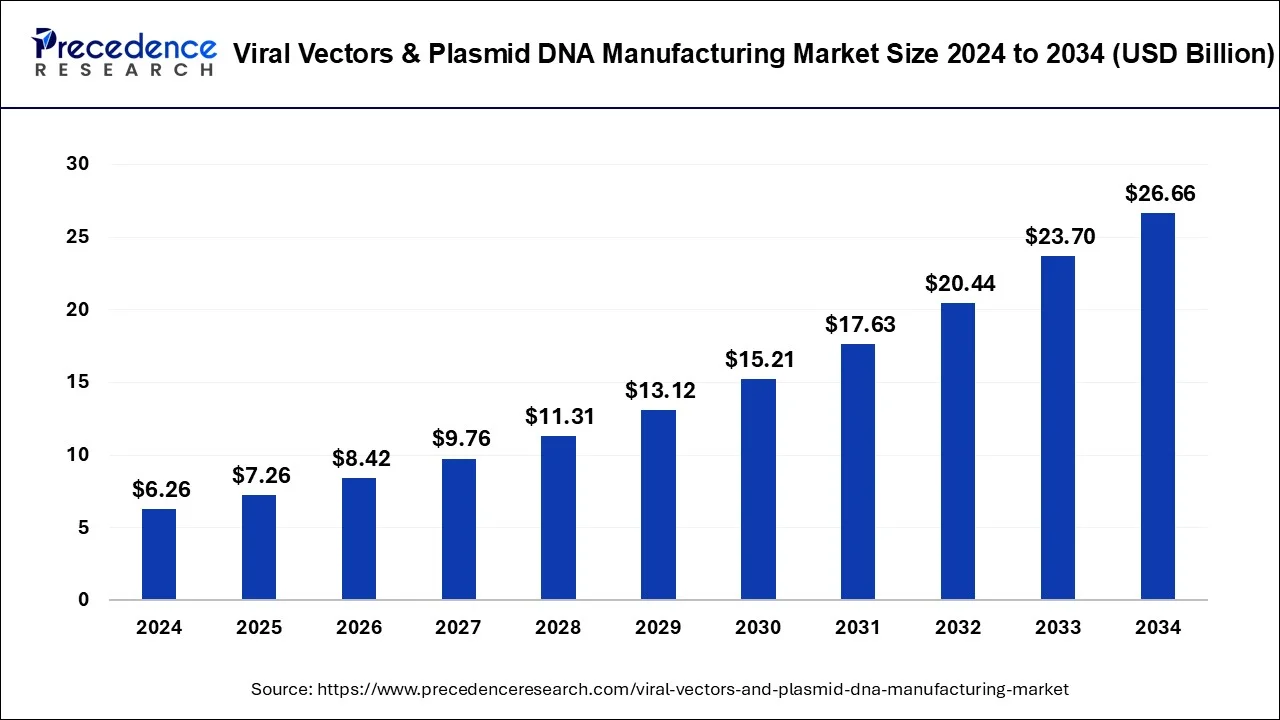

The viral vectors & plasmid DNA market is projected to reach USD 26.66 billion by 2034, growing from USD 6.26 billion in 2024 with a CAGR of 15.59%.

Viral Vectors & Plasmid DNA Manufacturing Market Key Takeaways

- North America leads the market, capturing a 49% revenue share in 2024.

- The AAV segment is showing strong growth, holding a 21% revenue share in the viral vectors & plasmid DNA manufacturing market in 2024.

- The downstream processing segment holds a dominant position in the market, contributing 54% of the revenue share in 2023.

The rapid expansion of the viral vectors & plasmid DNA manufacturing market occurs because of growth in demand from gene therapies, vaccines, and biological drug development. The product category under which this market fits includes viral vectors and plasmid DNA manufactured for applications in gene transfer technologies. With a projected CAGR of 15.59%, the market is expected to reach USD 26.66 billion by 2034, up from USD 6.26 billion in 2024. North America holds the largest share, while the AAV vector type and downstream processing workflow dominate market segments.

Sample Link: https://www.precedenceresearch.com/sample/1012

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 26.66 billion |

| Market Size in 2024 | USD 6.26 billion |

| Growth Rate | CAGR of 15.59% From 2025 to 2034 |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vector Type, Application, Workflow, End-User, Disease |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Key Drivers

The key drivers of the viral vectors & plasmid DNA manufacturing market are the increasing demand for gene therapies and vaccines, advancements in gene editing technologies, and increased investment in biological drug development. The growth in healthcare infrastructure and the increasing prevalence of genetic disorders are also propelling the market forward. In addition, more efficient production processes and improved regulatory frameworks are further accelerating the rapid growth of the market. AAV Vector Type and Downstream Processing Remain Leading in the Area of Revenues Generated.

Opportunities

- Gene Therapy Advancements: Increasing applications of gene therapy in treating genetic disorders create a growing demand for viral vectors and plasmid DNA.

- Expanding Vaccine Development: The ongoing need for new vaccines, especially for emerging diseases, presents significant opportunities in the viral vector space.

- Biopharmaceutical Growth: As biologic drugs continue to rise in popularity, there is a growing need for efficient manufacturing of viral vectors and plasmid DNA for drug development.

- Technological Innovations: Advances in vector production technologies and automation could reduce costs and improve manufacturing efficiency, driving market growth.

- Emerging Markets: Growing healthcare investments and biotech research in regions like Asia Pacific offer untapped potential for market expansion.

Challenges

- High Production Costs: The complex and specialized nature of viral vector and plasmid DNA production can lead to high manufacturing costs, impacting market affordability.

- Regulatory Hurdles: Navigating through stringent regulatory frameworks for gene therapies and biologics can delay product approvals and market entry.

- Scalability Issues: Scaling up production while maintaining high quality and consistency in viral vector manufacturing remains a significant challenge.

- Raw Material Shortages: Sourcing high-quality raw materials for vector production can be difficult, limiting supply and increasing costs.

- Safety Concerns: Ensuring the safety and efficacy of viral vectors and plasmid DNA for human use, while avoiding immune reactions or gene mutations, is a critical challenge.

Regional Insights

The U.S. dominates the viral vectors & plasmid DNA manufacturing market, projected to grow from USD 2.45 billion in 2024 to USD 10.45 billion by 2034, driven by FDA approvals for advanced therapies and significant investments in gene therapy manufacturing. North America leads in clinical trials, with 68% of global studies underway. Europe follows as a key market, accounting for 21% of trials. Meanwhile, the Asia Pacific region is emerging as a hub for gene therapy manufacturing, with multinational collaborations aiming to accelerate production in this area.

Don’t Miss Out: Medical Furniture Market

Market Key Players

- Novasep

- Aldevron

- MerckWaismanBiomanufacturing

- Creative Biogene

- The Cell and Gene Therapy Catapult

- Cobra Biologics

Recent News

2024 marks a pivotal year for cell and gene therapy (CGT) breakthroughs. The global launch of Amtagvi, a Tumor-Infiltrating Lymphocyte (TIL) therapy, ushers in a new era for solid tumor treatment. The approval of PM359 for clinical trials represents a major step forward in gene editing, while INT2104, the first in vivo modified CAR-T therapy, is set to expand CAR-T treatment options. Additionally, the A-T Children’s Project will host an international conference in November, focusing on gene therapy advancements for ataxia-telangiectasia (A-T), bringing together leaders in biotech, pharma, and academia.

Market Segmentation

By Vector Type

- Adenovirus

- Plasmid DNA

- Lentivirus

- Retrovirus

- AAV

- Others

By Application

- Gene Therapy

- Antisense &RNAi

- Cell Therapy

- Vaccinology

By Workflow

- Upstream Processing

- Vector Recovery/Harvesting

- Vector Amplification & Expansion

- Downstream Processing

- Fill-finish

- Purification

By End-User

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

By Disease

- Genetic Disorders

- Cancer

- Infectious Diseases

- Others

Ready for more? Dive into the full experience on our website!