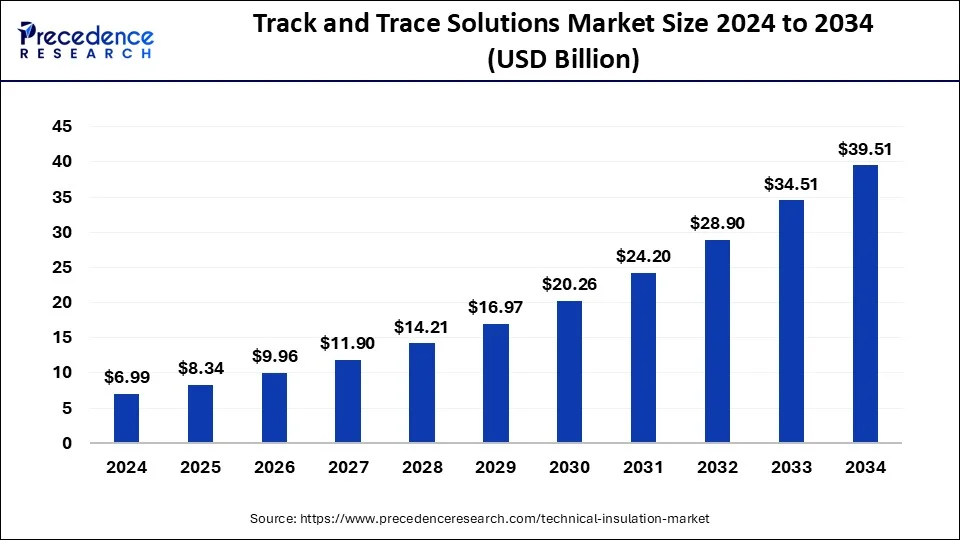

The global track and trace solutions market is expected to grow from USD 6.99 billion in 2024 to USD 39.51 billion by 2034, registering a strong CAGR of 18.91%.

Track and Trace Solutions Market Key Takeaways

- North America held approximately 37% of the market share in 2023.

- Software solutions led the market by product, accounting for 52% of the share in 2023.

- The hardware systems segment contributed 48% to the market share in 2023.

- Serialization solutions dominated by application, securing a 56% market share in 2023.

- Barcode technology captured the largest share by technology, holding 81% in 2023.

- Pharmaceutical companies emerged as the leading end-use segment, with around 27% market share in 2023.

The Track and Trace Solutions Market is experiencing significant growth, driven by the increasing need for product authentication, regulatory compliance, and supply chain transparency. In 2023, North America accounted for approximately 37% of the market share, highlighting its strong presence in the industry. Among products, software solutions led the market with a 52% share, while hardware systems contributed 48%. Serialization solutions emerged as the dominant application, securing 56% of the market.

By technology, barcode technology held the largest share at 81%, reflecting its widespread adoption. In terms of end-use, pharmaceutical companies led with around 27% of the market, showcasing the sector’s reliance on track and trace solutions to enhance security and regulatory adherence. With the market projected to grow from USD 6.99 billion in 2024 to USD 39.51 billion by 2034 at a CAGR of 18.91%, the industry is poised for rapid expansion, fueled by technological advancements and stringent regulations.

Sample Link: https://www.precedenceresearch.com/sample/1109

Key Drivers

Opportunities

- Increasing adoption of blockchain and AI-driven track and trace solutions for enhanced security and transparency.

- Expansion of e-commerce and online pharmaceutical sales, driving demand for advanced tracking systems.

- Growing need for anti-counterfeiting solutions in industries like healthcare, food & beverage, and automotive.

- Rising implementation of cloud-based track and trace solutions for real-time monitoring and data accuracy.

- Emerging markets in Asia-Pacific and Latin America offer significant growth potential due to regulatory developments.

- Advancements in IoT and smart packaging solutions enhance traceability and supply chain efficiency.

Challenges

- High implementation costs and maintenance expenses associated with track and trace technologies.

- Complex regulatory requirements across different regions, create compliance challenges for businesses.

- Data security and privacy concerns with cloud-based and connected tracking systems.

- Integration issues with existing supply chain infrastructure and legacy systems.

- Limited awareness and adoption in small and medium-sized enterprises (SMEs).

- Risk of counterfeiters adopting sophisticated methods to bypass track and trace systems.

Regional Insights

The Track and Trace Solutions Market exhibits varying growth trends across different regions. North America holds a dominant position, accounting for approximately 37% of the market share in 2023, driven by stringent regulatory requirements, advanced healthcare infrastructure, and the strong presence of key industry players. Europe follows closely, benefiting from strict anti-counterfeiting regulations, particularly in the pharmaceutical and food industries.

The Asia-Pacific region is expected to witness the fastest growth due to increasing government initiatives, expanding pharmaceutical and logistics sectors, and rising awareness about supply chain transparency. Countries like China and India are emerging as key markets due to rapid industrialization and the adoption of serialization and traceability solutions. Latin America and the Middle East & Africa are also showing promising growth, supported by improving regulatory frameworks and rising demand for product authentication in various industries.

Market Key Players

- Adents International

- Mettler-Toledo International, Inc

- Axway, TraceLink, Inc

- Optel Vision

- Siemens AG

- SeidenaderMaschinenbau GmbH

- Others

Recent News

The global track and trace solutions market is experiencing significant growth, driven by increasing demand for supply chain transparency, regulatory compliance, and product security. In 2023, the market was valued at approximately USD 6.82 billion and is projected to reach around USD 23.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 16.8%. North America currently leads the market, holding a significant share of over 36.8% in 2024.

Recent technological advancements are enhancing package tracking capabilities. Companies are adopting advanced tags that emit signals using cellular networks, Bluetooth, and RFID technology, enabling precise real-time location tracking. For instance, Royal Mail has implemented Bluetooth tags to optimize operations and plans to extend their use to individual parcels. Similarly, AT&T and UPS have introduced smart labels and RFID tags to monitor conditions like temperature and prevent delivery errors. These innovations are transforming supply chain visibility and operational efficiency.

Market Segmentation

By Technology

- RFID

- Barcode

By Product

- Hardware Systems

- Monitoring & Verification Solutions

- Printing & Marking Solutions

- Labeling Solutions

- Others

- Software Solutions

- Bundle Tracking Software

- Plant Manager Software

- Line Controller Software

- Others

By Application

- Aggregation Solutions

- Bundle Aggregation

- Case Aggregation

- Pallet Aggregation

- Serialization Solutions

- Carton Serialization

- Label Serialization

- Bottle Serialization

- Data Matrix Serialization

End-User

- Medical device Companies

- Pharmaceutical Companies

- Food and Beverage

- Healthcare

- Consumer Packaged Goods

- Luxury Goods

- Others