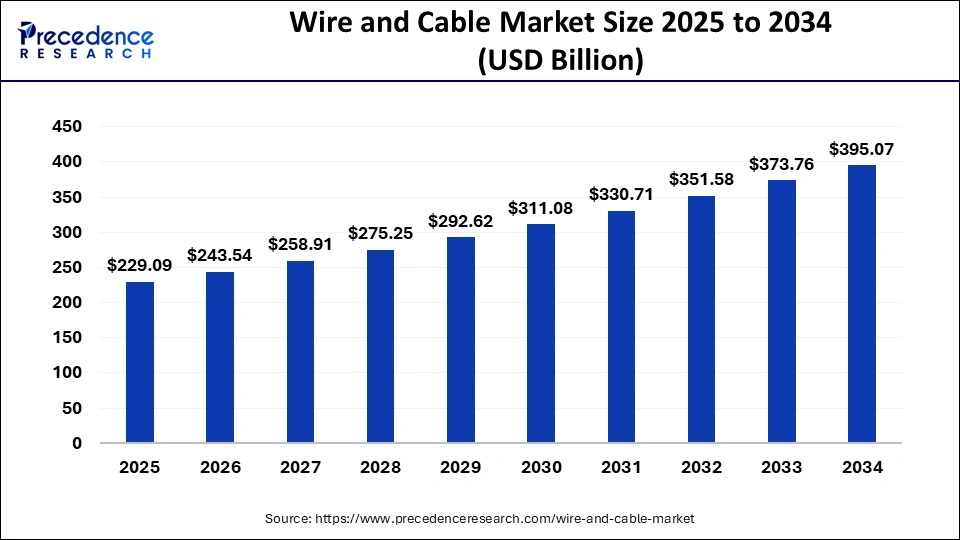

The wire and cable market is valued at USD 215.49B in 2024 and is set to reach USD 395.07B by 2034, growing at a CAGR of 6.20%.

Wire and Cable Market Key Takeaways

- Asia Pacific accounted for approximately 38% of the revenue share in 2024.

- The low voltage segment led the market with a 44% revenue share in 2024.

- Overhead installation dominated with a 65% revenue share in 2024.

- The energy and power sector contributed 38% of the total market revenue in 2024.

- The building and construction segment is expected to grow at a CAGR of 4.9% from 2025 to 2034.

The wire and cable market is a crucial segment of the global electrical and electronics industry, driven by increasing demand for power transmission, telecommunications, and infrastructure development. In 2024, the market is valued at USD 215.49 billion and is projected to reach USD 395.07 billion by 2034, growing at a CAGR of 6.20%. The Asia Pacific region holds a dominant share, while the low voltage segment leads in revenue. Overhead installation remains the preferred choice, with the energy and power sector as a key end-user. Additionally, the building and construction industry is set to expand at a CAGR of 4.9% from 2025 to 2034, contributing to market growth.

Sample Link: https://www.precedenceresearch.com/sample/1070

Key Drivers

Opportunities

- Expansion of Renewable Energy – Growing solar, wind and hydroelectric projects increase the need for specialized power cables.

- 5G and Fiber Optic Deployment – Rising demand for high-speed internet and data transmission boosts fiber optic cable adoption.

- Smart Grid and Electrification Projects – Government investments in modernizing power grids create new opportunities for advanced cabling solutions.

- Electric Vehicle (EV) Growth – Increasing EV production and charging infrastructure drive demand for high-voltage and fast-charging cables.

- Rising Urbanization & Infrastructure Development – Ongoing urban expansion and smart city projects fuel demand for efficient power distribution networks.

- Technological Innovations – Advancements in fire-resistant, lightweight, and high-capacity cables open new growth avenues.

Challenges

- Fluctuating Raw Material Prices – Volatility in copper, aluminum, and plastic prices affects production costs and profit margins.

- High Initial Investment Costs – Setting up advanced cable manufacturing and installation infrastructure requires significant capital.

- Stringent Government Regulations – Compliance with environmental and safety standards adds complexity to manufacturing processes.

- Counterfeit & Low-Quality Products – The presence of substandard cables in the market affects brand reputation and safety.

- Disruptions in Supply Chain – Global trade restrictions, geopolitical tensions, and raw material shortages impact production and distribution.

- Competition from Wireless Technologies – Advancements in wireless communication may reduce demand for certain types of cables.

Regional Insights

The wire and cable market exhibits strong regional variations, with Asia Pacific leading the industry, accounting for a significant revenue share due to rapid urbanization, industrialization, and government investments in power infrastructure. North America is experiencing steady growth driven by advancements in 5G technology, renewable energy projects, and smart grid developments. In Europe, stringent environmental regulations and the push for sustainable energy solutions are fostering demand for advanced cabling technologies.

The Middle East & Africa region is expanding due to increasing energy infrastructure projects, while Latin America is witnessing growth from telecommunications and power distribution investments. Overall, regional demand is shaped by factors such as economic growth, government policies, and technological advancements.

Don’t Miss Out: Air Purifier Market

Market Key Players

- Jiagnan Group

- General Cable Corporation

- LS Cable & System Ltd

- TPC Wire & Cable Corp

- Southwire Company, LLC

- Polycab Wires Private Limited

- Nexans S.A.

- Hitachi Metals Ltd

- Far East Cable Co., Ltd.

Recent News

In recent developments within the wire and cable industry, several significant projects and strategic moves have been announced. Meta has unveiled the Waterworth Project, an ambitious plan to construct a 50,000-kilometer undersea cable aimed at enhancing internet connectivity across five continents. This multibillion-dollar investment is set to open new oceanic corridors, providing the high-speed infrastructure necessary for global AI innovation. In Australia, the Marinus Link project, designed to connect Victoria and Tasmania via an undersea electricity cable, has confirmed its operational date for 2030.

This follows a nearly $1 billion supply agreement with Italian firm Prysmian, underscoring the project’s importance in facilitating renewable energy transmission between the two states. Additionally, Prysmian is considering a dual listing in New York and is exploring further acquisitions in the U.S., following its $4 billion purchase of Texas-based Encore Wire last year. This strategy aims to capitalize on favorable policies and expand its presence in the American market. In Southeast Asia, companies from Singapore and Vietnam are in discussions to develop new undersea fiber-optic cables to meet the region’s growing demand for data services and to enhance connectivity infrastructure. These initiatives reflect the dynamic and evolving landscape of the global wire and cable market, driven by technological advancements and the increasing need for robust connectivity solutions.

Market Segmentation

- Medium and High Voltage (MV & HV)

- Low Voltage (LV)

- Optical Fiber Cable

By Material

- Aluminum

- Copper

- Glass

By Installation

- Overhead

- Underground

By Application

- Data Transmission

- Building

- Power Transmission

- Transport