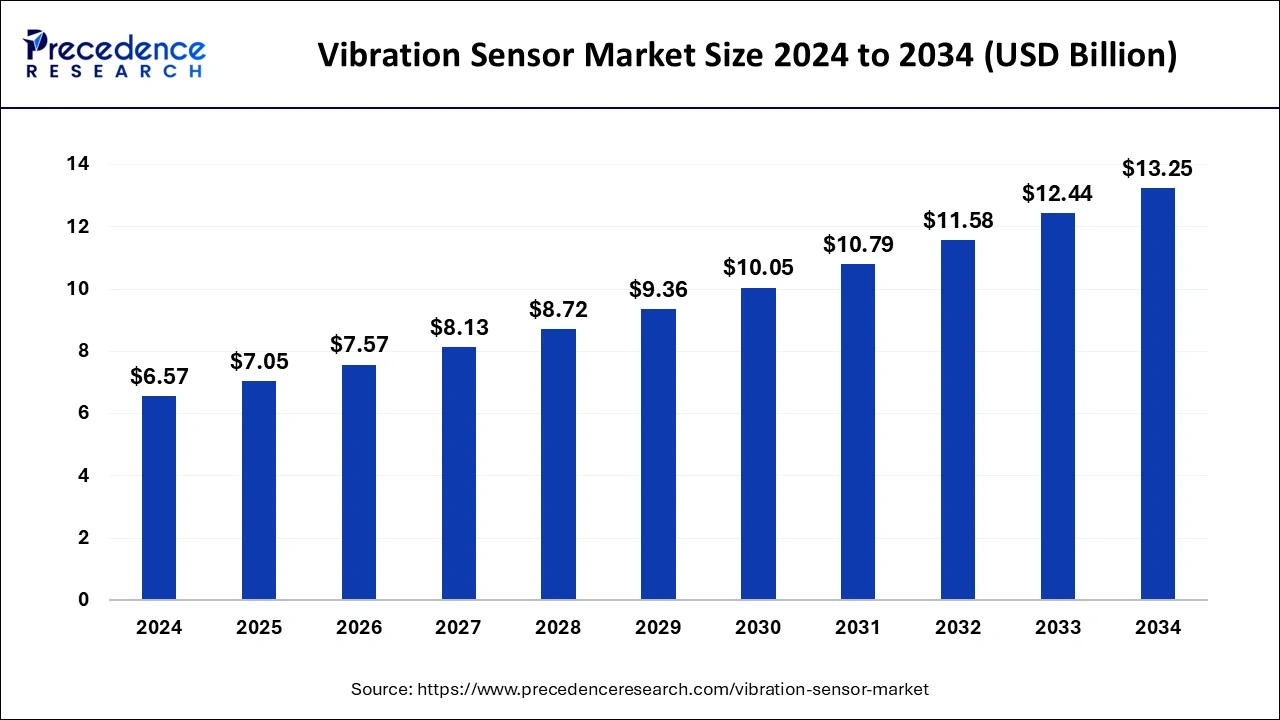

The global vibration sensor market size is anticipated to reach around USD 12.44 billion by 2033, growing at a CAGR of 7.35% from 2024 to 2033.

Key Points

- North America dominated the market with the largest market share of 38% in 2023.

- Asia Pacific is expected to witness the fastest CAGR of 8.62% between 2024 and 2033

- By type, the accelerometers segment has captured more than 45% in 2023.

- By type, the displacement sensors segment is expected to expand at a CAGR of 8.4% between 2024 and 2033.

- By technology, the piezoresistive sensors segment has generated 25% of market share in 2023.

- By technology, the tri-axial sensors segment is projected to grow at the fastest CAGR of 8.92% between 2024 and 2033.

- By end-use, the automobile segment has held the significant market share of 28% in 2023.

- By material, the quartz-based sensors segment has recorded more than 44% of the market share in 2023.

The vibration sensor market has witnessed steady growth in recent years, driven by increasing industrial automation, growing awareness about predictive maintenance, and the rising demand for monitoring and control systems across various sectors. Vibration sensors, also known as accelerometers, are essential components in machinery monitoring applications, providing crucial data on equipment health, performance, and safety. These sensors detect vibrations and oscillations in machines and structures, helping to identify potential faults, prevent unexpected downtime, and optimize maintenance schedules. With advancements in sensor technology and the emergence of wireless connectivity solutions, the vibration sensor market is poised for further expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3969

Growth Factors:

Several factors contribute to the growth of the vibration sensor market. Firstly, the increasing adoption of predictive maintenance strategies by industries seeking to minimize operational downtime and maximize asset reliability drives the demand for vibration monitoring systems. By continuously monitoring equipment vibrations and analyzing data in real-time, businesses can detect early signs of machinery degradation or malfunction, allowing for timely maintenance interventions and preventing costly breakdowns.

Moreover, stringent regulations and standards mandating equipment safety and performance in industries such as manufacturing, automotive, aerospace, and energy further fuel the demand for vibration sensors. Compliance with regulations necessitates the implementation of robust monitoring and control systems, driving investment in vibration sensing technologies to ensure operational efficiency and worker safety.

Additionally, the growing trend towards industrial automation and the integration of Internet of Things (IoT) technologies in manufacturing processes create opportunities for the deployment of vibration sensors. By embedding sensors within machinery and equipment, manufacturers can enable remote monitoring, predictive analytics, and condition-based maintenance, optimizing production processes and reducing maintenance costs.

Furthermore, the expanding applications of vibration sensors beyond traditional industrial settings, such as in consumer electronics, automotive safety systems, healthcare devices, and structural health monitoring, contribute to market growth. The miniaturization of sensor components, improvements in sensor accuracy and sensitivity, and cost reductions drive the adoption of vibration sensors in diverse end-use sectors, expanding the addressable market.

Region Insights:

The vibration sensor market exhibits regional variations in terms of demand, adoption, and technological innovation. In North America, the presence of a robust manufacturing base, stringent regulatory requirements, and a strong focus on industrial automation drive market growth. The region is home to several key players in the vibration sensor industry, investing in R&D to develop advanced sensor technologies and solutions tailored to specific industry needs.

In Europe, the vibration sensor market benefits from the region’s emphasis on sustainable manufacturing practices, energy efficiency, and machinery safety standards. Countries such as Germany, France, and the United Kingdom lead the adoption of vibration monitoring systems, particularly in industries such as automotive, aerospace, and heavy machinery manufacturing.

Asia Pacific emerges as a lucrative market for vibration sensors, fueled by rapid industrialization, infrastructure development, and the growing adoption of automation technologies across sectors. Countries like China, Japan, and South Korea are major contributors to market growth, driven by investments in smart manufacturing initiatives, automotive production, and infrastructure projects.

Latin America and the Middle East & Africa regions are witnessing increasing adoption of vibration sensors, albeit at a slower pace compared to other regions. However, the implementation of industrial digitization initiatives, infrastructure investments, and government initiatives to enhance industrial safety and efficiency present opportunities for market growth in these regions.

Vibration Sensor Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.35% |

| Global Market Size in 2023 | USD 6.12 Billion |

| Global Market Size by 2033 | USD 12.44 Billion |

| U.S. Market Size in 2023 | USD 1.74 Billion |

| U.S. Market Size by 2033 | USD 3.55 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology, By End-use, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vibration Sensor Market Dynamics

Drivers:

Several drivers propel the growth of the vibration sensor market. Firstly, the emphasis on machinery reliability, safety, and productivity in industries such as manufacturing, oil & gas, mining, and automotive fuels the demand for vibration monitoring solutions. Machinery downtime can result in significant production losses and safety risks, prompting companies to invest in vibration sensors to proactively identify and address equipment issues.

Moreover, the rise of Industry 4.0 and the adoption of IoT-enabled technologies drive the integration of vibration sensors into connected systems and smart devices. By leveraging sensor data analytics and machine learning algorithms, businesses can gain actionable insights into equipment performance, optimize maintenance strategies, and improve operational efficiency.

Additionally, the increasing focus on energy efficiency and sustainability motivates industries to invest in vibration sensors as part of energy management and conservation initiatives. By monitoring equipment vibrations and optimizing operating parameters, businesses can minimize energy consumption, reduce environmental impact, and achieve cost savings over the long term.

Furthermore, the growing awareness about worker safety and occupational health drives the adoption of vibration sensors in industrial environments. Exposure to excessive vibrations from machinery and equipment can lead to musculoskeletal disorders and other health hazards. By implementing vibration monitoring systems and adhering to regulatory guidelines, companies can mitigate health risks and ensure a safe working environment for employees.

Opportunities:

The vibration sensor market presents numerous opportunities for growth and innovation. Firstly, advancements in sensor technology, such as MEMS (Micro-Electro-Mechanical Systems) sensors, wireless connectivity, and edge computing capabilities, expand the capabilities and applications of vibration sensors. These technological innovations enable real-time data collection, remote monitoring, and predictive analytics, enhancing the effectiveness of vibration monitoring systems across industries.

Moreover, the emergence of new application areas for vibration sensors, such as in wearable devices, structural health monitoring systems, and consumer electronics, opens up diverse market opportunities. The integration of vibration sensors into smart devices and IoT ecosystems enables innovative use cases, including health and wellness monitoring, sports performance analysis, and structural integrity assessment.

Additionally, the growing trend towards smart cities and infrastructure development presents opportunities for the deployment of vibration sensors in structural health monitoring and asset management applications. By monitoring vibrations in bridges, buildings, and other critical infrastructure assets, authorities can ensure public safety, assess structural integrity, and prioritize maintenance interventions.

Furthermore, the increasing adoption of vibration sensors in automotive safety systems, such as anti-lock braking systems (ABS), electronic stability control (ESC), and active suspension systems, drives market growth in the automotive sector. Vibration sensors play a crucial role in detecting vehicle vibrations and motion, enabling advanced driver assistance features and enhancing vehicle safety and performance.

Challenges:

Despite the positive growth outlook, the vibration sensor market faces several challenges that may hinder market expansion. Firstly, interoperability and compatibility issues between different sensor devices and data management platforms pose challenges for seamless integration and data exchange in interconnected IoT ecosystems. Standardization efforts and interoperability protocols are needed to address these challenges and facilitate the deployment of interconnected sensor networks.

Moreover, concerns regarding data privacy, security, and regulatory compliance present challenges for businesses collecting and processing sensor data, particularly in sensitive industries such as healthcare and finance. Ensuring data confidentiality, integrity, and compliance with data protection regulations is essential to building trust and confidence in sensor-based monitoring solutions.

Additionally, the complexity of analyzing and interpreting vibration data poses challenges for businesses in extracting actionable insights and making informed maintenance decisions. Advanced data analytics tools and machine learning algorithms are needed to process large volumes of sensor data, identify meaningful patterns, and predict equipment failures accurately.

Furthermore, cost considerations and budget constraints may hinder the adoption of vibration monitoring solutions, particularly among small and medium-sized enterprises (SMEs) with limited resources. Manufacturers and solution providers need to offer cost-effective sensor solutions, flexible pricing models, and value-added services to address the affordability concerns of potential customers.

Lastly, the shortage of skilled personnel with expertise in vibration analysis and condition monitoring poses challenges for businesses in implementing effective vibration monitoring programs. Training and skill development initiatives are needed to equip technicians and maintenance professionals with the knowledge and expertise required to operate and interpret vibration sensor data effectively.

Read Also: Cardiac Rhythm Management Devices Market Size, Report by 2033

Recent Developments

- In January 2023, HARMAN International unveiled its sound and vibration sensor and external microphone products, designed to enhance the auditory experience in and around vehicles for various applications, including identifying emergency vehicle sirens and detecting glass breakage or collisions.

- In March 2022, SAMSUNG released the Galaxy A53 5G smartphone, which features an octa-core processor, a 120 Hz refresh rate display, and a sharp resolution of 1080 x 2400 pixels.

- In May 2022, Sensoteq announced the Kappa X Wireless Vibration Sensor. This compact sensor has a replaceable battery and can detect faults, making it suitable for various industrial applications.

Vibration Sensor Market Companies

- Dytran Instruments, Inc.

- PCB Piezotronics, Inc. (IMI Sensors division)

- Hansford Sensors Ltd.

- TE Connectivity Ltd. (formerly Measurement Specialties, Inc.)

- Honeywell International Inc.

- Robert Bosch GmbH

- National Instruments Corporation

- Analog Devices, Inc.

- Meggitt PLC

Segment Covered in the Report

By Type

- Accelerometers

- Velocity Sensors

- Displacement Sensors

By Technology

- Piezoresistive Sensors

- Tri-Axial Sensors

By End-use

- Automotive Sector

- Aerospace And Defense

- Consumer Electronics

By Material

- Quartz-based Sensors

- Doped Silicon Sensors

- Piezoelectric Ceramics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/