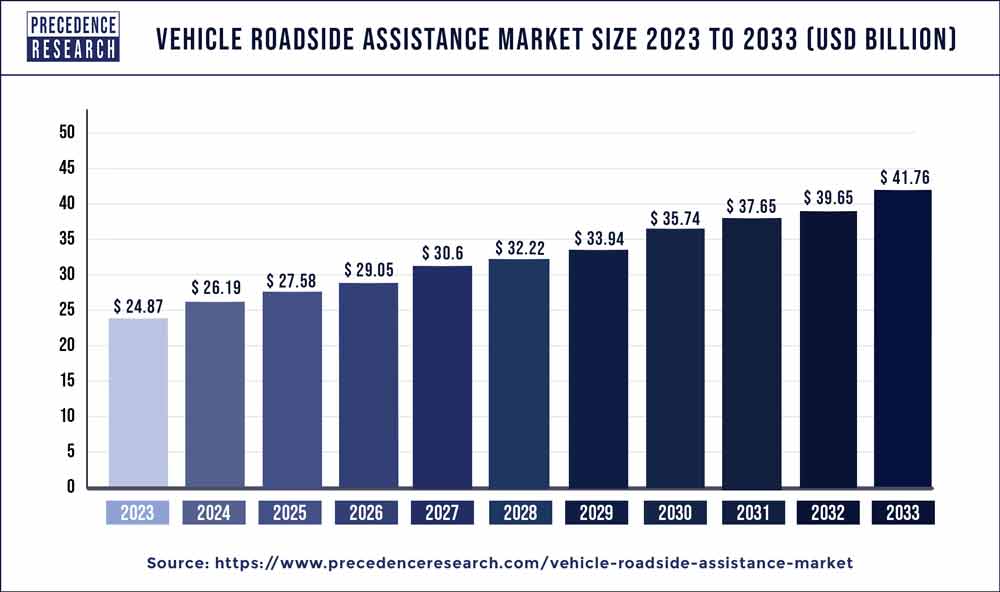

The global vehicle roadside assistance market was valued at USD 24.87B in 2023 and is expected to reach USD 41.76B by 2033, growing at a CAGR of 5.32%.

Table of Contents

ToggleKey Takeaways

- Europe contributed more than 38.14% of revenue share in 2023.

- By Service, the towing service segment captured the biggest revenue share in the global market in the year 2023.

- By Provider, the auto manufacturer segment is likely to dominate the market in the forecast years.

- By Vehicle, the passenger vehicle is a significant revenue share in the market.

The global vehicle roadside assistance market is growing steadily, driven by the increasing number of vehicles on the road and the rising demand for emergency support services. Roadside assistance services provide essential support, including towing, fuel delivery, tire changes, and battery jump-starts, ensuring safety and convenience for drivers. These services cater to both individual consumers and businesses, offering peace of mind for car owners. The market is segmented by service type (towing, fuel delivery, etc.), service provider (insurance companies, standalone providers), and region.

Sample Link: https://www.precedenceresearch.com/sample/1006

Market Scope

| Report Scope | Details |

| Market Size in 2023 | USD 24.87 Billion |

| Market Size By 2033 | USD 41.76 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.32% |

| Base Year | 2023 |

| Largest Market | Europe |

| Fastest Growing Region | Asia Pacific |

| Segments Covered | Service, Providers, Vehicle, Region |

| Companies Mentioned | Viking Assistance Group AS, ARC Europe SA, Swedish Auto, SOS International A/S, Allianz Global Assistance, Falck A/S, Allstate Insurance Company, AAA, Agero, Inc., Best Roadside Service, AutoVantage |

Key drivers

Key drivers for the global vehicle roadside assistance market include the rising number of vehicles on the road, leading to a higher demand for emergency support services. Increasing consumer awareness about the convenience and safety offered by roadside assistance is fueling adoption. The growing trend of vehicle leasing and rentals, especially in urban areas, is further driving the market. Advancements in technology, such as mobile apps for easy access to services and GPS tracking, are enhancing the efficiency of roadside assistance. Additionally, partnerships between insurance companies, service providers, and automakers are boosting market growth.

Opportunities

- Integration with Connected Cars: The growing adoption of connected vehicles presents opportunities for seamless integration of roadside assistance services through real-time diagnostics and remote assistance.

- Expansion in Emerging Markets: As vehicle ownership increases in emerging markets, there is a growing demand for roadside assistance services, offering untapped market potential.

- Partnerships with Automakers: Collaborating with vehicle manufacturers to offer bundled roadside assistance services or warranties could expand service reach and customer base.

- Technological Advancements: Leveraging mobile apps, GPS tracking, and AI-based systems can improve service delivery, customer satisfaction, and operational efficiency.

- Electric Vehicle Support: With the rise of electric vehicles, providing specialized roadside assistance for EVs (such as charging support and battery issues) presents a growing opportunity.

- Subscription-Based Models: Offering roadside assistance through subscription models or memberships can help businesses create consistent revenue streams and enhance customer

Challenges

- High Operational Costs: Maintaining a fleet of vehicles and providing 24/7 service can lead to high operational expenses, affecting profitability.

- Geographical Coverage: Expanding service coverage to rural or remote areas where road conditions may be poor can be challenging and costly for service providers.

- Customer Expectations: Meeting the growing customer expectations for faster response times and more personalized services can be difficult, especially during peak demand periods.

- Competition: The increasing number of roadside assistance providers, including insurers and app-based platforms, has led to intense competition, reducing profit margins.

- Technological Integration: Integrating new technologies, such as GPS tracking and AI-driven services, requires significant investment and expertise.

- Regulatory Compliance: Navigating through varying regulations and legal requirements across different regions can create operational complexities for service providers.

Regional Insights

In 2023, Europe accounted for over 38.14% of the global vehicle roadside assistance market revenue, making it the leading region. The towing service segment generated the largest share of revenue across all services globally. The auto manufacturer segment is expected to dominate the market in the coming years, likely driven by increased partnerships and service offerings. Additionally, passenger vehicles contributed significantly to the market’s revenue share, highlighting the importance of roadside assistance for personal vehicle owners.

Read Also: https://www.precedenceresearch.com/5g-services-market

Market Key players

- Viking Assistance Group AS

- ARC Europe SA

- Swedish Auto

- SOS International A/S

- Allianz Global Assistance

- Falck A/S

- Allstate Insurance Company

- AAA

- Agero, Inc.

- Best Roadside Service

Recent news

Recent developments in the vehicle roadside assistance market include the growing integration of AI and GPS technologies for faster and more efficient service delivery. Mobile apps have become a key platform for users to access assistance quickly, with some offering real-time tracking and updates. Partnerships between automakers and roadside service providers are expanding, allowing seamless service integration for customers. Additionally, the rise of electric vehicles is prompting service providers to include specialized support for EVs, such as charging and battery-related issues.

Market Segmentation

By Service

- Tire Replacement

- Towing

- Jump Start/Pull Start

- Fuel Delivery

- Lockout/Replacement Key Service

- Battery Assistance

- Winch

- Trip Routing/Navigational Assistance

- Other Mechanic Service

By Provider

- Motor Insurance

- Auto Manufacturer

- Automotive Clubs

- Independent Warranty

By Vehicle

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Passenger Vehicles

- Hatchback

- Sedan

- Utility Vehicles