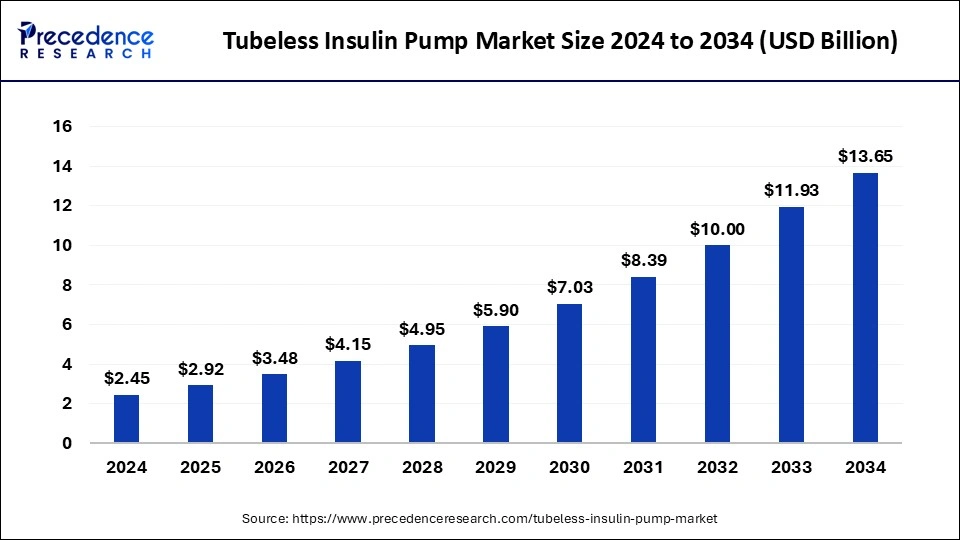

The global tubeless insulin pump market size is anticipated to hit around USD 11.93 billion by 2033, growing at a CAGR of 19.25% from 2024 to 2033.

Key Points

- North America held the largest market share of 55% in 2023.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By type, the insulin patch pump segment accounted for the dominating share in 2023. The segment is observed to continue growth at a significant rate in the upcoming period.

- By component, the pod or patch segment held the largest share of the market in 2023.

- By end users, the hospitals segment held the largest share of the market in 2023.

The tubeless insulin pump market is experiencing significant growth due to the rising prevalence of diabetes globally. Tubeless insulin pumps are innovative devices designed to provide continuous subcutaneous insulin infusion without the need for tubing. These pumps offer greater convenience, flexibility, and discretion to diabetic patients compared to traditional insulin delivery methods. With advancements in technology and increasing awareness about diabetes management, the tubeless insulin pump market is poised for substantial expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3944

Growth Factors

Several factors contribute to the growth of the tubeless insulin pump market. Firstly, the increasing incidence of diabetes, fueled by sedentary lifestyles, unhealthy dietary habits, and rising obesity rates, drives the demand for advanced insulin delivery solutions. Additionally, the growing preference for minimally invasive and user-friendly diabetes management devices among patients and healthcare professionals boosts the adoption of tubeless insulin pumps. Moreover, continuous technological innovations leading to improved pump features, such as automated insulin delivery systems and integration with mobile applications, further propel market growth.

Tubeless Insulin Pump Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 19.25% |

| Global Market Size in 2023 | USD 2.05 Billion |

| Global Market Size by 2033 | USD 11.93 Billion |

| U.S. Market Size in 2023 | USD 790 Million |

| U.S. Market Size by 2033 | USD 4,590 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Component, and By End-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tubeless Insulin Pump Market Dynamics

Drivers:

Several drivers are accelerating the growth of the tubeless insulin pump market. One of the primary drivers is the rising demand for personalized diabetes care solutions tailored to individual patient needs. Tubeless insulin pumps offer customizable insulin delivery profiles and bolus doses, allowing patients to better manage their blood glucose levels. Furthermore, the convenience and discretion offered by tubeless pumps, with no visible tubing or bulky devices, enhance patient adherence to insulin therapy regimens. Additionally, favorable reimbursement policies for diabetes management devices in many regions contribute to increased adoption of tubeless insulin pumps among patients.

Restraints:

Despite the promising growth prospects, the tubeless insulin pump market faces certain restraints that may impede its expansion. One of the key challenges is the high cost associated with tubeless insulin pump therapy, which may limit access for some patients, particularly in low- and middle-income countries. Moreover, concerns regarding the reliability and accuracy of tubeless pump technology, especially in delivering precise insulin doses, pose a significant restraint to market growth. Additionally, regulatory hurdles and stringent approval processes for new tubeless insulin pump devices may delay market entry and innovation.

Opportunity:

Despite the challenges, the tubeless insulin pump market presents significant opportunities for growth and innovation. Continuous research and development efforts aimed at enhancing pump functionality, improving accuracy, and reducing costs could expand market penetration. Moreover, strategic collaborations between healthcare companies and technology firms to develop integrated diabetes management solutions leveraging artificial intelligence and data analytics hold immense potential. Furthermore, the untapped market potential in emerging economies, coupled with increasing healthcare expenditure and improving access to healthcare services, presents lucrative opportunities for market players to expand their presence globally.

Read Also: Protective Face Masks Market Size to Rake USD 16.32 Bn by 2033

Region Insights:

The tubeless insulin pump market exhibits varying dynamics across different regions. North America dominates the market, driven by the high prevalence of diabetes, advanced healthcare infrastructure, and early adoption of innovative medical technologies. Europe follows closely, fueled by increasing awareness about diabetes management and favorable reimbursement policies. The Asia Pacific region presents significant growth opportunities, attributed to the large diabetic population, rising disposable incomes, and expanding healthcare infrastructure. Latin America and the Middle East & Africa are also witnessing steady growth, supported by improving access to healthcare services and increasing investment in diabetes care.

Recent Developments

- In August 2023, the Tubeless insulin pump received FDA clearance for diabetes people. The Accu-Chek Solo micropump (Roche Diabetes) was granted 510(k) clearance from the FDA. Accu-Chek Solo micropump is tubeless, small, and lightweight. Users can place the device on four different infusion sites on the body. The device is detachable, allowing people with diabetes to change the infusion site when necessary.

- In July 2023, the FDA announced the clearance of Tandem Diabetes Care’s Mobi durable automated insulin pump. The approval covers people with diabetes aged six and above, expanding Tandem’s portfolio of products. Mobi features a 200-unit insulin cartridge and an on-pump button to provide an alternative to phone control for insulin boluses.

- In February 2024, Omnipod 5 received approval to integrate with the new freestyle libre two plus sensor. The Omnipod 5 hybrid closed loop system has received approval to integrate with the Abbott FreeStyle Libre 2 Plus Sensor in the UK, which will give people living with diabetes additional choice and flexibility for managing their blood sugar levels.

- In April 2023, Insulet announced FDA clearance of Omnipod GO, a first-of-its-kind basal-only insulin pod for people with type 2 diabetes aged 18 and above. Omnipod GO is a wearable, standalone insulin delivery system that provides a fixed rate of continuous rapid-acting insulin for 72 hours.

Tubeless Insulin Pump Market Companies

- Medtronic plc

- Hoffmann-La Roche Ltd

- Tandem Diabetic Care, Inc.

- Insulet Corporation

- Ypsomed

- Cellenovo

- Abbott

- Tandem Diabetes Care

- Insulet Corporation

- Sooil Development

- Valeritas, Inc

- JingasuDelfu Co., Ltd.

- Cellnova

- Roche Holdings

- Spring Health Solutions

- Johnson & Johnson

- Medtrum Technologies

- Debiotech

- CeQur

- Valeritas Holding

- Animas Corporation

Segments Covered in the Report

By Type

- Insulin Patch Pump

- Traditional Pump

By Component

- Pod or Patch

- Remote

- Accessories

By End-users

- Hospitals

- Pharmacies

- E-commerce

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/