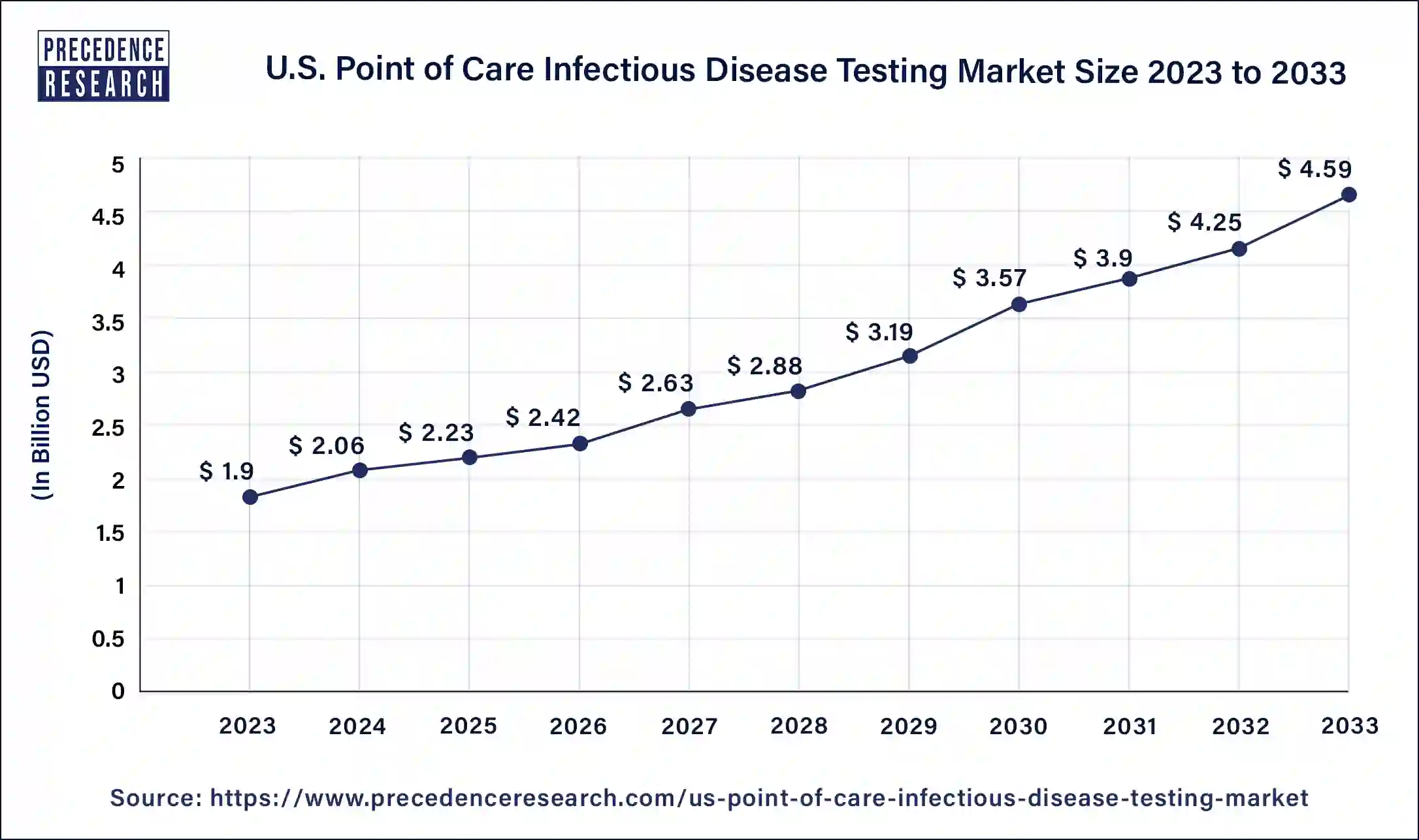

The U.S. point-of-care infectious disease testing market size was valued at USD 1.9 billion in 2023 and is expected to reach around USD 4.59 billion by 2033. The market is expanding at a solid CAGR of 9.30% from 2024 to 2033.

Key Points

- By disease, the influenza/flu segment has held a major revenue share of 24.42% in 2023.

- By disease, the respiratory syncytial virus (RSV) segment is the second largest in the market in 2023.

- By end-user, the hospitals segment dominated market with the largest revenue share of 38.56% in 2023.

The U.S. point of care (POC) infectious disease testing market is a dynamic sector within the broader healthcare diagnostics industry. POC testing refers to medical diagnostic testing at or near the site of patient care, offering rapid results that aid in immediate clinical decision-making. In the context of infectious diseases, POC testing plays a crucial role in facilitating early detection, monitoring disease progression, and guiding appropriate treatment strategies. This market encompasses a wide range of infectious diseases, including but not limited to respiratory infections, sexually transmitted diseases (STDs), gastrointestinal infections, and emerging infectious diseases like COVID-19.

Get a Sample: https://www.precedenceresearch.com/sample/4461

Growth Factors

Several factors contribute to the growth of the U.S. POC infectious disease testing market. Firstly, technological advancements have led to the development of innovative POC testing devices that offer enhanced accuracy, speed, and ease of use. These advancements have expanded the applications of POC testing beyond traditional healthcare settings to include pharmacies, clinics, and even home settings, thereby increasing accessibility to diagnostic services.

Secondly, the increasing prevalence of infectious diseases and the rise in global travel have heightened the demand for rapid diagnostic solutions that can quickly identify pathogens and help contain outbreaks. POC testing meets this demand by providing timely results, reducing the need for complex laboratory infrastructure, and enabling early intervention and treatment initiation.

Furthermore, the growing awareness among healthcare providers and patients about the benefits of POC testing, such as reduced turnaround times and improved patient outcomes, has significantly boosted market adoption. These factors collectively contribute to the expanding market size and the diversification of POC infectious disease testing offerings in the U.S.

Regional Insights

Geographically, the U.S. POC infectious disease testing market is influenced by regional variations in healthcare infrastructure, regulatory frameworks, and prevalence of infectious diseases. Urban centers and areas with higher population densities tend to have greater demand for POC testing due to easier access to healthcare facilities and higher incidences of infectious diseases.

Moreover, regulatory policies and reimbursement mechanisms play a crucial role in shaping market dynamics. The U.S. FDA regulates the approval and marketing of POC diagnostic devices, ensuring their safety, effectiveness, and accuracy. Reimbursement policies from government healthcare programs and private insurers also impact market growth, as favorable reimbursement encourages healthcare providers to adopt POC testing solutions.

U.S. Point of Care Infectious Disease Testing Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 1.9 Billion |

| Market Size in 2024 | USD 2.06 Billion |

| Market Size by 2033 | USD 4.59 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.30% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Disease and End-user |

U.S. Point of Care Infectious Disease Testing Market Dynamics

Drivers

Several drivers propel the growth of the U.S. POC infectious disease testing market. The increasing prevalence of chronic infectious diseases, such as HIV/AIDS and hepatitis, drives the demand for regular monitoring through POC testing. Additionally, the rising healthcare expenditure and investments in healthcare infrastructure support the adoption of advanced POC testing technologies across various healthcare settings.

Moreover, the shift towards personalized medicine and the emphasis on early disease detection and prevention further stimulate market growth. POC testing enables healthcare providers to tailor treatment strategies based on real-time diagnostic results, thereby improving patient management and clinical outcomes.

Opportunities

The U.S. POC infectious disease testing market presents numerous opportunities for stakeholders. Technological innovations, such as the integration of smartphone-based applications and cloud computing with POC devices, enhance connectivity and data management capabilities. This integration enables remote monitoring, telemedicine applications, and seamless healthcare delivery, especially in underserved rural areas.

Furthermore, the COVID-19 pandemic has underscored the importance of rapid diagnostic testing in controlling infectious disease outbreaks. The accelerated development and deployment of POC tests for COVID-19 have demonstrated the market potential and scalability of POC testing platforms in responding to public health emergencies.

Challenges

Despite its growth prospects, the U.S. POC infectious disease testing market faces several challenges. Regulatory complexities, including stringent FDA approval processes and varying state-level regulations, can delay market entry and increase development costs for POC testing manufacturers. Moreover, ensuring the accuracy and reliability of POC tests remains a critical challenge, as inaccuracies can lead to misdiagnosis and inappropriate treatment decisions.

Additionally, market fragmentation and competition among POC testing providers pose challenges in terms of pricing pressures and market consolidation. Healthcare providers often face dilemmas regarding the selection of POC testing platforms that offer the best balance of cost-effectiveness, accuracy, and ease of use.

Read Also: Credit Card Payments Market Size to Reach USD 1,331.50 Bn By 2033

U.S. Point of Care Infectious Disease Testing Market Companies

- Beckton Dickinson

- Roche

- Biomerieux

- Siemens

- Bio-rad

- Chembio Diagnostic Systems

- Quidel Corporation

- Abbott

Recent Developments

- In March 2024, in spring 2024, the City University of New York (CUNY) Institute for Implementation Science in Population Health (ISPH) and the CUNY Graduate School of Public Health and Health Policy (CUNY SPH) will launch a critical two-year prospective epidemiologic study in partnership with Pfizer to monitor acute respiratory infections nationwide.

- In February 2022, The World Health Organization (WHO) approved Trinity Biotech plc’s new HIV screening tool, Trin Screen HIV.

Segments Covered in the Report

By Disease

- Pneumonia Or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV)

- TB and Drug Resistant TB POC

- Influenza/Flu POC

- HIV POC

- Others

By End-user

- Hospitals

- Clinics

- Home

- Assisted Living Healthcare Facilities

- Laboratories

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/