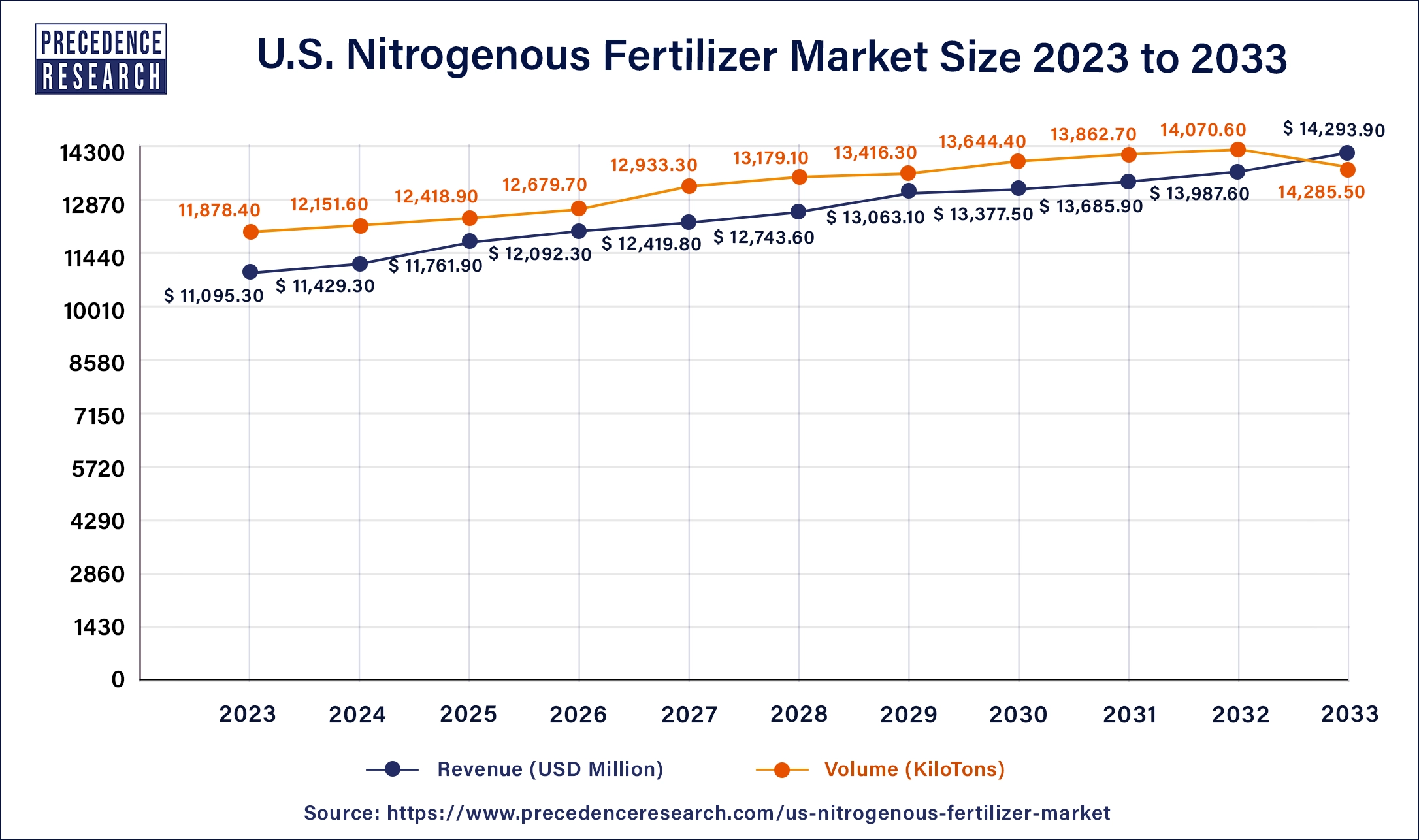

The U.S. nitrogenous fertilizer market size was estimated at USD 1,1095.3 million in 2023 and is projected to reach around USD 1,4293.9 million by 2033, growing at a CAGR of 1.81% from 2024 to 2033

Key Points

- By product, the urea segment dominated the U.S. nitrogenous fertilizer market with the largest share in 2023.

- By product, the NPK compound held the second-largest share in the market in 2023.

- By application, the agricultural use segment dominated the market in 2023.

- By application, the industrial use segment is expected the fastest growth in the market during the forecast period.

The U.S. nitrogenous fertilizer market is a vital component of the agricultural industry, playing a crucial role in ensuring high crop yields and food security. Nitrogenous fertilizers, which primarily consist of ammonia, urea, and ammonium nitrate, are essential for providing plants with the nitrogen necessary for growth and development. The U.S. is one of the largest consumers and producers of nitrogenous fertilizers globally, with a significant portion of its agricultural output reliant on these fertilizers to maintain productivity levels.

Get a Sample: https://www.precedenceresearch.com/sample/4420

Growth Factors:

Several factors contribute to the growth of the U.S. nitrogenous fertilizer market. Firstly, the increasing demand for food due to population growth and changing dietary habits drives the need for higher agricultural yields, thereby boosting the demand for nitrogenous fertilizers. Additionally, technological advancements in fertilizer production processes have led to greater efficiency and cost-effectiveness, further fueling market growth. Moreover, government subsidies and support programs for the agricultural sector play a significant role in incentivizing farmers to use nitrogenous fertilizers, thereby stimulating market expansion.

Region Insights:

The U.S. nitrogenous fertilizer market exhibits regional variations in demand and consumption patterns. Regions with intensive agricultural activities, such as the Midwest and the Great Plains, tend to have higher usage of nitrogenous fertilizers due to the large-scale cultivation of crops like corn, wheat, and soybeans. Conversely, regions with less arable land or specialized agricultural practices may have comparatively lower demand for nitrogenous fertilizers. Additionally, variations in soil types, climate conditions, and cropping patterns influence the distribution and utilization of nitrogenous fertilizers across different regions within the U.S.

U.S. Nitrogenous Fertilizer Market Scope

| Report Coverage | Details |

| U.S. Nitrogenous Fertilizer Market Size in 2024 | USD 11,429.3 Million |

| U.S. Nitrogenous Fertilizer Market Size by 2033 | USD 14,293.9 Million |

| U.S. Nitrogenous Fertilizer Market Growth Rate | CAGR of 1.81% from 2024 to 2033 |

| U.S. Nitrogenous Fertilizer Market Volume in 2024 | 12151.6 Kilotons |

| U.S. Nitrogenous Fertilizer Market Volume by 2033 | 14285.5 Kilotons |

| Quantitative Units | Revenue in USD Million/Billions, Volume in Tons, CAGR from 2024 to 2033 |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product and End-Use |

U.S. Nitrogenous Fertilizer Market Dynamics

Drivers:

Several drivers propel the growth of the U.S. nitrogenous fertilizer market. One of the primary drivers is the increasing adoption of modern farming practices, such as precision agriculture and controlled-release fertilizers, which optimize nutrient utilization and enhance crop yields. Additionally, the growing trend of biofuel production, particularly ethanol from corn, has contributed to higher demand for nitrogenous fertilizers, as corn cultivation requires significant nitrogen inputs. Moreover, the expansion of the organic farming sector has created opportunities for nitrogenous fertilizer manufacturers to develop organic-certified products to cater to this niche market segment.

Opportunities:

The U.S. nitrogenous fertilizer market presents several opportunities for growth and innovation. With the rising awareness of environmental sustainability and the need to minimize the environmental impact of agricultural practices, there is increasing demand for environmentally friendly and nutrient-efficient fertilizers. Manufacturers can capitalize on this trend by investing in research and development to produce next-generation nitrogenous fertilizers with reduced carbon footprint and enhanced nutrient uptake efficiency. Furthermore, strategic partnerships and collaborations with agricultural research institutions and universities can facilitate knowledge exchange and technology transfer, enabling companies to stay at the forefront of innovation in the nitrogenous fertilizer industry.

Challenges:

Despite the promising growth prospects, the U.S. nitrogenous fertilizer market also faces several challenges. One of the major challenges is the volatility of raw material prices, particularly natural gas, which is a primary feedstock for nitrogenous fertilizer production. Fluctuations in natural gas prices can significantly impact production costs and profit margins for fertilizer manufacturers, leading to pricing uncertainties in the market. Additionally, environmental concerns related to nitrogen pollution, such as nitrate leaching and greenhouse gas emissions, pose regulatory challenges for the industry, necessitating adherence to stringent environmental standards and sustainability practices. Moreover, competition from alternative nutrient sources, such as organic fertilizers and bio-based amendments, presents a challenge for nitrogenous fertilizer manufacturers to differentiate their products and maintain market competitiveness.

Read Also: Wireless Charging Market Size to Reach USD 140.75 Bn By 2033

U.S. Nitrogenous Fertilizer Market Recent Developments

- In April 2024, Nitricity launched its new field test with the collaboration of Elemental Excelerator, Olam Food Ingredients, and the Madera/Chowchilla Resource Conservation Districtat the Madera County event. The launch is results in the significant rise in scale from small delivers to the first tonnage delivery of Nitricity’s produced liquid calcium nitrate product.

- In May 2024, American companies purchased fertilizers worth $174 million in March- end up 10% from the last February. Russia is become the second largest exporter of fertilizers to the United States followed by Canada with the supplies worth of $338 million commodity in March.

- In May 2024, The US Commerce Department (USCD), announced the increase in the import duty on Moroccan fertilizers. As per the US media, USCD announced the hike from 2.12% to 14.21% with reducing duties on Russian phosphate fertilizers to 18.83% from 28.5%.

U.S. Nitrogenous Fertilizer Market Companies

- Yara International ASA

- ICL Specialty Fertilizers

- The Mosaic Company

- Nutrien Limited

- CF Industries

- BASF

- Sigma AgriScience, LLC

- Scotts Miracle-Gro Company

- Intrepid Potash Inc

Segments Covered in the Report

By Product

- Urea

- NPK Compound

- Nitrates

- Ammonium Phosphate

- Others

By End-Use

- Agricultural Use

- Industrial Use

- Residential And Consumer Use

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/