2033, growing at a CAGR of 4.57% from 2024 to 2033.

Key Points

- North America has generated more than 42% of market share in 2023.

- By ingredients, the corn segment has contributed more than 52% of market share in 2023.

- By processing type, the fresh segment has recorded the maximum market share of 63% 2023.

- By product type, the tortilla chips segment dominated the market with the biggest market share of 36% in 2023.

- By distribution channel, the hypermarket/supermarket distribution segment has held a major market share of 37% in 2023.

The tortilla bread market has experienced significant growth in recent years, driven by the rising popularity of Mexican cuisine, changing consumer preferences towards healthier food options, and increasing demand for convenient and versatile food products. Tortilla bread, a staple in Mexican cuisine, has gained widespread acceptance globally, becoming a preferred choice for wraps, tacos, quesadillas, and other dishes. The market for tortilla bread is characterized by a diverse range of products, including corn tortillas, flour tortillas, and specialty varieties such as whole wheat and gluten-free options. Manufacturers are continuously innovating to cater to evolving consumer tastes and preferences, leading to a wide array of flavors, sizes, and textures in the market.

Get a Sample: https://www.precedenceresearch.com/sample/4018

Growth Factors:

Several factors contribute to the growth of the tortilla bread market. One of the primary drivers is the increasing consumer inclination towards healthier eating habits. Tortilla bread, particularly whole wheat and multigrain variants, is perceived as a healthier alternative to traditional bread due to its lower calorie and fat content. Moreover, the gluten-free options cater to the growing demand from consumers with gluten intolerance or sensitivities, expanding the market reach of tortilla bread. Additionally, the versatility of tortilla bread makes it a convenient option for various meal occasions, driving its adoption among busy consumers seeking quick and easy meal solutions.

Region Insights:

The tortilla bread market exhibits strong regional variations in terms of consumption patterns, preferences, and market dynamics. In North America, particularly in the United States and Mexico, tortilla bread holds a prominent position as a dietary staple, owing to the rich culinary heritage of Mexican cuisine and the large Hispanic population. The market in this region is characterized by a wide range of product offerings, with corn tortillas being the traditional choice in Mexican cuisine, while flour tortillas are more popular in the United States. In Europe and Asia-Pacific regions, the market for tortilla bread is experiencing steady growth due to increasing globalization and the rising popularity of ethnic cuisines. Market players are focusing on product innovation and distribution expansion to capitalize on emerging opportunities in these regions.

Tortilla Bread Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 26.26 Billion |

| Global Market Size by 2033 | USD 41.05 Billion |

| U.S. Market Size in 2023 | USD 8.27 Billion |

| U.S. Market Size by 2033 | USD 12.93 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Ingredients, By Processing Type, By Product Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tortilla Bread Market Dynamics

Drivers:

Several key drivers are fueling the growth of the tortilla bread market. Changing consumer lifestyles, characterized by hectic schedules and a preference for on-the-go meals, are driving the demand for convenient and portable food options such as tortilla wraps and sandwiches. Moreover, the growing awareness of health and wellness among consumers is leading to a shift towards lighter and healthier food choices, further boosting the demand for whole grain and low-carb tortilla bread variants. Additionally, the increasing popularity of Latin American and Mexican cuisines, both in their countries of origin and globally, is driving the adoption of tortilla bread as an essential ingredient in various dishes, stimulating market growth.

Opportunities:

The tortilla bread market presents numerous opportunities for growth and innovation. One of the key opportunities lies in product diversification and customization to cater to the evolving tastes and preferences of consumers. Manufacturers can introduce new flavors, fillings, and textures to differentiate their products and attract a wider consumer base. Additionally, expanding distribution channels, including online retail platforms and convenience stores, can help reach untapped markets and increase accessibility to tortilla bread products. Furthermore, collaborations with restaurants, foodservice providers, and other food manufacturers can create opportunities for product bundling and cross-promotion, further driving market growth.

Challenges:

Despite the promising growth prospects, the tortilla bread market faces several challenges that need to be addressed. One of the primary challenges is the intensifying competition from alternative flatbread and wrap options, including pita bread, naan, and lavash. Manufacturers need to differentiate their products through quality, taste, and nutritional value to maintain their competitive edge in the market. Moreover, fluctuating raw material prices, particularly for corn and wheat, pose a challenge to profit margins and supply chain management for tortilla bread manufacturers. Additionally, regulatory hurdles and compliance requirements related to food safety and labeling standards can add complexity to market operations, especially for players operating across multiple regions.

Read Also: Tissue Expanders Market Size to Attain USD 1,309.69 Mn by 2033

Recent Developments

- In March 2024, Tortilla Restaurants unveiled an enticing offer for evening diners: a £10 evening meal deal complete with a choice of burritos, tacos, naked burritos, or salads, accompanied by a side of sweetcorn ribs in sour cream, tortilla chips and salsa, or queso fundido.

- In October 2023, Doritos unveiled Doritos Dinamita, a fiery addition to its lineup, tailored specifically for the Indian market. These rolled tortilla chips come in two bold flavors: Fiery Lime and Chilli and Sizzlin’ Hot. Accompanied by a sizzling campaign, Doritos aims to ignite taste buds with its spicy offerings.

Tortilla Bread Market Companies

- Grupo Bimbo SAB de CV

- General Mills

- Aranda’s Tortilla Company Inc.

- Ole Mexican Foods Inc

- Easy Foods Inc.

- Gruma SAB de CV

- PepsiCo Inc.

- La Tortilla Factory

- Catallia Mexican Foods

- Tyson Foods Inc.

- Azteca Foods Inc.

Segments Covered in The Report

By Ingredients

- Wheat

- Corn

By Processing Type

- Fresh

- Frozen

By Product Type

- Tortilla Chips

- Taco Shells

- Tostadas

- Flour Tortillas

- Corn Tortillas

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/